The sale of a business requires sellers to make a range of promises to the buyer regarding the condition and facts about the business. Those promises cover a myriad of issues ranging from regulatory compliance, payment of all tax obligations, the condition of equipment and other assets, and the accuracy and completeness of financial statements. These promises are commonly referred to as representations and warranties.

Accompanying these promises is a financial “guaranty”(referred to as indemnification) provided by the seller that the promises are true and correct. Codified in the purchase and sale agreement, the promises and the guaranty that the promises can be relied upon are often among the hardest-fought issues in negotiating the purchase agreement. Both sides strenuously negotiate the wording of the promises, their longevity, and the penalties for a broken promise.

One avenue for sellers to mitigate their post transaction financial exposure is to purchase representations & warranty (“R&W”) insurance. With R&W insurance, an insurance company assumes the risk that the buyer suffers monetary damages after the purchase as a result of broken promises.

Although still only used on a small proportion of all M&A deals, the R&W insurance market is growing at 20 – 30% per year, starting from almost nothing less than ten years ago. This growth is largely due to the competitive M&A market (multiple bidders on any deal), and the prevalence of private equity buyers. Private equity firms utilize R&W insurance to improve the competitiveness of their acquisition bids as well as to preserve the post-closing relationship with sellers who often become operating partners by “rolling over” a portion of their ownership into the new capital structure.

How Does it Work?

Similar to all insurance policies, before the insurer will pay under a claim, the policyholder must suffer the first loss. This first-loss deductible (“retention”) ensures that the insured has “skin in the game,” thereby providing comfort to the carrier that the insured has taken steps to protect against surprises. Retention periods typically last between 12 and 24 months beyond closing but, since the likelihood of claims declines over time, the first-loss deductible often declines as the coverage period lengthens.

Because buyers have the most incentive to protect themselves (and thereby the insurer) by performing a thorough diligence investigation, the vast majority of policies cover buyers. Although some insurers will write policies in favor of sellers, the fact that interests of sellers and insurance carriers are not as well aligned, make seller policies less prevalent. In cases where the benefits of a policy favor the sellers (for example, when there are multiple shareholders who collectively don’t share an intimate knowledge about the business), sellers often pay the premium, even though the buyer is generally the covered party.

Coverage

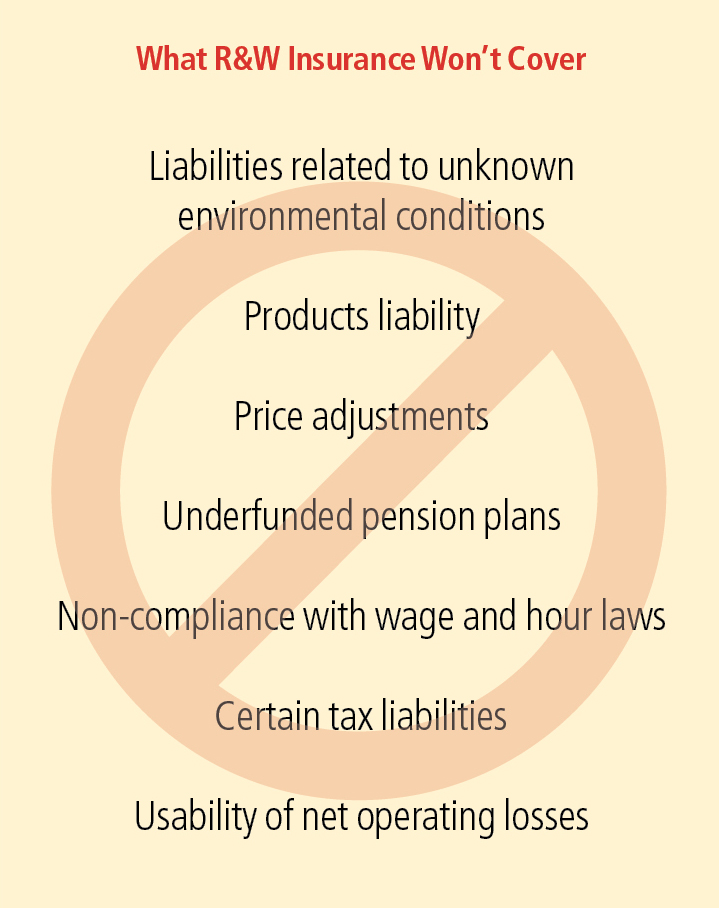

While R&W insurance is generally designed to cover all of the representations in the purchase agreement, certain exclusions from coverage may apply. Risks that are often excluded from R&W policies (or are heavily negotiated) include liabilities related to unknown environmental conditions, products liability, price adjustments (where the ultimate purchase price is subject to future events), underfunded pension plans, non-compliance with wage and hour laws, certain tax liabilities that might arise as a result of transfer pricing between affiliates, and the usability of net operating losses. These risks will either remain with the seller or, in some circumstances, it is possible to arrange special coverage.

Cost

R&W insurance involves a one-time premium, paid up-front, typically costing in the range of 2.5 – 4% of the indemnity limit (generally 10 – 25% of the transaction value) – implying a total cost of less than 1% of the total deal value. As might be expected, the larger the deal, the lower the premium as a percentage of the transaction value.

A quote from an insurance company requires its review of the specific representations and warranty language and the indemnity package that have been negotiated between buyer and seller. Interested carriers will then issue a non-binding indication of interest letter (“NBIL”) that provides specific coverages, likely exclusions, and a premium quote.

Upon acceptance of the NBIL, the carrier will require an underwriting fee in the range of $25,000 – $35,000 to fund its diligence efforts, not crediting to the premium. In some situations, insurers agree to return a portion of this fee if they ultimately decline to provide coverage.

The premium is payable, and coverage commences, upon delivery of a “No Claims Declaration” (a statement by the buyer that it is unaware of any breaches of the representations or warranties as of the closing) and payment of the premium. Typically, a policy can be in place within two to three weeks from acceptance of the NBIL.

Qualifications

Growing competition in the R&W market has lowered the eligibility bar for the size of transactions that can gain coverage. However, the smaller the deal, the higher the premium, and the less customized the coverage package, implying a practical minimum of approximately $20 million. Additionally, certain insurance companies will deny coverage on transactions of companies without audited financial statements or a quality of earnings report.

Benefits to Both Buyers and Sellers

R&W coverage can offer benefits to both buyers and sellers. Sellers benefit by financially extricating themselves from ongoing financial liability related to obligations for breach of their promises and the elimination of the need for a significant escrow as security for those promises. This is particularly attractive when there are multiple shareholders that would otherwise be required to remain jointly and severally liable for the indemnifications, private equity or ESOP ownership that desire to speed the distribution of proceeds to investors/beneficiaries, or when one of the sellers is joining the buyer as a go-forward partner (so as to minimize future disputes).

Buyers can benefit by improving the probability of closing, both by making their bid more attractive to the seller and by eliminating the pain and torture often inflicted when negotiating an indemnity package with an owner regarding post-closing risks.