There is a mystique that surrounds family offices that has made this class of investor particularly alluring to privately held business owners. For business owners concerned about preserving legacy and community, a common perception is that family offices offer a permanent stable home for the business. We recently conducted a wide-ranging survey of family offices across the U.S. and Canada, and the results paint a picture of family offices as a disparate group of investors that are generally different than private equity. These investors don’t really act as a class as the constituents exhibit a very broad range of investment philosophies that largely reflect the philosophies of the people who created the wealth. Even more than with private equity, knowledge of the particular characteristics of investors is important to select the select few family offices that fit with the business owners’ goals.

Few Family Offices Make Direct Private Equity Investments

The family office investment model has been employed for decades by families such as the Pritzkers, Phipps, and other “old money” families as a way invest their considerable family wealth. Locally, there are the obvious names – Gates, Bezos, Paul Allen’s estate – as well as a growing list of lesser-known Pacific Northwest families. A small portion of this class is interested in middle-market businesses, and an even small portion has interests in direct investing.

Historically, family offices of a certain size – generally starting at $100 million – have opted to invest their funds directly as opposed to employing investment managers. A subset have recently extended that approach to executing direct investments in privately-held operating companies.

Differences from Traditional Private Equity

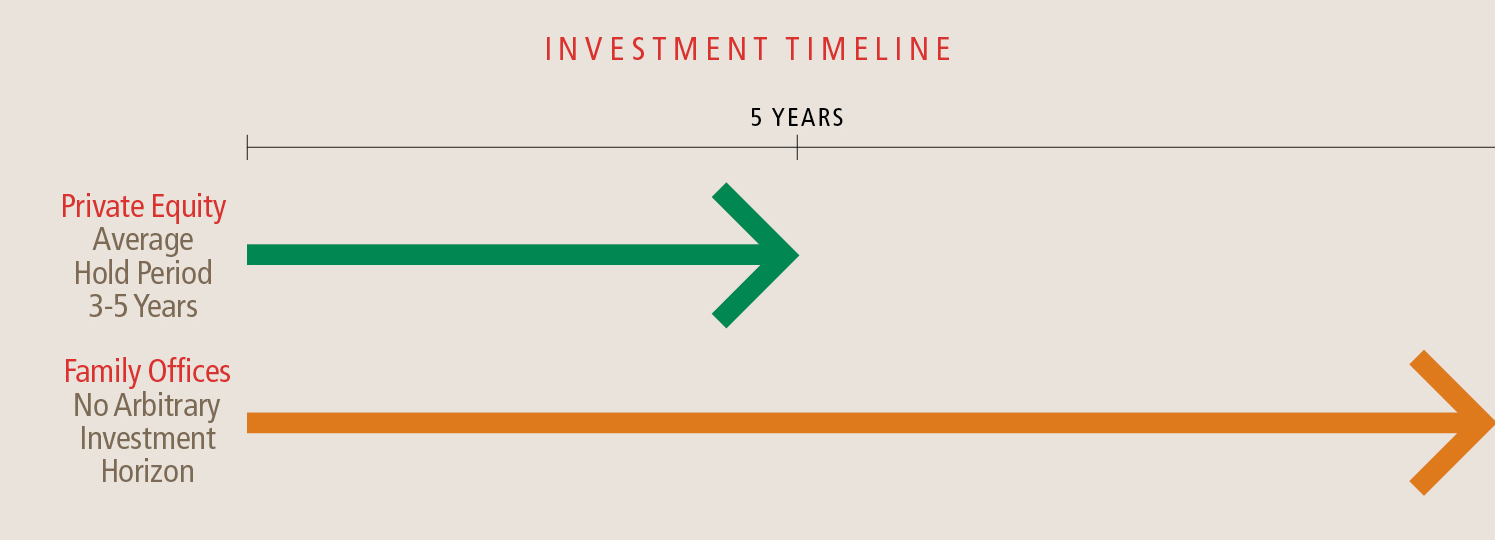

While many private equity funds tout themselves as long-term partners, the reality is the average “hold period” for a private equity investor has historically been three-to-five years, lengthened only during times of economic decline or individual company issues. This is largely a byproduct of the typical private equity fund structure (“Private Equity – Fund Economics”, IN$IGHT, Summer 2016). Long-term owners struggle with a sale of their “baby” to a private equity firm that will make changes quickly to alter the company’s trajectory followed by a sale to a third party. Many private company owners think of their businesses as an extension of themselves, and believing that what they built will be perpetuated is an appealing transition. Family offices represent to them a pathway to achieve that goal.

Family offices do have an advantage over private equity investors as a result of having no arbitrary or contractual investment horizon. This open-ended investment horizon gives more flexibility to pursue investment strategies that take time and patience. Time flexibility also removes the exit pricing risk of having to sell the business in a short number of years. Mistakes can be absorbed and revised plans can be reloaded. Similarly, because private equity investors are so focused on timing their exits, cyclical industries can be of interest to family offices who do not have those constraints. While family offices have this structural flexibility, the degree to which they incorporate it varies widely, which means that there is not a single common approach among the family office set.

Preference To Invest Alongside Or Behind Other Investors.

Many family offices prefer to co-invest with other family offices or some other lead investor they rely upon to lead intensive due diligence and take on the day-to-day monitoring and leadership that investments require. In our nationwide survey of family offices, while nearly two thirds indicated interest in majority ownership, a much smaller part of this group have that as a requirement. The remainder either preferred a minority position or were indifferent. When considering a family office as a potential investor in a private company, understanding that preference and what it implies can avoid disappointment down the road for a selling business owner. A potential seller infatuated with a particular family office may learn that it will only buy a minority interest or will require other investors to join, thereby creating a much more complicated deal with a lower probability of successfully closing on the initial terms.

Investment Thresholds Limit Involvement to The Lower Middle Market

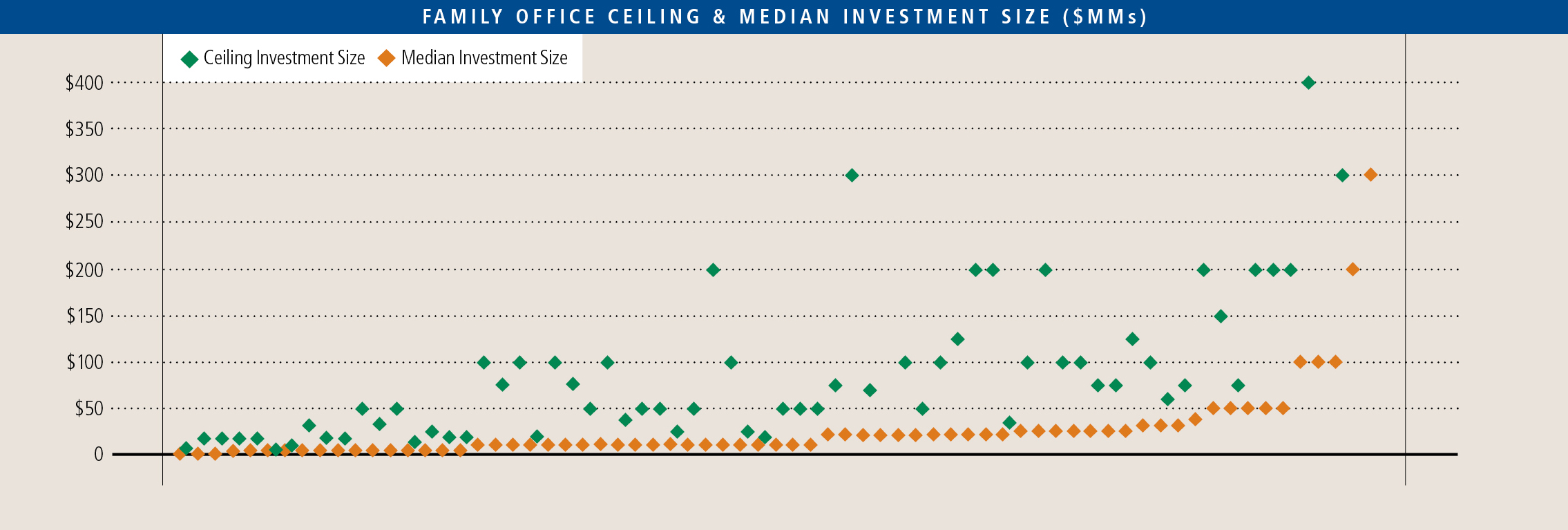

While some family offices are often funded with billions in capital, many are much smaller. In any case, only a portion of their portfolios are allocated to direct private investment. The implication is that other than for a few, the equity check is smaller than the private equity category. The exhibit above illustrates the preferred range of equity investments for more than 70 family offices we recently surveyed. The median range of target equity investments was $10 to 75 million, which on the bottom half of that range makes it difficult to consider family offices as buyers of businesses above the lower middle market.

While some family offices are often funded with billions in capital, many are much smaller. In any case, only a portion of their portfolios are allocated to direct private investment. The implication is that other than for a few, the equity check is smaller than the private equity category. The exhibit above illustrates the preferred range of equity investments for more than 70 family offices we recently surveyed. The median range of target equity investments was $10 to 75 million, which on the bottom half of that range makes it difficult to consider family offices as buyers of businesses above the lower middle market.

Hard-to-Predict Interests

Family offices are often very idiosyncratic. Particularly for newer offices, what is exciting to the wealthy founder can be fickle and subject to rapid changes. Very few have a deep team of experienced professionals trained in private equity investing. Even massive operations, like the late Paul Allen’s Vulcan family office, often have a history of cycling through private equity professionals as the family leader’s interest changes. In general, the multi-generational family offices that have developed disciplined processes and have had decades removed from the original wealth creators tend to be more predictable and act similar to traditional private equity groups in terms of holding true to identified criteria and processes.

Lean Investment Teams

Family offices are not necessarily “in the business” of investing and are much more opportunistic. They rightfully claim that they have no pressures to put money to work and can therefore be more selective. The other side of that coin is that if the volume of transactions is low, it is not economic to retain a full-time deal team. Lean can be cost-efficient but it translates into slow. Expect family offices to take longer to make reliable decisions and complete transactions.

Conclusion

While family offices have funding advantages relative to private equity that can give them an advantage in certain industries and situations, the nuances and idiosyncrasies of many family office investors make it difficult to have great conviction with them as a single class of investors. Much as with private equity thirty years ago, family office direct investing as an industry is in its infancy and exhibits a very wide range of thought processes, approaches and philosophies. Our deep experience with both traditional private equity and family offices offers clients an informed perspective to help achieve a successful outcome by creating a process that brings the right buyers to the table.