From sovereign wealth funds, to endowments, to pension funds, to native organizations and family offices, many patient investors that traditionally would have acted as limited partners (LPs) are shedding their traditional conservatism and making direct investments in private companies. We have found that while this raises the possibility of a greater return on invested capital – by removing intermediary investment layers and associated fees – it is also riskier, and potentially riskier by a greater degree than is justifiable for the possibility of a marginally higher return.

In other words, for LPs seeking an alternative to perceived high fees, lockup period, and diminishing returns from investing in traditional closed-end private equity (PE) funds, skipping an intermediary altogether may not be an improvement. But, there are a variety of alternative ways patient investors can access PE in today’s marketplace.

Accessing Private Investments

The simplest definition of PE is that it is equity that is not publicly listed or traded. Virtually every LP type has been aggressively increasing its allocation to PE in recent years – the common rationale being that the low-yield environment that has existed since the financial crisis has rendered PE a relatively high return-generating asset class.

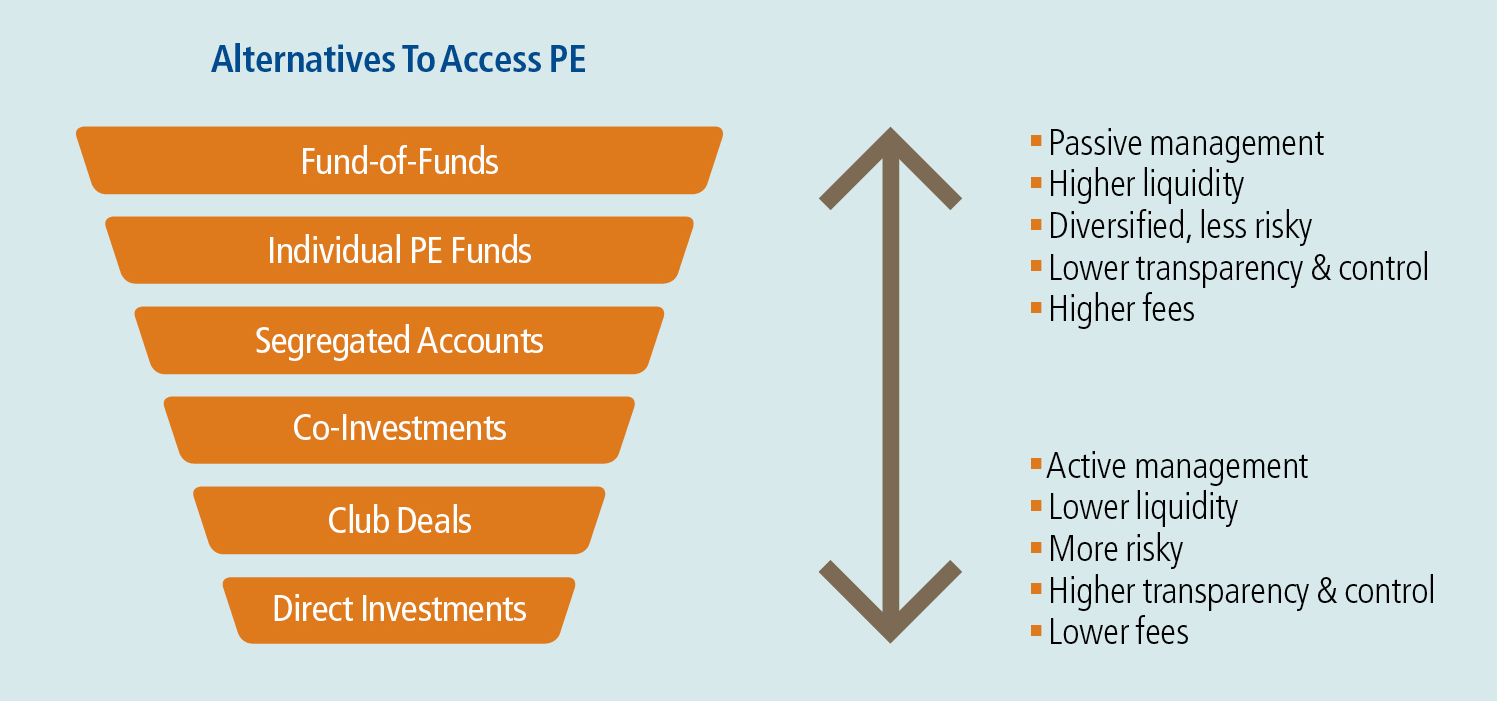

While individual fund commitments are the most common way for LPs to access PE markets, other access points exist as well. These choices are primarily driven by appetite for risk and the associated costs.

While Fund-of-Funds (FoFs) have delivered weak performance due to duplicative fees, many LPs continue to allocate capital through them, instead of investing in specific PE funds, due to their passive approach to private markets.

Larger investors can also negotiate partnerships directly with PE funds and invest through segregated accounts. The money they commit gets invested in parallel with core funds, in different asset classes, or in some combination of the two.

Equity co-investment is a minority investment in a company made by an LP alongside a PE fund manager. Equity co-investment enables LPs to participate in potentially highly profitable PE investments without paying the usual fees charged by the fund.

There is also the option of club deals where a number of LPs come together to pool capital, splitting the risk and costs of direct investment among the participants.

Finally, LPs have the option of investing in private companies directly, internalizing not only all of the costs and risk associated with the investment, but also the potential upside.

Shifting to Direct Investing

According to Cambridge Associates, while the median net internal rate of return of global private equity funds declined from 20.2% in 1993 to 10.7% in 2015, the traditional “2 and 20” (2% management fees and 20% carried interest) fund fee structure has remained essentially unchanged. As such, LPs are collectively paying the same fees for half the return, individual fund performance notwithstanding. The prospects of reduced fees and expenses are an important reason family offices have pursued direct investing.

Other reasons cited for direct investing include:

- Greater sense of control over operations and exit

- Increased transparency and decision-making authority

- Ability to invest for the long-term; time horizon arbitrage to get paid for illiquidity

- Using less leverage to lower risk

- Sector-specific skill-set and knowledge that might lead to higher returns

- Opportunity to make positive social or environmental impact

- Minimize taxes

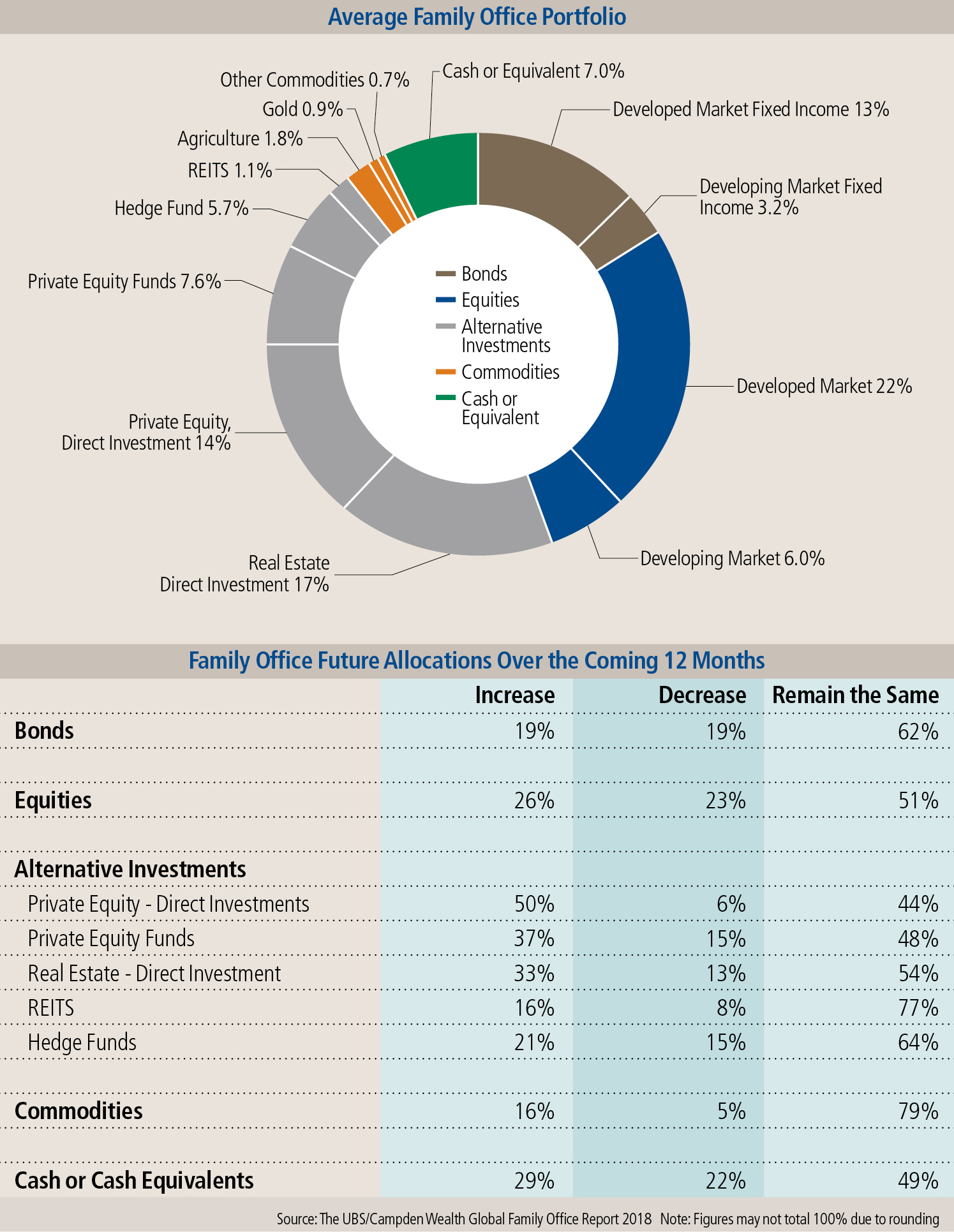

The average family office portfolio in 2018 had 14% allocated to PE direct investing, the vast majority of which was in private middle-market companies. Furthermore, almost half of all family offices intend to increase their PE direct investing allocation in the coming 12 months.

However, Direct Investing is Hard

Despite the attractiveness of direct investing, we have witnessed a number of horror stories where acquisitions haven’t gone as planned. In our opinion, not every family office has the scale, skills, or the will necessary to execute a successful direct investing program.

To begin with, successful direct investing requires the capital source to recreate all of the capabilities and processes a PE fund possesses – sourcing its own deals, conducting rigorous due diligence, leading robust post-acquisition value-creation plans, ongoing monitoring of each investment, and managing successful exits. Developing these skills, much less matching the experience that seasoned investors have attained over decades, takes time and dedication. Many smaller LPs are simply ill-equipped to do all this messy work right.

Take deal sourcing as an example. Substantial networking goes into ensuring a strong deal pipeline, so much so that Bain & Company estimates that each senior director at a PE fund spends over 25% of their time networking and managing relationships with deal originators. They further estimate that for every 100 potential opportunities a PE fund reviews, only 1- 2 of those may get acquired. Creating a deal pipeline of this scale requires a substantial investment of time and money, an investment many LPs have not made.

Effectively managing acquired businesses is time-consuming and stress levels can be high. Driven by a “buy to sell” mindset, many PE firms are hands-on and constantly try to maximize value by reevaluating every aspect of the business. However, in our experience, family offices are hesitant to aggressively manage their acquisitions, even when they are underperforming. This is often because of misaligned incentives of investment managers of the family office and the operating managers of the business, or a lack of knowledge of what to do.

Finally, patient LPs are far more susceptible to the sunk-cost fallacy. Managers responsible for direct investing are often hesitant to admit a bad investment decision and continue throwing good money after bad. As a result, bad investments get bankrolled much longer than they should. We have seen the “buy to keep” strategy embodied by many patient investors, negatively impact returns.

In conclusion, we believe that numerous patient capital LPs have likely overextended themselves in recent years through their direct investment programs. Many of these organizations have not invested the time or money to match the investment platforms that their PE fund competitors bring to the table, leading to unsatisfactory returns. The pendulum has swung too far on direct investing and, as economic growth slows in the coming years, we expect a number of these investors to retreat from their direct investing strategies.