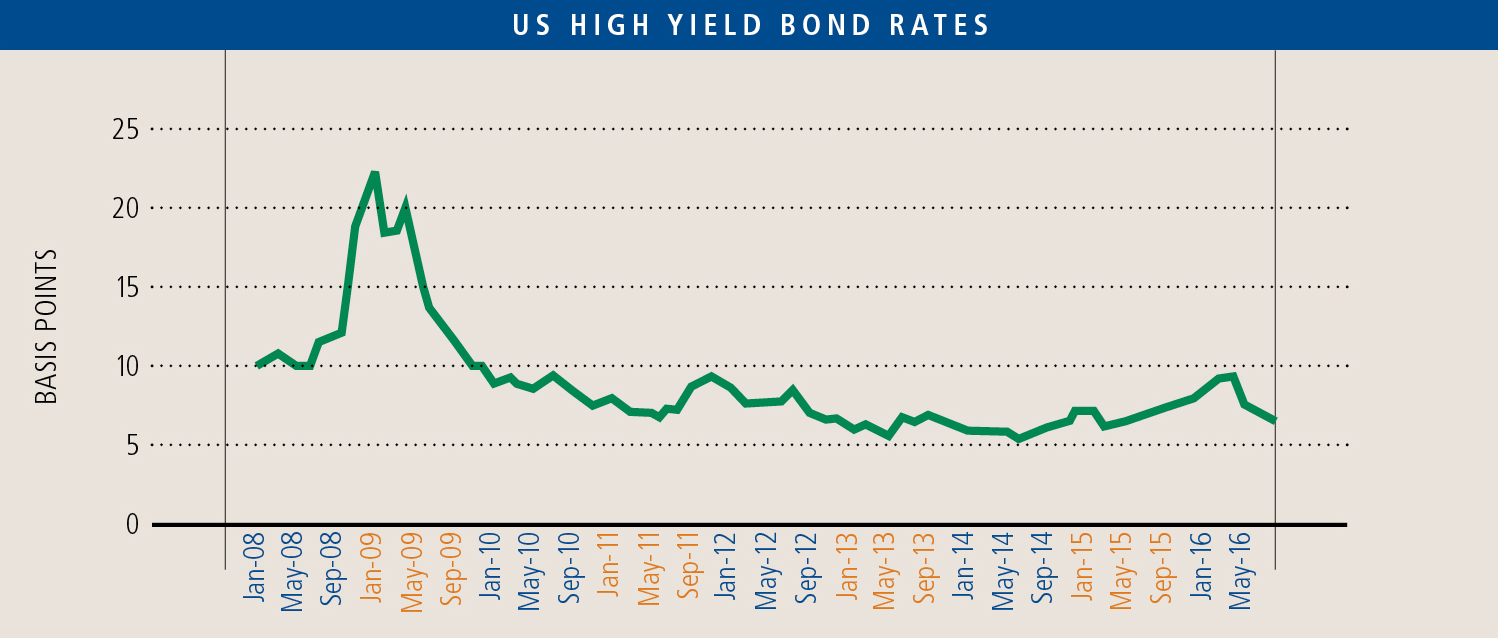

As 2016 began, we observed cracks in the credit markets (see “No Rain, but Clouds are Forming,” IN$IGHT January 2016). Our rationale then was that there had been a turn up in high yield rates, BDCs couldn’t raise cash as a result of impaired portfolios, and some commercial bankers indicated that troubles were appearing in their own loan portfolios. Since then, high yield bond rates have moderated (see chart below). BDCs that were stymied from raising money to make new loans simply created new entities and took on new investors. Bankers have reassessed portfolios and no longer see concerns.

In speaking with our friends that provide senior secured loans, second lien and mezzanine loans, preferred equity, and unitranche capital, we offer our thoughts below to provide better insight into the private capital markets.

In speaking with our friends that provide senior secured loans, second lien and mezzanine loans, preferred equity, and unitranche capital, we offer our thoughts below to provide better insight into the private capital markets.

Senior Debt

Both commercial bankers and asset-based lenders provide senior credit to operating companies. Both usually take collateral and have the primary right to cash flow as their source of repayment. The primary difference is focus. Commercial bankers focus on a company’s cash flow characteristics with collateral as backup support, whereas asset-based lenders focus on the value and liquidity of the assets of the business and have more tolerance for cash flow variability.

Senior lenders unanimously commented that they remain aggressive on both pricing and terms. New asset goals are not easily met, as current borrowers are retiring debt and new opportunities are few and far between. Anemic economic growth is precluding companies from aggressively expanding capacity (and borrowing to do so). Borrowings to support acquisitions have also declined, as the mergers and acquisitions market is off from 2015 by about 20%. As a result, senior credit providers say the volume of loans they would like to make far exceeds the number of new opportunities.

Pricing

Loan pricing and terms still weigh in favor of the borrower. Stiff competition to supply loans has created a “pricing barbell,” wherein large companies with access to the public markets and small companies serviced by a single bank enjoy the most attractive pricing. Meanwhile, middle market companies that employ multi-bank groups as their credit source pay more. This is surprising, since credit markets have always treated bigger companies deferentially relative to smaller companies, since larger companies typically have superior market positions and are less risky from a credit perspective. As such, they can support higher leverage and better pricing.

In the Pacific Northwest, there are three general levels of non-public credit, each treated somewhat differently. The largest middle market companies, generally with EBITDA in excess of $20 million and with a club or syndicated bank group, can borrow up to approximately 3X EBITDA at a rate of LIBOR + 200-250 basis points. For smaller companies or for companies with borrowings between $10 and $50 million ($50 million is often considered a guideline “hold” limit), rates can be as much as 50-75 basis points lower. Below $10 million in borrowings, the pricing can be even lower. There are two factors that affect this dynamic – competition and ancillary services.

The banking system is now organized with a small number of “large” banks suchas, Bank of America, JP Morgan Chase, US Bank, Wells Fargo, and Keybank. As bank groups come together, the level of competition declines. What might not be apparent is that the last bank in the group influences price; therefore the most competitive bank might not drive the group pricing. A second factor is also taken into account. Only one bank in the group is likely to get the ancillary banking services the company needs – cash management services, trade finance, foreign currency and interest rate hedges – which can be very profitable. The other banks in the group need to price their credit on a stand-alone basis.

Once the credit is small enough to be handled by a single bank, competition is for the entire relationship. Banks consider the complete package of services and credit when competing for the business. In essence, credit pricing is sacrificed to obtain other profitable pieces of business.

For credit relationships below $10 million, an extra level of competition comes into play as regional and community banks will compete for the same business. In some cases, loans are being competitively bid to below LIBOR + 100 basis points.

Leverage Limits

Commercial banks generally limit leverage at 3x EBITDA, but are making exceptions up to 4.5x EBITDA (or more) for businesses that they think deserve the credit and show an ability to reduce leverage quickly. There appears to be a limit on total leverage (senior and junior capital combined) of 6x EBITDA. Asset-based lenders view leverage in terms of advance rates on collateral, which can result in higher multiples of EBITDA.

Advance rates by asset-based lenders (the amount that can be borrowed relative to value for a category of asset pledged) remain aggressive – 85% of accounts receivable, 50-70% of inventory, and 50-80% of fixed assets. “Airballs,” or the amount borrowed in excess of the calculated advance rate, are offered to some borrowers, although rarely will the airball exceed 10% of total borrowings. This extra credit is offered when it can be demonstrated that amortization of the airball can occur over a short period of time (1-2 years).

Plan for More Time to Close

Loans are taking somewhat longer to get closed, although credit approval is not the obstacle. Instead, the issue is the regulatory checklist that has to be reviewed prior to commitment. Commercial bankers in particular say that the number of regulatory checks that need to be addressed for each loan has expanded such that this process is sometimes more onerous than the credit approval process.

Junior Capital

Many types of firms exist to provide junior capital in addition to that provided by senior lenders. Some are subordinated to senior lenders and some will blend several categories of risk into a single credit facility. Unitranche capital providers will take the entire right hand side of the balance sheet. Unlike senior lenders, greater size positively impacts both leverage and pricing, as the only factor being priced is risk; there are no ancillary services to factor in.

Each junior capital source (e.g., second lien, mezzanine, preferred equity, unitranche) has its own unique characteristics that determine in which situation it best fits. On a blended basis, the overall blended cost of the debt side of the balance sheet (senior debt plus junior capital) is around 6%. Other than for preferred equity or mezzanine for small businesses (less than $10 million EBITDA), rarely are warrants or other equity kickers now found.

Conclusion

Lenders of all varieties are anxious to put money to work to recapitalize companies, finance acquisitions, or finance value creating growth opportunities. Designing the right combination of sources to accomplish the company’s specific goals and risk appetite takes some expertise and knowledge, but the credit window remains wide open with product offered at bargain prices.