For most of the leveraged buyout era, private equity investors have funded their acquisitions with a combination of senior secured debt from banks, subordinated debt (or mezzanine) provided by specialty funds, and equity. Many private equity funds we know well have changed their approach and are eschewing this tried and true formula for a new form of capital – unitranche debt. Although more expensively priced capital than the senior/mezzanine combination, equity investors have determined that unitranche debt is less costly in certain circumstances. Our purpose with this article is to explain the unitranche credit product and why and when it could be a useful capital structure tool.

Background on Leverage Philosophy of Private Equity Firms

Private equity firms manage money for institutional investors. Their value proposition is that they can employ capital in privately-held companies and earn an attractive return for the risk level. Part of the way private equity firms earn returns for their investors is adding leverage to the capital structure under the theory that the unlevered return expectations are in excess of the cost of debt, so by borrowing part of the purchase price, their equity return is increased.

Once a company is purchased, the private equity fund works with a management team to improve operations and grow the business with the objective of improving profitability. During the period of its ownership, debt is retired and the more profitable company justifies an increase in price of the business when it is sold. The combination of a higher valued business and the repayment of debt causes the value of the equity to grow even faster.

When the investment is realized, private equity firms judge their success by the return on investment over the time for which the capital was at risk, either in terms of an internal rate of return or the multiple of cash returned relative to the amount invested.

For a middle market company, it would not be unusual for a private equity buyer to borrow in the range of 4x EBITDA, usually with a senior lender providing 2.5-3.0x EBITDA and the remainder provided by a mezzanine lender. The senior lender is the lowest cost (3.5-4.0%) compared to the mezzanine (12-14%). At an average mix, the blended cost would be in the range of 7%. Virtually all businesses invested in by private equity firms would be expected to grow in value by a higher rate than that, thereby providing the leverage to the equity return.

What is a Unitranche Loan?

Although unitranche products have several different forms, the primary characteristics are twofold: 1) no meaningful amortization, and 2) higher rates— approximately 10%—for lower middle market companies. Even though the rate is higher than the blended senior/mezzanine combination, the fact that there is no amortization usually allows more leverage. In the case in which a senior/mezzanine combination would allow 4x EBITDA total leverage, a unitranche loan would likely be able to justify 5x leverage. It is the extra leverage and the extra cash flow during the ownership period that causes the interest among private equity investors.

Unitranche loans are provided by specialized non-bank funds that are designed to take additional risk relative to senior bank lenders. The credit perspective is that these lenders loan based on a proportion of enterprise value subject to cash flow coverage limitations. Due diligence is less on asset quality and more on market position and competitive advantage. They loan more than other senior and subordinated lenders and leave their capital in place for a longer period of time, therefore requiring a higher rate of compensation.

Comparison of Senior/Mezzanine and Unitranche Structures

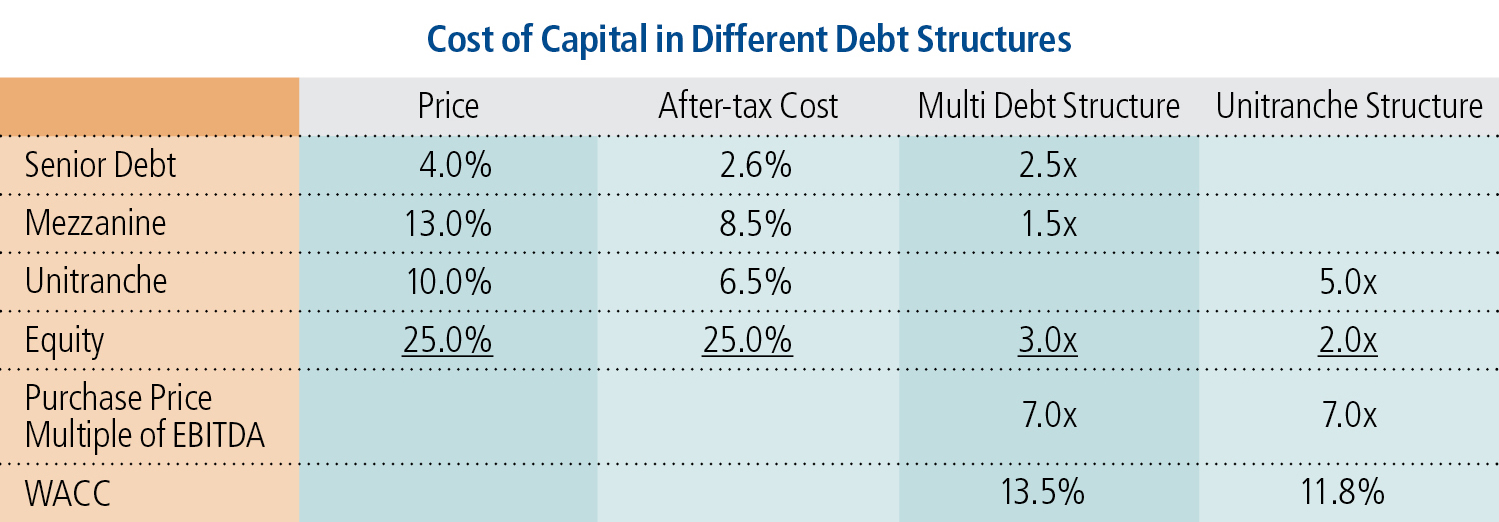

Although more expensive on a rate basis, the additional leverage allowed by unitranche loans implies a lower overall cost of capital, as seen in the adjacent table. Small differences can be meaningful when a particular investment exceeds the cost of capital.

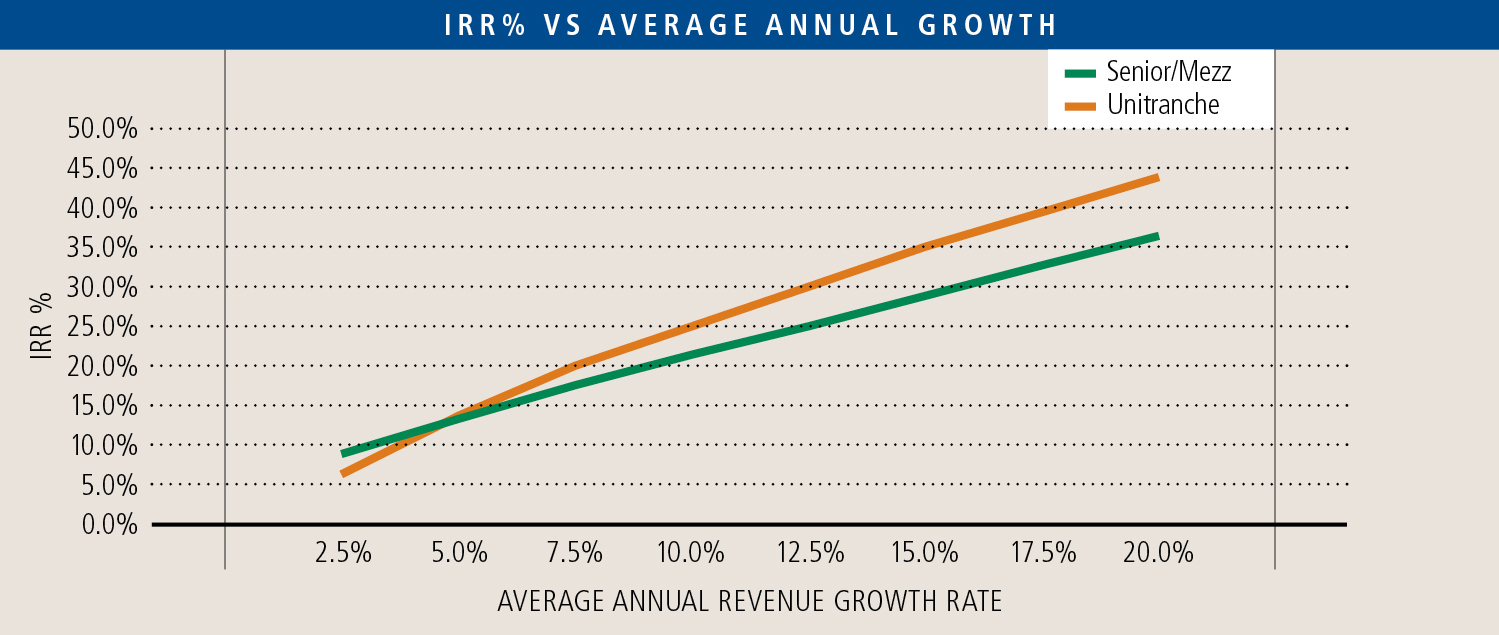

Despite the higher leverage of the unitranche structure, the release of the requirement of debt amortization gives substantially more flexibility for operating performance variation as well the ability to fund future growth initiatives. We analyzed a hypothetical middle market company generating 10% EBITDA margins, modest capital expenditure requirements and average working capital turnover. The following graph shows the relationship between investment return (IRR) and growth rate.

Although operating metrics can vary from the underlying assumptions in our model, they are directionally instructive and lead us to several conclusions.

- The senior/mezzanine structure is much more cash constrained than the unitranche structure. At 4x EBITDA leverage, the company uses most of its operating cash flow for debt service, leaving little or none to fund growth. The unitranche structure generates substantial additional cash over the five-year period, which can support a much higher growth rate without further borrowing.

- Capital intensity matters. As investment in capital expenditures and working capital increases per dollar of growth, the unitranche structure has an advantage as the return on growth exceeds the extra carrying cost of the debt. Likewise, when the business is a stable performer, applying excess cash to debt reduction optimizes the return to equity

holders. - The breakeven point is different for each business, but at some point the need to fund growth capital favors the unitranche structure.

Conclusions

One size doesn’t fit all, which is what drives the capital markets to provide different products. Private equity investors have found that unitranche lenders offer a compelling product when future growth is expected and capital will be required to support the growth. For entrepreneur-owned companies facing a growth curve, unitranche loans offer more growth to be achieved before having to realize dilution with new equity. The degree of investment required to support additional growth would determine which structure is most beneficial in the specific circumstances.

Over our years of advising companies, we have maintained that different capital sources and products are merely tools by which to help achieve the objective of increasing equity value. We never recommend optimizing any single characteristic, such as price, leverage, or ownership. Ultimately, the most important attribute of a capital structure is to make sure there is enough capital to achieve the business plan, followed by a structure that is flexible enough to withstand the inevitable variations from plan, and finally to minimize the cost of the capital. The individual circumstances of the business will dictate the answer. Carefully weighing the alternatives could pay off with a better result for owners.