“Every Picture Tells a Story”

Rod Stewart, May 1971

The composite characteristics and attributes of each business presents a picture to be viewed by the businesses’ owners, creditors, employees, suppliers, and customers. That picture can tell a story of dynamic growth, sedentary stability, or decline. It influences company culture, perceived opportunity, and ultimately value.

When investors screen for and perform due diligence on businesses, they spend an inordinate amount of time analyzing the product or service being offered, market size, competition, pricing dynamics, customer experience, financial history, and strength of the management team. They do this not because they have a checklist to complete, but because when they own the business, these are the important factors that will help them preserve capital and earn an acceptable return.

When investors screen for and perform due diligence on businesses, they spend an inordinate amount of time analyzing the product or service being offered, market size, competition, pricing dynamics, customer experience, financial history, and strength of the management team. They do this not because they have a checklist to complete, but because when they own the business, these are the important factors that will help them preserve capital and earn an acceptable return.

A growth plan need not be about hockey stick projections. In fact, it doesn’t necessarily mean getting bigger; rather, it means getting better. And, in that regard, every company should have a growth story.

Definition of Better

In corporate finance language, getting better means improving the present value of future cash flows relative to doing nothing. The set of strategic actions should increase cash flows, extend their duration, and/or improve predictability. Changing the trajectory of these factors by making strategic decisions makes the business better.

Actions that improve the business include strengthening relationships with customers, diversifying suppliers, investing in technology to improve efficiency, putting in place redundant systems, making the customer experience easier, more efficient, or productive, or accelerating product development. They can also include the introduction of new products or expansion into new channels and geographies for growth or diversification. Complementing these actions by investing in a team, processes, and systems that allow the business to operate independently of any one person further achieves the goals and improves the business.

The market place is dynamic and competition makes it difficult, if not impossible, to generate superior returns on capital indefinitely. It is always “better” to be doing something than nothing.

How Growth Affects Culture, Opportunity, and Value

Orienting a business towards growth can empower the workforce and attract greater talent. Managers take direction from their leaders and, without a directive or incentive to think outside the status quo, the future will look like the past. In our engagements, we often encourage owners to install retention plans that incentivize key employees to stay with the company through a transaction. In almost every case, we find that aligning interests serves as a catalyst for new ideas and creates a sense of urgency. It is no surprise that cost savings are easier to find and expansion opportunities become more attractive to managers when they perceive that owners are receptive to new thoughts and ideas. Plus, it is more fun than just repeating yesterday, and that dynamic alone makes it more interesting to employees. Making this a priority ahead of, rather than during, a transaction can help the value accrue to the current owner rather than the new one.

Creating excitement for the future of the business has an added benefit. During a sale process, information is shared through statements of facts (i.e. memorandums, data sites, etc.) and through communication with management (i.e. management presentations). While it is important that the former is organized to position the business positively, the latter offers the best opportunity to form an emotional connection with the buyer (see Creating Value in Management Presentations: April 2015). When managers have the opportunity to share their excitement in the future and can inspire a buyer’s confidence, the perception of risk decreases, and value increases.

Regardless of how it is expressed, at the end of the day, value is a function of the perceived future cash flows of the business.

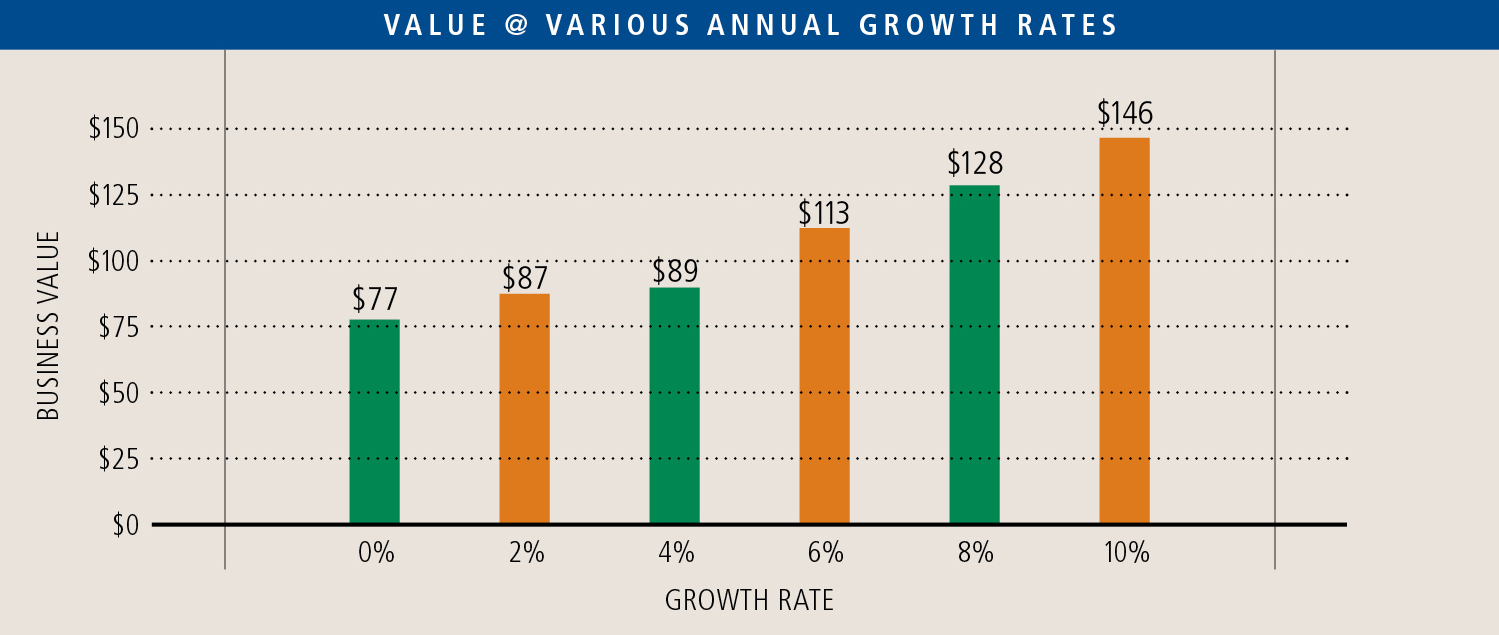

To illustrate the impact of growth on valuation, take the following example, where a business is growing at 2% annually. Assuming $10 million in operating profit and a cost of capital of 10%, the discounted cash flow analysis implies an intrinsic value of $87 million. Growth in cash flow, either as a result of lower costs, increased prices, or greater volumes, drives higher values.

Developing the Growth Plan

A good plan will separate revenue growth into achievable actions that have been vetted with data and analysis. This plan might include current market penetration, product extension, geographic expansion, complementary acquisitions, or potential price increases. The size of each opportunity and the likelihood of success will be limited by competition, customer demand, and business infrastructure. Given the limited resources at most middle market businesses, the capability to size each opportunity accurately may not exist internally. Using a third party skilled at customizing market studies and consumer research to the specific needs of a business can give decision-makers the valuable information to prioritize initiatives efficiently.

Likewise, the cost structure can be affected by action. Revenue growth by definition will provide leverage on fixed expenses, while input prices, the use of new technology, and process improvements can drive down variable costs. Combined, revenue growth and operational cost improvements drive greater future margins and higher value.

Increasing shareholder value is never easy and there is generally not a silver bullet. Rather, success requires a combination of initiatives, and by breaking down each of these growth strategies into actions, the numbers or results can follow.

Business planning is a dynamic process with no target end point. Those organizations that prioritize continuous improvement will be best positioned to maximize shareholder value.