From an historical perspective, the market for privately held businesses is robust with multiples at historic highs. Owners of businesses now think of these multiples as being the new “norm”. There are two primary reasons for price determinations – the economic performance of businesses and the supply/demand of capital – and both change over time. Planning for the future assuming today will repeat itself indefinitely is not wise. As Herb Stein, a famous economist once said, “If something cannot go on forever, it will stop.”

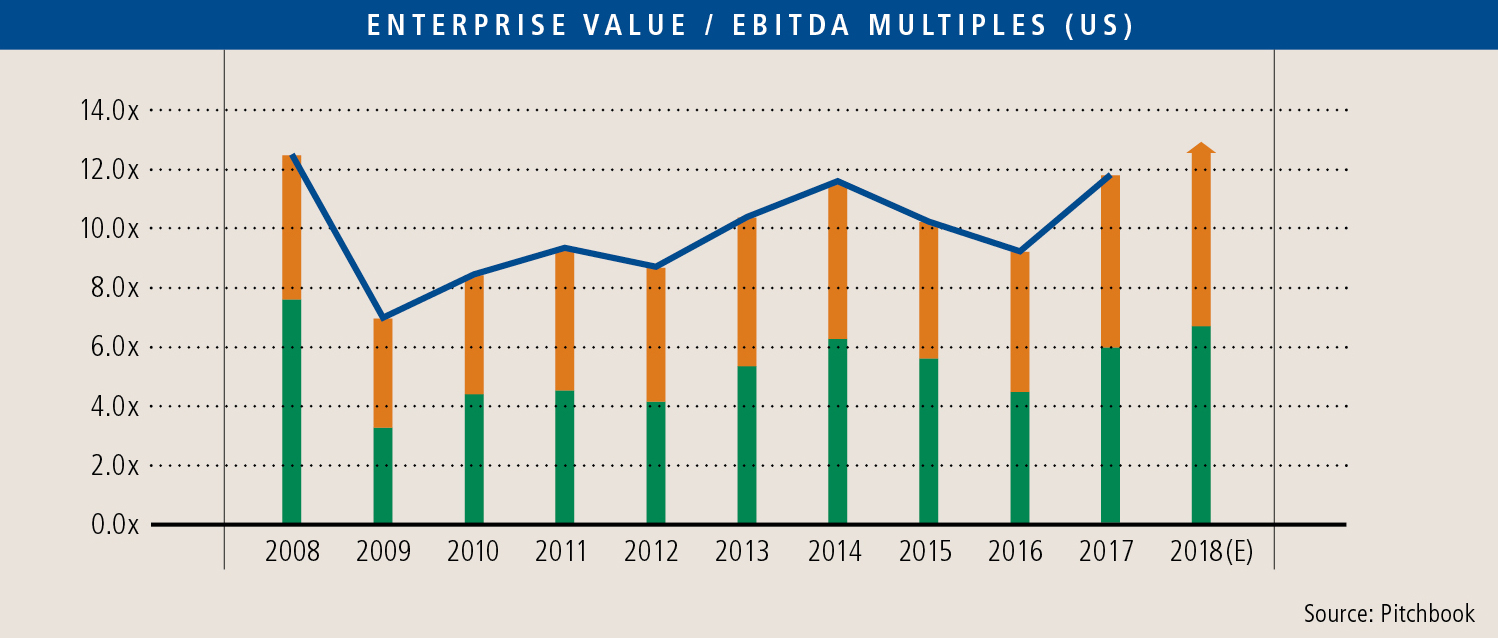

Historical Prices for Middle Market Business

In the past ten years since the financial crisis, multiples for businesses in the US have creeped steadily upwards, even beyond their levels in 2008.

Given the steady but slow growth in the US economy over the same time, one could argue that multiples today are actually higher than their pre-financial crisis levels when normalized for expected earnings growth, supporting the conclusion that the market is currently at a high point relative to relevant history.

Is it the Economy / Yes and No

A growing economy means more demand for goods and services.

Volume increases for businesses usually imply more profit as the scale of the business comes into play. More importantly, valuation in the form of multiples of current performance is a function of expectations about the future.

As we have commented on in many past IN$IGHT articles (e.g., “What’s in a Multiple?” July 2015), multiples increase when buyers expect that risk-adjusted future cash flows from the business will increase, and the multiple is directly correlated to the expected rate of increase in and perceived certainty of future cash flows. So, no matter what current EBITDA is, the multiple is related to what buyers think the future EBITDA will be.

Those expectations are influenced by the most recent experience as well as views on the future of the industry, the global and domestic economy, interest rates, and political stability, among other factors. We have certainly experienced a revival of the economy over the past two years. The recent tax law has also spurred new capital investment that one would anticipate will lead to higher future productivity (and profits).

Those expectations are influenced by the most recent experience as well as views on the future of the industry, the global and domestic economy, interest rates, and political stability, among other factors. We have certainly experienced a revival of the economy over the past two years. The recent tax law has also spurred new capital investment that one would anticipate will lead to higher future productivity (and profits).

A majority of economists are cautiously optimistic about the next 12-24 months, but still project a modest slowdown from 2018. The good news and bad news is that labor is gaining traction as unemployment continues its decline and wages are increasing – good for employees and issues for employers. Concerns about the Fed, slowing international markets, trade wars, and heightened attention on political instability are causing dampened projections but not a recession. In other words, the macro perspective on economic growth does not in and of itself support the current market multiples in the middle market.

So what else influences the appetites of buyers of middle market companies?

Investor Demand

Ask almost any private equity investor and you will hear that the competition for investments is brutal and has driven higher and higher prices to win deals. We cannot underestimate the market impact of the private equity universe. In our own experience, private equity buyers are often very competitive with strategic corporate buyers on deals, showing they can and will pay the market price or more for a company they like. Rather than market multiples being driven from underlying fundamentals, our view is that buyers are just paying more and accepting either greater risk or a lower rate of return.

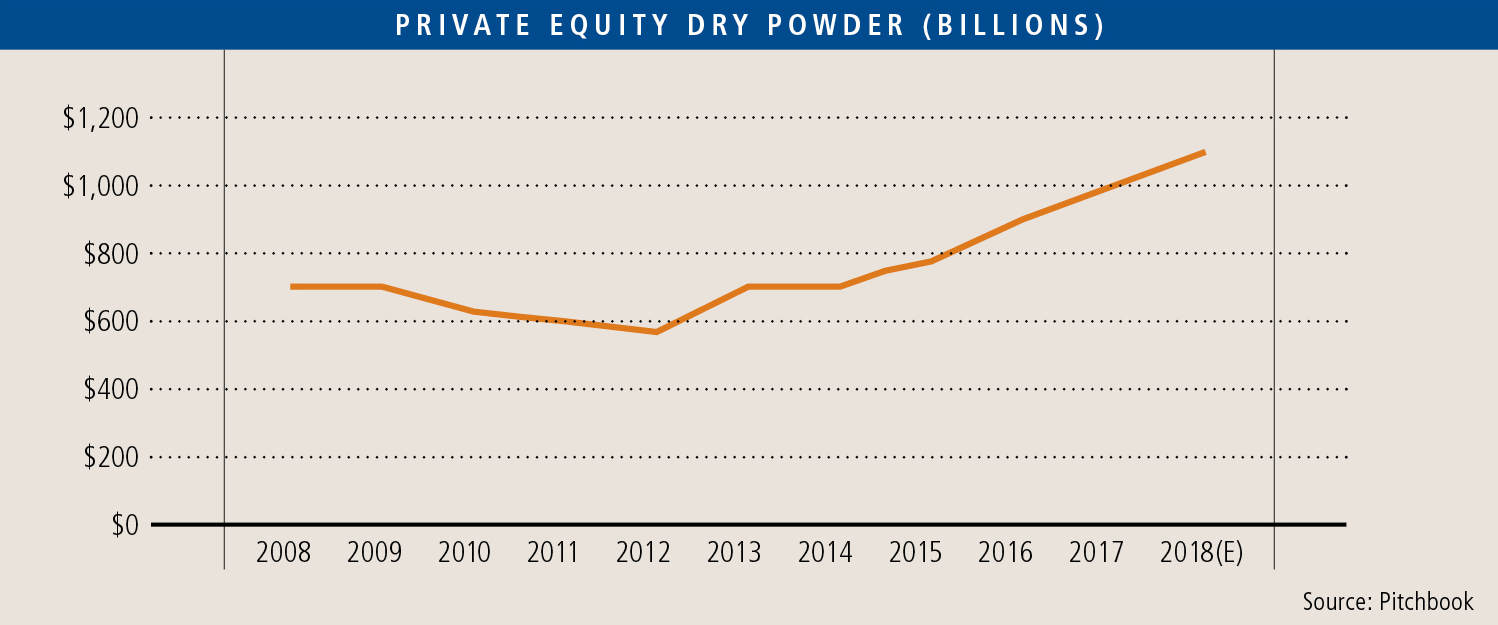

Competition comes from the sheer amount of unused equity capital contained in private equity funds. Since 2012, the amount of pent-up demand for new opportunities fueled by growing captive funds has increased by more than 50% while the dollar volume of deals has not kept pace. The resulting dry powder awaiting investment has climbed steadily over that time.

Our view is that the pressure of putting money to work from a time-limited fund, in an increasingly competitive environment, without a growing universe of targets, limits the avenues available to equity investors to structure deals such that they have the potential to earn an attractive return for their investors. One avenue that remains currently available is the use of high levels of cheap debt.

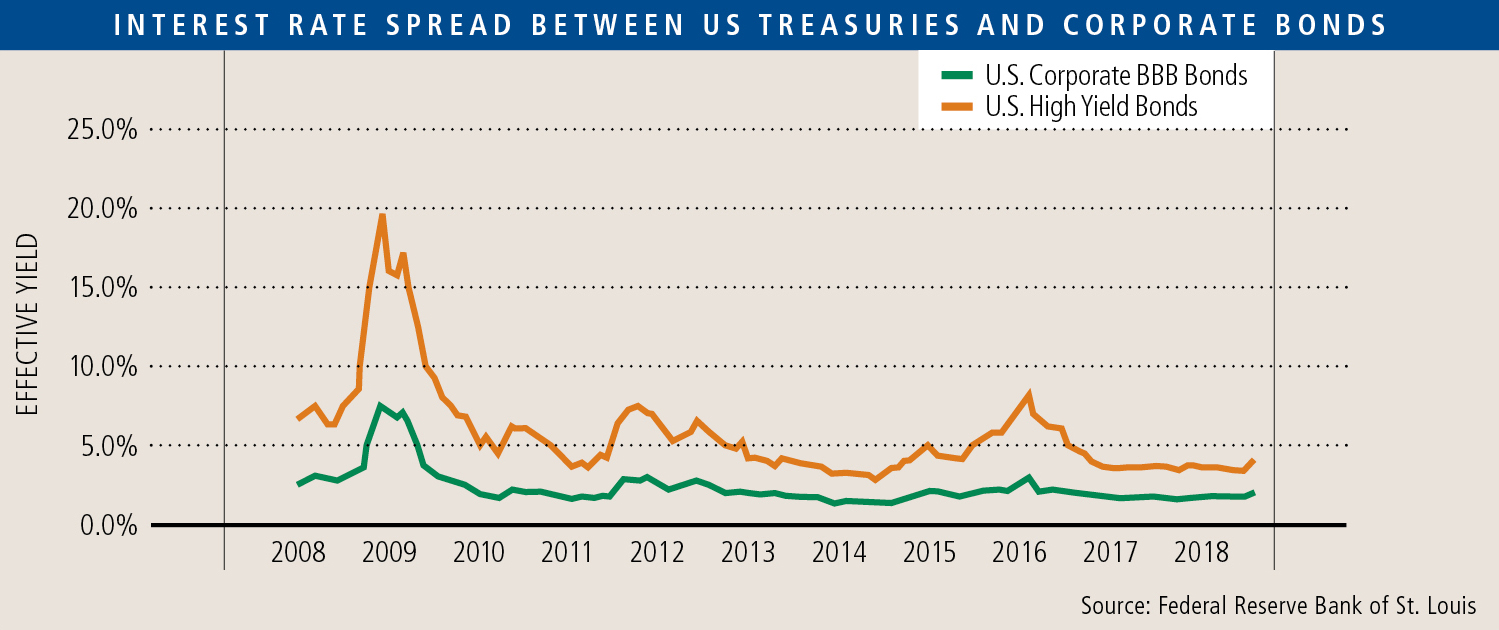

Our IN$IGHT article in the Fall of 2015, “Growth, Leverage, and Multiples”, describes how investors utilize cheap debt capital to “juice” equity returns and thereby justify a high purchase price. We commented then that “Only a few times over the past thirty years has there been a time like today where the combination of optimism over future growth and abundant, low cost capital have been present.” That environment has continued to today.

The private equity overhang will continue to provide upward pressure on prices – lockup periods for recent fund vintages won’t expire until the mid 2020s at the earliest – but credit availability is the key ingredient to keeping this train on the tracks. At the present, defaults on credit, both from national statistics and anecdotally from our friends in the lending business, are of no concern. This is also reflected in the stability of spreads between treasuries and corporate bonds. But, we are watching credit indicators closely, as this is where changes should show themselves first.

The private equity overhang will continue to provide upward pressure on prices – lockup periods for recent fund vintages won’t expire until the mid 2020s at the earliest – but credit availability is the key ingredient to keeping this train on the tracks. At the present, defaults on credit, both from national statistics and anecdotally from our friends in the lending business, are of no concern. This is also reflected in the stability of spreads between treasuries and corporate bonds. But, we are watching credit indicators closely, as this is where changes should show themselves first.

Conclusion

Economic growth smooths over a lot of credit and investment mistakes. But if there is a “pause” in our economic growth, cracks are likely to appear in credit portfolios, leading credit administrators to clamp down on risk. When the credit spigot gets turned off, all buyers will readjust their purchase equations with the likely result being a contraction in multiples paid.

What to do? Unless nearing an exit for personal reasons, in which case it is important to understand that current seller-friendly conditions are not permanent, the best thing is to stay focused on what is under direct control and continue to make improvements.