For over a decade, interest rates have been near zero and banks have courted borrowers with historically cheap and abundant credit. In the blink of an eye, with the aid of inflation and the response of the Federal Reserve, the world of borrowing has changed – for the worse. The road between two points is not always a straight line and so it is with what has happened in the last year. There are many factors at play, but the end point is that rates have risen dramatically, the cost of credit risk (e.g., credit spread) has also increased, and the availability of credit has been reduced, with the ultimate effect being that borrowers are being squeezed at the very time they need more liquidity in their businesses.

Inflation, the Balance Sheet Balloon Effect

Money is pumped into the economy at a greater speed than the growth in activity. The water level raises all boats – costs of materials and labor, costs of capital, prices of end products, and the income of the populace to afford the higher prices. In the long term, there really is no change. But, as John Maynard Keynes said, “In the long term we are all dead.”

In the real world, costs of production and capital have increased but incomes have not risen enough to accommodate higher prices. Demand for products is declining and the economy is slowing. Inventory costs and, subsequently, working capital have increased with no change in actual production. As machines wear out, replacements are far more expensive. Many companies have financed their working capital and capital expenditures with cheap debt. Companies face the double-whammy of paying higher costs, financed more expensively, to replace equipment to maintain the same economic output.

The Basic Cost of Money Has Risen

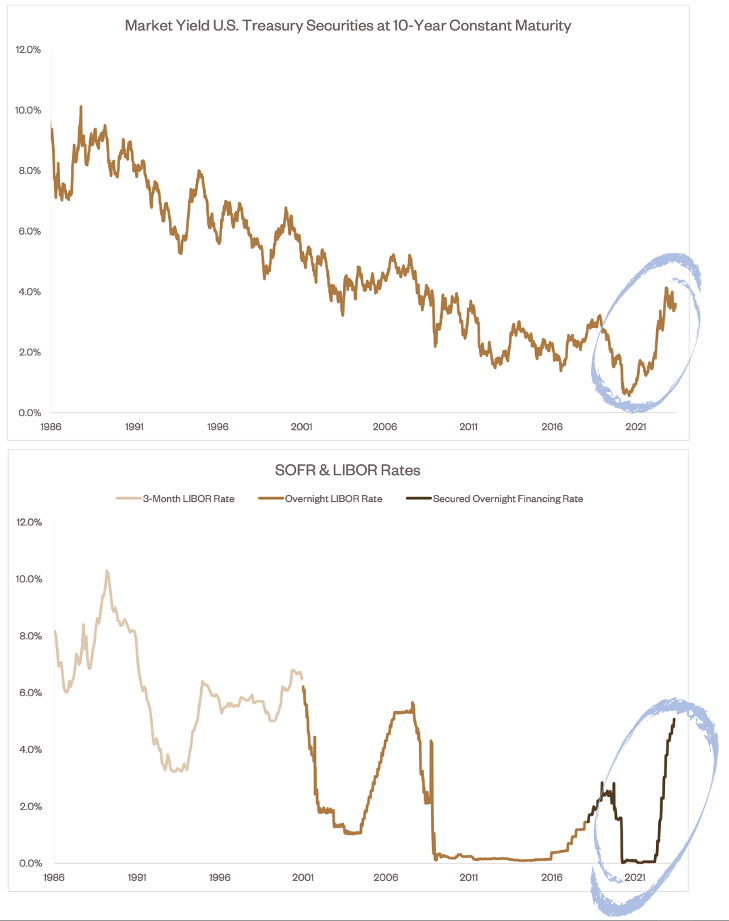

The market for money is represented by the cost to the least risky borrowers: the US government, for risky term-debt lenders, and the largest banks for overnight short-term rates. Ten-year US treasuries and SOFR (and its predecessor, LIBOR) are proxies for the cost of term and floating rate, respectively, money.

The following exhibit shows the history of 10-year US treasury rates. Since 1981, which is near the beginning of even the oldest financial professionals’ careers, rates have dropped from 15% to less than 1%, hitting the low at 0.64% in April 2020, three years ago. Since then, rates have climbed up to 3.7%. Not that high relative to history, but still an increase of almost 500% in three years. Floating rates have experienced an even more stratospheric rise. In April 2020, SOFR stood at effectively zero (actually, 0.01%). In the last year, SOFR has risen to its current rate of 5.06%. Since all credit to commercial borrowers is based on a cost index, whether borrowing on a term or floating rate basis, most businesses are painfully aware that the base cost is up dramatically.

The Cost of Credit Has Also Increased

Lenders require a spread over the cost of money to account for the risk of not getting their loans repaid. This is the cost of credit risk. With more perceived credit risk comes widening spreads. Last November, we observed the tightening credit markets and the consequent effect of higher pricing and reduced leverage. The trend has continued because the claims of “no cracks in the portfolio” have been taken back. Amortization, term, credit spread, and fees are all moving away from the borrower. The effect of inflation on businesses and the economy has also made lenders concerned about the future performance of borrowers. Their perception of risk has increased, and they intend to be more cautious and to be paid for increased perceived risk. As an aggregate result of all these causes, the effect is that relative to a year ago, the cost of borrowing has increased dramatically. Whereas a borrower may have experienced floating rate costs in the range of 2% (credit spread of 1.5% plus SOFR of 0.5%), it now has a cost of 8% (an additional credit spread of 1%, plus a 5% increase of SOFR).

Higher Credit Prices Creates More Leverage

Most think of leverage as a balance sheet measurement but real leverage is the proportion of cash flow from operations that must be dedicated to debt service. To illustrate, a company with $100MM revenue, $10MM EBITDA, and $3MM of tax obligations normally borrows an average of $40MM and would recently have experienced a cost for interest of $800k per year (2% of $20MM), or 8% of EBITDA. To repay that debt over ten years, it would make payments of $4.5MM per year and dedicate 64% of its after-tax cash flow to debt service. Today, that same business would have interest costs of $3.2MM or 32% of EBITDA and must dedicate 85% of its after-tax cash flow to debt service – effectively a 33% increase in leverage.

If working capital has increased because of inflated costs, say by 10%, and EBITDA has taken a hit of 10%, the equation gets much more dramatic. The business can no longer repay the debt in a ten-year period even using 100% of its cash flow. It explains why lenders are more cautious and perceive more risk.

The Silicon Valley Bank Effect – An Additional Force to Restrict Credit

“I have full confidence in banking regulators to take appropriate actions”

– Janet Yellen (March 10, 2023)

Despite Janet Yellen’s confidence in bank regulators being able to maintain bank stability, the truth is that no bank can withstand a run on deposits. Banks are very highly leveraged businesses with a sizable portion of their funding coming from deposits. Banks cannot turn loans into cash overnight, but depositors can immediately convert their deposits to cash at any time. The banking system relies on depositors’ trust that the system works, and the likelihood that withdrawals won’t “bunch.” If depositors do not have confidence, they can initiate withdrawals, and large aggregate withdrawals can cause a liquidity issue. Once upon a time, a depositor would have to show up at a bank and request a withdrawal. Requiring physical presence was effective enough at slowing runs to give banks time to obtain necessary liquidity and to address depositor fears. Today, depositors go online and initiate transfers at will. The truth is that a bank, and maybe the system, cannot withstand real, instantaneous fear in the marketplace.

The circumstances around Silicon Valley Bank are not as important as the fact that large depositors became concerned about the safety of their deposits and enough rushed to withdraw their money that SVB could not withstand the rush. With several others following the same path, banks are now trying to lower the ratio of loans to deposits to increase liquidity reserves. How do they do that? They quit making new loans.

The increase in interest rates puts banks in a tough situation: either increase rates on deposits to hold them and thereby reduce profitability or allow deposits to leave for other markets and be faced with a need to reduce loans even further. Either way, forces are pushing for higher borrowing rates and/or reduced credit availability.

Borrowers are facing a sea change in credit availability and costs, while capital requirements are increasing. Within a single year, the cost of a floating rate loan has increased fourfold, and leverage has increased by a third. That is quite a whack to corporate borrowing costs and the ability to borrow.

The implications are obvious to the acquirer of a business as we pointed out in our February issue of INSIGHT, “Six” Is The New “Eight.” The effects on businesses outside of transactions are no less serious. Formerly highly leveraged companies could now be in the “dangerous” range. Leverage cuts both ways and on the way down, it can get bloody. The options are a sale, a merger to create efficiencies, or a new partner to bring an equity injection. These represent a substantial change from the status quo and is better considered over time than in the face of a crisis.