Confidentiality is among a business owner’s top concerns when considering a transaction. In particular, potential information leaks can have adverse consequential impacts on employee, customer, and supplier relationships. While every transaction demands a high degree of confidentiality, some situations are more sensitive than others and require additional levels of security and protection.

Traditional nondisclosure agreements (NDAs) are meant to protect a company and its owners in the event of a confidentiality breach. Although appearing ominous to the signer, the challenges relating to proving a breach, determining actual damages, obtaining a judgment, and collecting represents a long, arduous, and potentially expensive route, thereby damping their protectiveness. The reality is that NDAs are rarely litigated, and are not always taken as seriously as one would expect. What steps then can business owners and their advisers take to facilitate a successful transaction while preserving confidentiality?

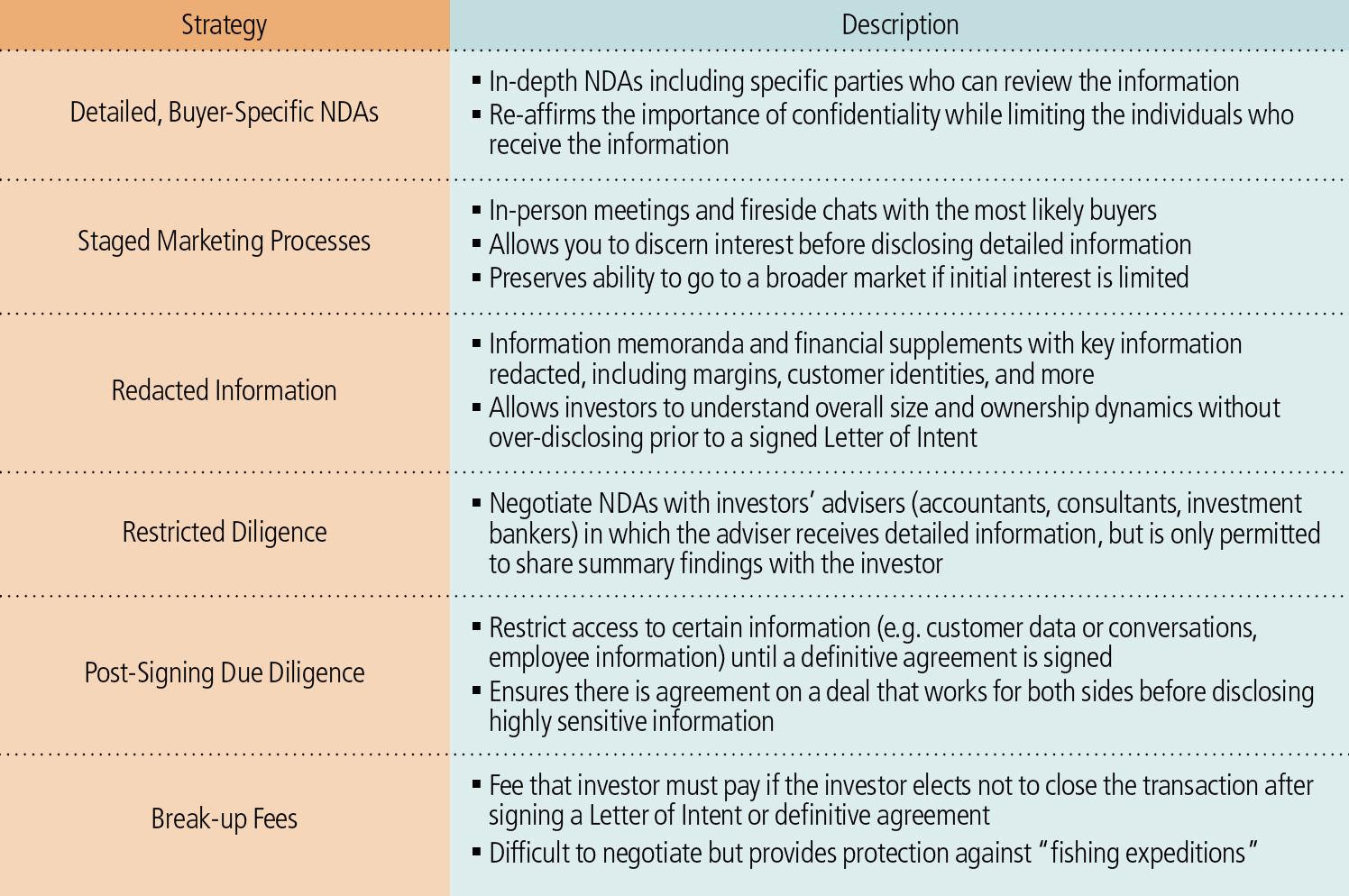

In each phase of a transaction, there are strategies that can be implemented to maintain confidentiality while providing investors with sufficient information to come to a reasonable conclusion. These strategies, summarized, can be utilized in combination with each other or in concert with one another.

Initial Outreach Phase:

Undesired disclosure of the simple fact that a business is for sale is most likely to occur during the initial marketing phase of a transaction. Even with NDAs in place, it can be difficult to prevent word from spreading beyond the intended audience. When confidentiality is a heightened concern, it is best to limit the group of potential investors to only those with the highest likelihood of closing a transaction at an acceptable price. Once this group is determined, the parties can be contacted with detailed, investor-specific NDAs and confidential discussions can begin.

If there are competitive concerns with contacting certain strategic acquirers, it may be best to first gauge the interest of financial investors to assure that there are alternatives prior to disclosures to competitors. At a minimum, competition from financial investors helps to push competitors to participate in the seller’s process, according to the seller’s rules, in terms of timing of information disclosure.

Marketing & Preliminary Diligence Phase:

When buyers begin to receive information about the company, confidentiality concerns generally shift away from the fact that an owner is contemplating a transaction to leaks about company-specific operating and financial information. Information memoranda with redacted information can prevent unnecessary disclosure up front, at least until it can be confirmed that an investor has a genuine interest in the opportunity and isn’t simply on a “fishing expedition.”

Investors will typically utilize third-party advisers such as accountants, environmental firms, and market research consultants to assist with evaluating the opportunity. Rather than including these advisers under the generic NDA signed by the investor, individual NDAs can be negotiated directly with these service providers or each such party can be required to sign a joinder to the base agreement. When there is extremely sensitive information that the seller doesn’t want shared in detail with a buyer, these advisers can be used as intermediary investigators such that they can have access not allowed their client and they can give summary conclusions absent the underlying information. These NDAs and procedures can be administratively burdensome but provide an extra layer of protection, particularly in situations with significant competitive concerns.

Confirmatory Diligence & Documentation Phase:

Once exclusivity is granted and an investor moves on to confirmatory due diligence, a buyer will attempt to uncover every minute detail of the business, regarding its history, operations, customer base, financial performance, and more. Even during this phase, certain information can be withheld until a definitive agreement is signed. In such a case, a purchase agreement is signed that includes specific conditions that must be met in order to close the transaction. Examples of these conditions include conversations with customers, discussions with key employees, or review of key contracts. The purpose of withholding this information is to ensure that there is an acceptable deal for both parties, including price, structure, representations and warranties, and indemnifications before disclosing the most sensitive or potentially damaging information.

In the most competitive situations, a break-up fee may be possible. A break-up fee can be included in a letter of intent or definitive agreement, and provides that in the event an investor elects not to consummate the transaction, the investor owes a fee to the company to compensate for lost time, expended resources, and disclosure of confidential information. In middle-market transactions, these break-up fees are rare but sometimes justifiable.

Conclusion:

Concerns about confidentiality should not preempt business owners from considering a sale or other transaction involving their businesses. Situations involving heightened confidentiality concerns may hinder an ability to run a broad auction process, but careful deployment of the strategies discussed above can still allow a business owner to explore options and obtain a successful outcome.

When considering a transaction, it is important to work with an adviser who appreciates the importance of confidentiality, and who can customize a process that finds the delicate balance between minimizing leaks and maximizing optionality and value.