The modern private equity industry has only been in existence for about 30 years. During this period, interest rates have declined and leverage, partially accommodated by lower rates, has increased. As a byproduct, valuation multiples have expanded. This built-in return enhancement has largely been erased through competition from many new entrants pursuing the same opportunities. In response to these dynamics, private equity investors have had to evolve their approaches to investments.

Still, one element of private equity fund investing has not changed – the “2 and 20” fund structure. In Part I of this series, we described the mechanics and economics of a typical fund structure and introduced the idea that this structure creates certain inherent conflicts between the general partners (“GPs”) and the limited partners (“LPs”), whose money the GPs invest. In recent years, limited partner complaints have become louder, but we suspect the noise is less about principle than principal – investors want more than they are getting for their money. Owners shouldn’t be indifferent to these issues between managers and investors. Owner-operators should understand these issues and consider them when a deal is negotiated with a new partner.

The GP/LP structure incents risk taking

“You can’t make money without taking risk,

But taking risk doesn’t assure one of making money”

Most private equity GPs benefit from an asymmetric payoff structure that skews the risk / reward tradeoff. Relative to the capital invested and the profits to be earned, GPs do not invest meaningful capital, which translates into considerable potential for upside gain and little or no downside capital loss. The genesis of the 2 and 20 model dates back to KKR’s founding, as Kravis and Roberts relied upon the old “third for a quarter” sharing of profits made famous in the oil & gas wildcatting industry. The original third for a quarter, however, required the GP to invest one quarter of the capital in return for one third of the profits. Today, the majority of private equity GPs have considerably less skin in the game, investing only a nominal amount in the fund, yet are still entitled to 20% of the fund’s profits.

Furthermore, carry is based on nominal returns to equity without regard for leverage. In other words, a 20% internal rate of return (“IRR”) to LPs looks far better than a 12% IRR, but viewing these returns absent the financial risk embodied in different leverage profiles is misleading. One might ask how much value has really been added if higher leverage is the primary reason for higher returns.

To combat the heightened financial risk of a leveraged recapitalization, GPs often structure their equity investments in a superior position to other shareholders. Business owners retaining ownership in a private equity-led recapitalization should be aware that their equity might not carry the same return profile as their new partners. Preferred returns, liquidation rights, and other provisions should be viewed with caution by selling owners. The selling entrepreneur needs to consider the change in risk position of his or her remaining capital investment. Operating under the pressures of high leverage and with a requirement to first return the capital to the new partners likely offers an unfamiliar operating environment. The headline price may be alluring, but what follows needs to be considered.

Holding Periods Distort Investment

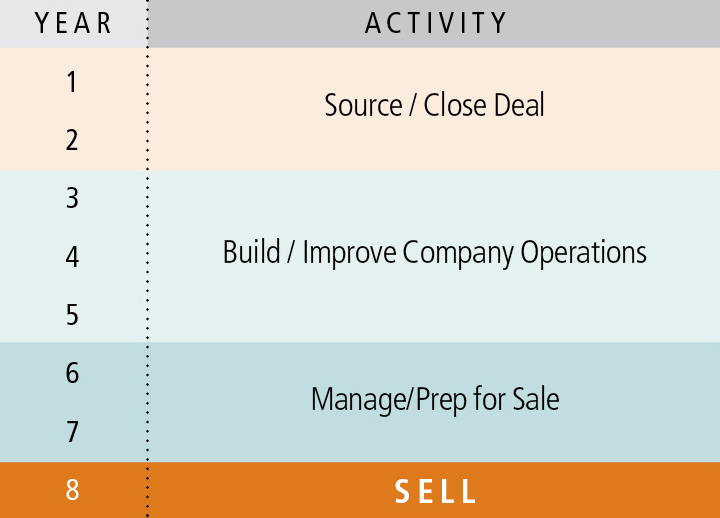

Private equity firms often describe themselves as “long-term partners,” but the constraints on fund length and structure imply holding periods far shorter than the fund life. The chart below illustrates a typical time horizon for an investment within a fund.

In a ten year fund, a GP may spend two years finding, negotiating, and closing a deal, three years building / improving operations, two years managing financials and preparing for a sale, and one year completing a sale. For later investments in the fund, the timeframe can become more compressed.

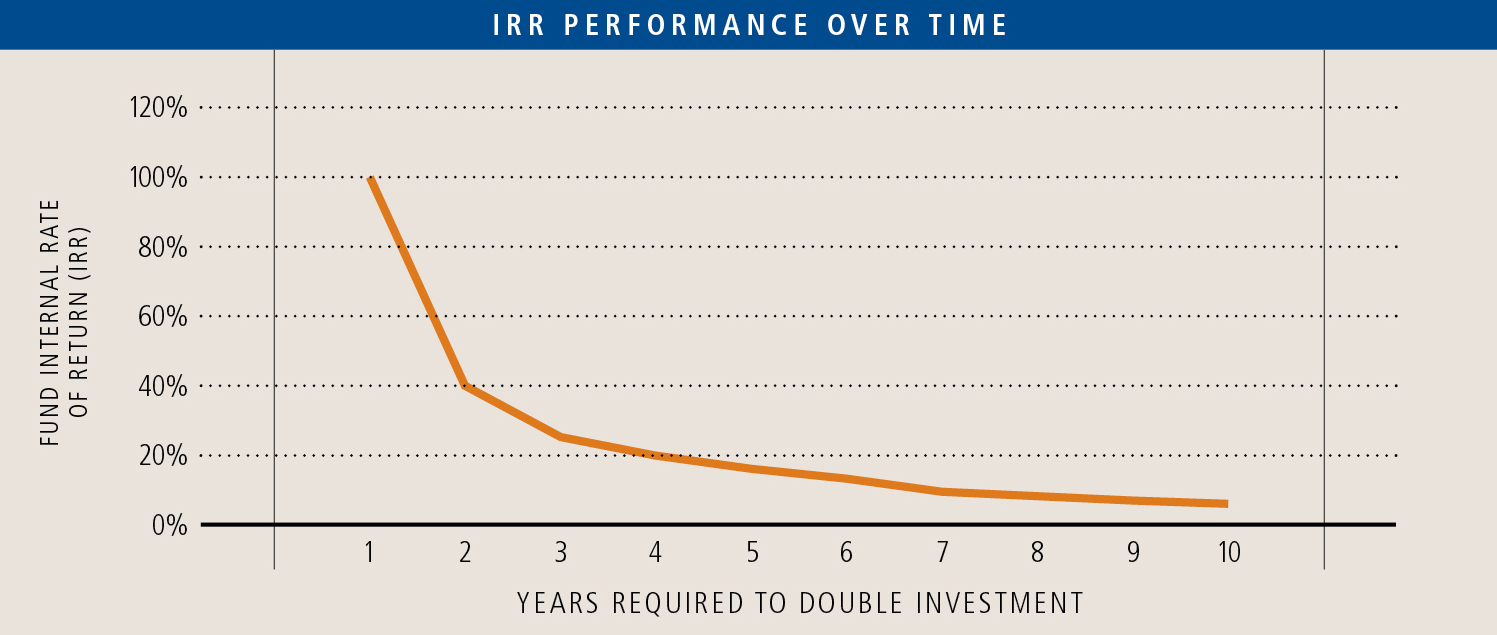

The nature of PE performance measurement is a culprit in the short-term nature of ownership. The standard measure of performance, a fund’s IRR, encourages achieving results as rapidly as possible. For example, as seen in the chart below, fund IRRs decline dramatically as the time required to improve performance lengthens.

The arithmetic itself leads to certain pressures:

“Sell winners and hold losers” – IRRs are time-based and dollar-weighted, which means fund performance improves when a quick rate of profit can be earned. This doesn’t make sense to many entrepreneurs who don’t want to stop when the runway in front of them looks promising.

“Sell winners and hold losers” – IRRs are time-based and dollar-weighted, which means fund performance improves when a quick rate of profit can be earned. This doesn’t make sense to many entrepreneurs who don’t want to stop when the runway in front of them looks promising.- Investing in the business must have immediate payback – Selling a business based on the future is harder than selling based on actual performance. Therefore, private equity firms are wary of trading current performance for future potential and any investments that payoff outside the expected holding period are avoided.

- Avoid cyclical industries for fear of getting “caught” on timing – Generally, private equity funds avoid cyclical industries. When they do invest in cyclical businesses, they are quick to react to signs of a downturn.

Self-Liquidating Nature Increases Costs

Operating a private equity fund is expensive. Staffing a full professional team, office space, and travel and entertainment are all significant operating expenses even before accounting for deal-specific fees needed to acquire, manage, and sell a company. The private equity industry is comprised of very bright people, but they are generally not industry experts. Therefore, they require substantial third-party research and arrangements with consultants and seasoned industry executives, all of which add costs. Fund structures allow for transaction fees to be covered by the fund. Management fees can be drawn down on the entire commitment for five years and for a much longer period for invested amounts. Since it takes up to five years and an equal time to wind down the fund, fees need to be high enough to keep the organization intact for the life of the fund. The 2% management fee is intended to support the size of organization needed to employ the relative amount of capital. For a typical middle-market fund, management fees will take at least 15-20% of committed funds. If one has $0.80-0.85 to invest instead of a dollar, there is a lot of ground to make up.

The self-liquidating nature of private equity funds creates another reason to “sell the winners and hold the losers.” GPs need to continually market their capabilities to raise the next fund. Selling the winners shows the next investors how well they’ve done and holding the losers retains management fees, partially obscuring poor performance.

Conclusion

The result of these constraints often leads GPs to select companies with projected growth trajectories that align with their intended holding period. That allows them to ride enough of the upward momentum to realize increased revenue and cash flow, while hopefully leaving enough on the table for future owners to project their own optimistic future. While a private equity fund may represent a logical source of liquidity of a potentially valuable partner, business owners should be aware of the incentive systems involved and recognize that if control is ceded, they are along for the ride. How the world of private equity is evolving to address some of these issues will be discussed in Part III of this series.