For many of us in the Pacific Northwest who appreciate quality seafood, summertime means fresh salmon. We aren’t alone; due to its instantly recognizable and desirable color and flavor, salmon is the economic giant of Alaska seafood, the unprocessed catch representing nearly $1 billion in annual value. But most consumers might be surprised to learn that the industry is in the middle of a crisis. The confluence of the largest salmon run in the last 100 years, along with high inflation and interest rates, has resulted in a profit and liquidity squeeze on salmon processors. As a result, nobody’s happy – fishermen, processors, and bankers alike.

The Setting

Before we dive into just how the industry got in this mess, we need to paint the background picture of the Alaskan salmon industry (as a note – all Alaskan salmon is wild-caught, for now). Alaskan salmon fishing occurs just over a few weeks in the summertime, from about the last week of June to early- or mid-August. If you’ll remember your high school biology class, salmon spawn in rivers and then live out most of their lives in the ocean, miraculously returning up the rivers to their exact spawning point to mate and die.

Fishermen wait at the mouths of the river systems to scoop up salmon right before they leave the ocean to head upstream, since that’s the place and time where salmon concentrate and can be caught most efficiently. This “bunching” of salmon peaks in just a few days every summer, but the “run” can yield enough salmon for fishing to continue for a few weeks.

The size and timing of salmon runs (multiple, as each river system’s run is slightly different) are monitored by the Alaska Department of Fish and Game to assure that enough salmon are allowed to move up into the river systems to spawn and create the next salmon generation (this allowed “escaped” volume is referred to as escapement). Once escapement is counted and is estimated by ADF&G to be enough to sustain a healthy fish population, individual permitted commercial fishing vessels are allowed to lower their nets in the path of the incoming salmon. Fishermen compete for fish, catch as much as they can over a few short weeks, and deliver their catch to shore-based processors. These processors turn the whole fish into saleable forms and sell the resulting products into different markets around the globe.

Simple enough, except that salmon are remarkably uncooperative, as far as projections are concerned. No one knows in advance how many salmon will return to each river system, exactly when, and if weather will cooperate with fishing conditions; as a result, it’s incredibly challenging to predict how many salmon will be caught, where they will be caught, and by whom. Biologists do their best to make projections of run size and timing, but the pattern (a wall of fish over a few days, a steady flow of fish over the few weeks, or somewhere in between), the size of the fish, and the impact of weather disruptions make the end result a guessing game.

The other wrinkle is that these river systems are remote, mostly in Western Alaska. The remoteness severely limits the ability of anyone – fisherman or processor – to adjust to changing conditions in-season. Industry participants move people and supplies to remote Alaska over the course of the spring to be ready for a big range of possibilities. All of this activity costs money, which adds risk to every individual season by locking in costs before knowing the rest of the equation.

The other OTHER wrinkle is that while a small percentage of salmon is sold truly fresh, most of the catch gets frozen or canned and stored, for sale sometime after the season. That means that market prices, themselves quite volatile, aren’t known until even further down the road and are difficult to predict when preparing for a short fishing season. It’s even more complicated than that as decisions need to be made during a few short weeks as to the form of final product to be produced when the demand for different forms may change over the full year.

You might see what we’re building to. The way the salmon industry works requires salmon processors to accept tremendous risks, both from their own operating costs, biology, and from outside commodity markets. Not only that, but processors compete viciously for fishermen, in an attempt to assure at least a minimum supply. A common theme among processors is that “more volume is better,” both because spreading fixed costs over higher volumes reduces per-unit costs of finished product, and because turning fishermen away for any reason is viewed as a cardinal sin that risks their allegiance in the following year.

So let’s recap: processors have to lock in costs early, accepting operating cost risk and market pricing risk, while in a constant street fight to capture as much volume as possible in a short timeframe and turn it into forms that might or might not match consumer demand. This setup doesn’t leave many levers for a manager to pull if … things change.

2022 – The Confluence

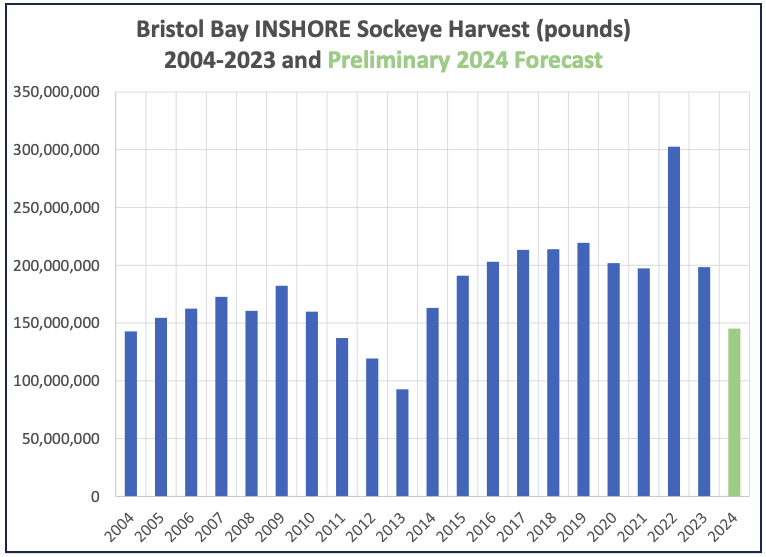

Entering the 2022 season, processors were, as always, jockeying to gain fleet. One company “set a grounds price” (indicated to fishermen what they would pay, per pound, for fresh-caught whole fish) early, and a bit higher than expected, to attempt to entice fishermen to sell fish to them. Other processors followed suit, confirming the same price, as they did not want to potentially lose fishermen to the first mover. Then, as the graph below shows, the industry experienced the largest salmon run in the past 100 years.

There were early indications that this run would be big, but even the most aggressive projections fell short of just how many salmon were in the 2022 run and how many would be caught. Following the learned behavior of years past, fishermen caught as many fish as they could, and the processors bought every one, concerned as always that turning away fishermen would result in losing them for following seasons. Fishermen rejoiced, as the great combination of an advantageous price, good fishing conditions, and a massive run promised record-breaking profits. Processors were literally buried in fish, unable to process them in a timely manner. Millions of pounds of fish sat around in tenders or in totes on the docks, waiting to be processed. Sometimes they were tendered for multiple days to other plants where there might be an opening in processing capacity. Anyone reading this article who has hunted or fished knows that as soon as an animal has died, time and temperature are the meat’s two worst enemies. Fish quality suffered, inventories exploded, lines of credit hit limits. One outlet for imperfect salmon is to put it in a can—so canned salmon in inventory spiked to two year’s worth of sales, and frozen product piled up in cold storage facilities (who were very thankful for such high demand and enjoyed a very profitable year).

One would expect that such a large supply increase would, by itself, dampen market prices of finished product like in any commodity market. The decrease in average quality added additional downward pressure on market prices. But at the same time, overall demand also dropped, making the market situation even worse. American consumers felt the pinch of inflation and became more conservative in their food spending budgets, substituting higher-priced proteins like salmon with cheaper alternatives. Europe and Japan, historically high consumers of salmon, experienced the double whammy of inflation and devaluation of their currencies relative to the US dollar, making a wild Alaskan salmon fillet on the table a little out of reach for many. Because of a constellation of effects, salmon simply wasn’t commanding the price on the open market that processors had envisioned before the season. Processors were sitting on a mountain of fish that couldn’t be sold for its costs.

To add yet another insult to injury, inflation hit processors in another way – high interest rates. Loaded with extraordinary seasonal inventories, funded by lines of credit, interest costs on those maxed-out lines skyrocketed (our July Insight, Unintended and Unwelcome Leverage, goes into this topic in more depth).

Current Year

As processors approached the 2023 season, they still had high levels of inventory, as the market simply could not absorb the 2022 catch over a single year. Since the inventory hadn’t entirely been turned over yet, the processors were yet to recognize all the inevitable losses from the over-costed, under-priced previous year.

This year, salmon came again in historically large numbers, and fishermen and processors largely pursued the same strategies as they did the previous year, with one exception. Processors didn’t set prices for fishermen until the run was almost completed—you read that correctly, fishermen sold the bulk of their catch before a price had been quoted to them—as the processors could not afford to get burned again on high input costs for a large catch.

Rumors of processor ailments through late 2022 and early 2023 made fishermen expect a lower price than they had earned in 2022, but when the price was finally announced, fishermen were enraged. At less than 50% of the previous year price, some fishermen complained they lost money on the year and couldn’t afford to pay their crew. Some fishermen have threatened not to fish in coming years, while others have reached out to Congressmen to provide a government-led solution to provide price transparency in the fishery, or even to get the State of Alaska involved in price-setting.

This isn’t the only way the federal government has become more recently involved in the state of the fishery; the USDA has announced relief measures, buying unprecedented amounts of salmon to give relief to processors’ inventories. This salmon will end up in hunger relief roles, either as part of international aid packages or in subsidized meal programs, like in-school lunches.

From the processor perspective, the decision to delay price announcements and ultimately arrive at a very low grounds price was a question of survival, not trying to exploit fishermen. Even so, the lower grounds price was not enough to offset processor problems. Currently, bloated balance sheets with tepid market demand and market prices that squeeze away margin leave processors in a challenged state. Unless the market picks up and inventory can be unloaded, some processors won’t be able to borrow to operate at full strength for the 2024 season.

Now What?

The good news—kind of—is that the projected 2024 salmon run is expected to result in a much smaller catch volume. That will help right-size processor balance sheets as the bubble of 2022-2023 excess inventory is absorbed into the market. However, lower volumes mean higher unit costs, which makes achieving profitability on the catch even more dependent on improved market dynamics. Processors are hurting from the last two years as they have been unable to sell off their inventories at prices that result in profits, so processors have been unable to “recharge” their balance sheets and pay down borrowing lines. Unless market prices tick up in the next year, processors and fishermen alike will get squeezed again on profits. The pressure will be to again keep grounds prices low and that will exacerbate the already tenuous relationship with fishermen.

The solution? It will take some time and some additional capital to swallow the 2022 problem, possibly catalyzing more industry consolidation as processors yearn for greater efficiency. Another likely outcome will be the introduction of different models for establishing prices paid to fishermen, the end result being more transparency and predictability to fishermen.

Ultimately, consumers will probably not magically decide to eat more salmon at higher prices, so there will have to be some other solution on the operations side of the industry to unlock long-term profitability. To remain competitive, the industry will have to find a way to address some of its inherent risks, and better match its costs with capacity and end-market demand. It won’t be easy, but there are only so many shocks like the one over the past 15 months that an industry can survive.