Republicans in the House of Representatives have proposed sweeping corporate tax reform with the objective of reducing the current 35% marginal rate to as little as 15%. While the ultimate shape and size of corporate tax relief can only be surmised at this point, our interest is to consider the potential impact of lower corporate tax rates on business value.

The value of a business is equal to the amount of cash that can be extracted over its remaining life, discounted back to the present by a rate that is appropriate for the risk of those cash flows. All else equal, a reduction in corporate federal income tax rates directly increases after-tax cash flow, making that extra cash available to pay returns to the owners of the business. Logically, higher cash flows to owners should mean higher business values. However, like most things in life, it isn’t that simple.

There are three primary ways in which lower corporate tax rates could positively affect business value – increasing after-tax cash flows, changing the expected future growth rate of the cash flows, and reducing the discount rate.

Increasing Free Cash Flow

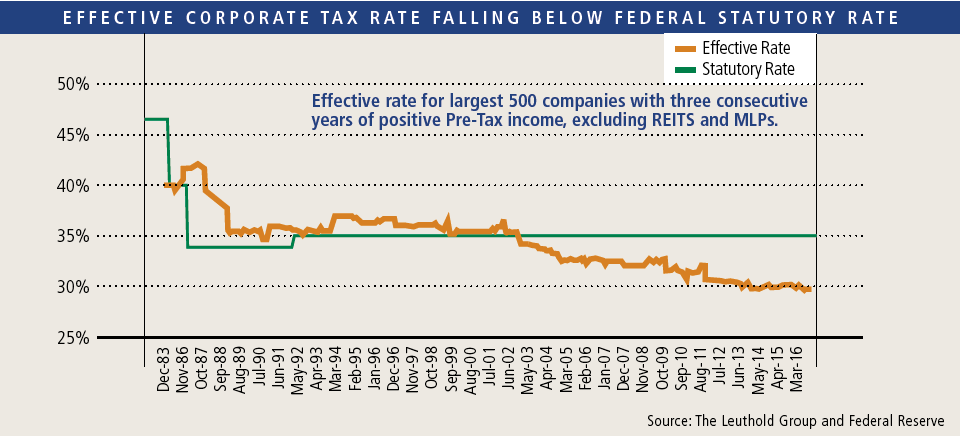

The United States has one of the highest statutory corporate tax rates in the world. Those high tax rates have led companies to increasingly use sophisticated tax management schemes to reduce their effective tax rates. A recent study found that the effective domestic corporate tax rate (including federal and state tax payments) has declined from north of 35% in 2002 to 29% today.

As illustrated above, the average corporate tax rate is approaching 80% of the statutory rate. However, not all companies and not all industries benefit equally. Certain industries enjoy tax breaks not available to others and large multinational corporations with access to sophisticated tax resources tend to benefit more than smaller private companies.

Embedded in today’s valuations are various tax shields that companies use to reduce effective tax rates. As corporate tax rates decrease, these tax shields become less valuable. In exchange for lower rates, it may well be that certain deductions (bonus depreciation, goodwill amortization, and export tax credits, to name a few) will be eliminated or meaningfully reduced. Until the dust settles, it is premature to calculate the degree of benefit to individual businesses.

Increasing Growth Rates

Many economists have argued that lowering the marginal corporate tax rate will increase the competitiveness of businesses and, therefore, increase their opportunities to grow. The effect of a decline in marginal tax rates from 35% to 25% is an increase in after tax cash flow for a company of approximately 15%. That extra cash flow should position the business to pursue other value creating strategies:

Many economists have argued that lowering the marginal corporate tax rate will increase the competitiveness of businesses and, therefore, increase their opportunities to grow. The effect of a decline in marginal tax rates from 35% to 25% is an increase in after tax cash flow for a company of approximately 15%. That extra cash flow should position the business to pursue other value creating strategies:

- In a price elastic market, a company could reduce prices and thereby stimulate demand. Depending on the tradeoffs between incremental margins and volume, the added growth from this action could meaningfully increase the future cash flow and thereby the value of the business.

- Higher free cash flow margins will cause companies to accept investment opportunities that previously would not meet their return hurdles. Pursuit of these investments could increase productivity, add capacity, or develop new products, each of which can lead to greater business value.

- Compete more effectively with other businesses, such as foreign competitors or domestic companies that previously relied on tax incentives unique to their businesses.

Lowering the Discount Rate

It makes sense that lower corporate tax rates are likely to influence a reduction in the discount rate used to capitalize expected future corporate earnings, thereby increasing the value of the company’s future cash flows. The rationale is that taxes are another form of cost businesses must bear. A tax rate decline has the same economic effect as increasing operating margins, thereby giving the business greater margin for error and a better coverage of fixed costs. This implies that the variability of returns relative to changes in business activity (i.e., volume, prices, margins) will decline – therefore reducing the risk of the cash flows.

However, there are offsetting factors that will vary among companies. Assuming that capital sources will not change the risk adjusted after-tax rates of return they require to invest their capital, values relative to after-tax cash flows should increase as a result of the lower risk associated with the cash flows. That same dynamic should allow businesses to support debt as a greater percentage of the capital structure, as well. The degree to which this is the case will determine if the greater portion of the capital structure funded by debt will offset the increased after-tax cost of debt resulting from lower tax rates. This will vary by company and industry. In particular, companies granted credit based on cash flow could benefit, while those borrowing on an asset base will not.

Should Owners Delay a Decision to Sell?

Whether and how any individual business will benefit from lower corporate tax rates will depend on the details of any new tax law, as well as the circumstances of the individual business. No matter how it falls out, the results will not be distributed evenly. That being said, values of businesses in general should benefit from lower corporate tax rates, mostly due to the fact that they will retain a greater share of operating cash flow. Additionally, business value is likely to benefit from a faster than expected growth trajectory fueled by the reinvestment of after-tax earnings. The jury is out with regard to the effect on costs of capital. How the perception of risk may change for various capital providers is likely to be company specific. Certainly, businesses that rely on tax benefits derived from tax shields on goodwill, accelerated asset depreciation, and high leverage will find those strategies less useful in a lower tax environment.

The equation is not static. There will be secondary and tertiary consequences of any changes, which are hard to predict in advance. Our experience has been that selling into a robust market is more influential on value than are policy or regulatory changes. The current positive economic outlook combined with abundant and low cost capital contributes to a sellers’ market. However, if there is no pressing need for an immediate transaction and the changes proposed become more likely, waiting could be a reasonable choice. Everything else equal, the lower the proposed corporate tax rates, the more logical it would be to wait. On the other hand, if there are compelling reasons for a sale, such as concern about the end of the current expansionary business cycle, changes in industry conditions, or personal situations, those considerations should be closely weighed relative to the potential benefits of waiting.