Debt markets serving the lower middle market remain favorable to borrowers and should continue despite the conflicting economic and political environment. The fact remains that there is so much liquidity relative to the demand for credit that pressure on terms and pricing continues.

We hear on a daily basis both good and bad economic news. The rate of growth of the US economy is increasing, with second quarter GDP growth expected to top 4% for the first time in 10 years. Unemployment continues to drop, reaching 3.8%, the lowest since the late 1960s. At the same time, the stock market is being jolted as fears of trade wars influence investors and the Fed is expected to raise interest rates at least two more times in 2018.

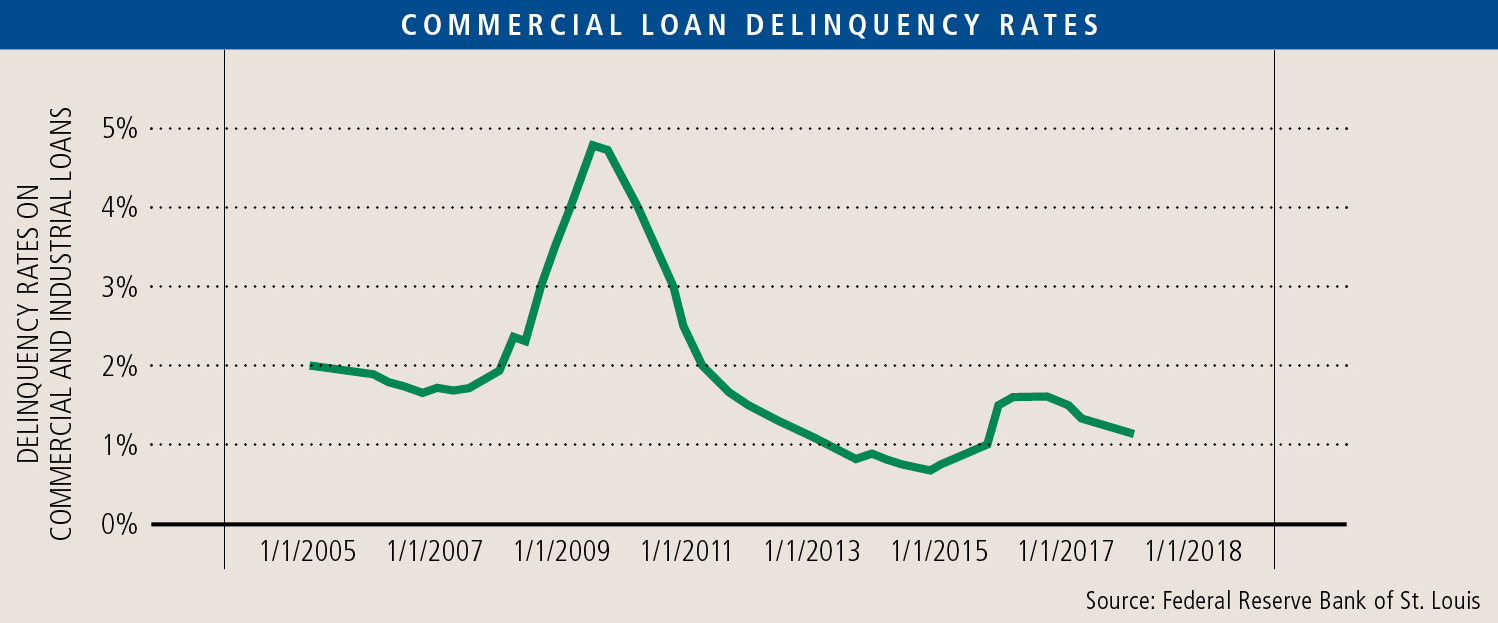

Against this backdrop, capital continues to flow into private equity funds; commercial and shadow banks are highly liquid and ready to deploy. Banks appear to be in good shape from a credit stance as delinquencies remain at low levels.

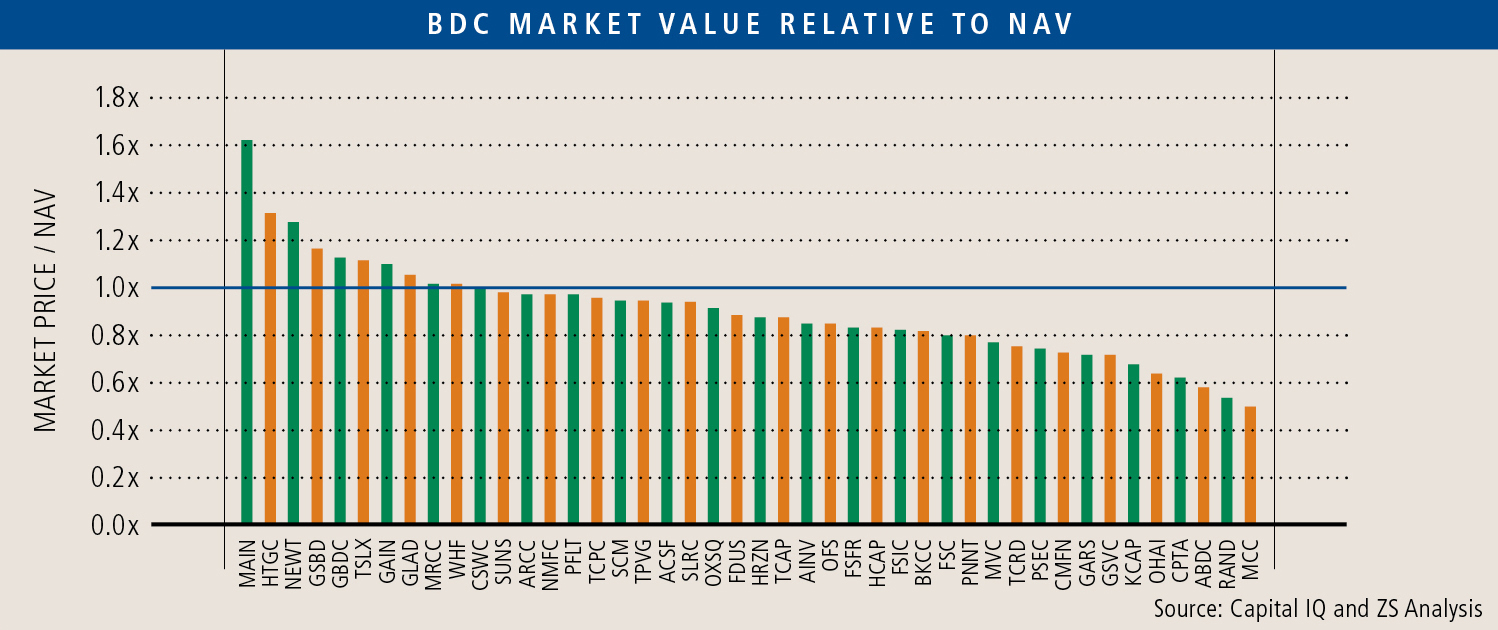

Meanwhile, the shadow banking system (non-commercial bank sources) continues to grow with more funds and new issues occurring daily. Business Development Companies (BDCs) have been the primary vehicle for private credit. Total BDC capital now exceeds $35BN and represents approximately 10% of the leveraged loan market for middle market companies. As we discussed in “Unitranche Debt—Higher Rates but Lower Costs?” (Insight Fall 2017), BDCs have become very popular with buyout private equity firms, which have rocketed their growth.

BDCs raise capital in the public market and generally avoid new issuances when their stocks are valued less than their net asset value (meaning investors think the loans are too cheap relative to the credit risk) to avoid diluting existing investors. BDC performance in that regard has been variable. As can be seen from the following graph, there are only a few BDCs that currently meet the test. All firms received a boost in March when the Consolidated Appropriations Act of 2018 became law and allowed BDCs to increase leverage from a 1:1 to 2:1 debt to equity ratio, the stated objective being to provide more capital to small growing businesses. If BDCs decide to borrow more in accordance with the new law, they increase the risk profile for shareholders but have access to more capital without diluting current shareholders.

Demand for Capital

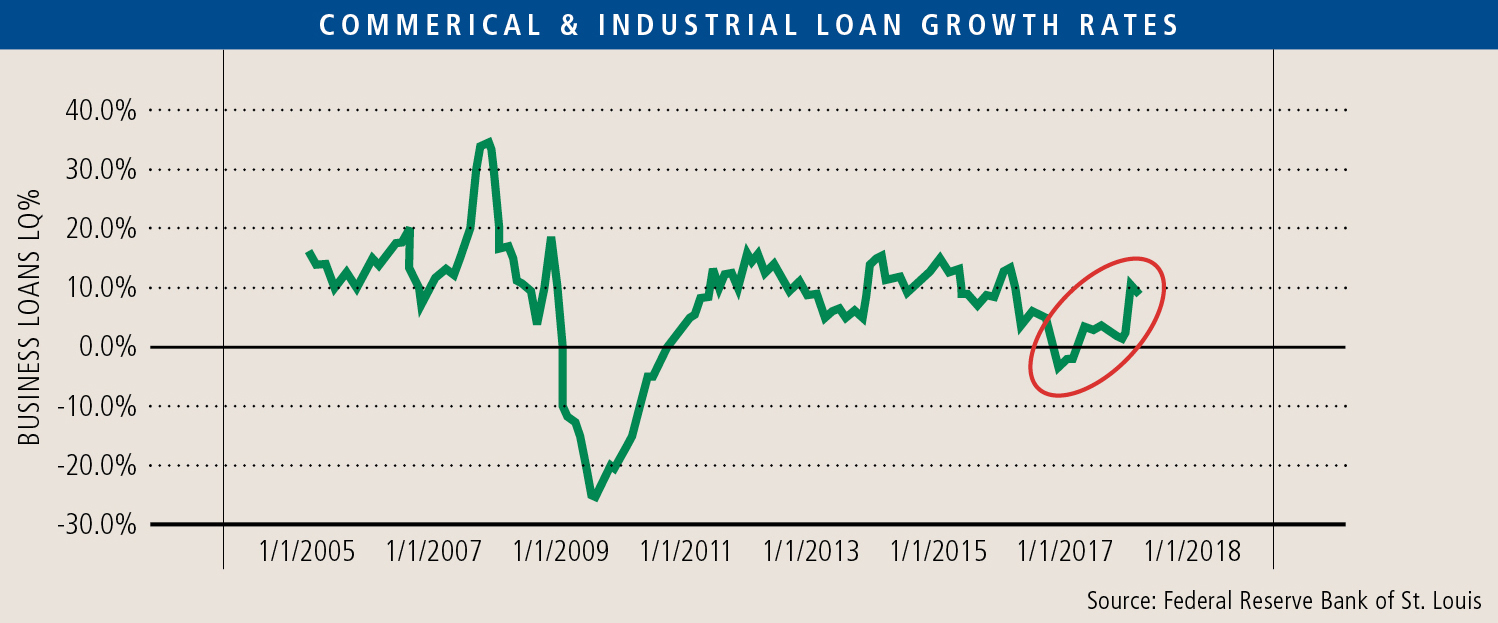

With all the liquidity available to borrowers, demand has not been nearly as robust. Capital is not getting deployed at the same rate as it accumulates. Relative to capacity, there is a very large overhang of credit and equity capital seeking homes in the lower middle market. As can be seen in the following chart, commercial and industrial loan growth rates have been stodgy for years, dropping to zero in 2016. A small recovery has occurred over the last two quarters.

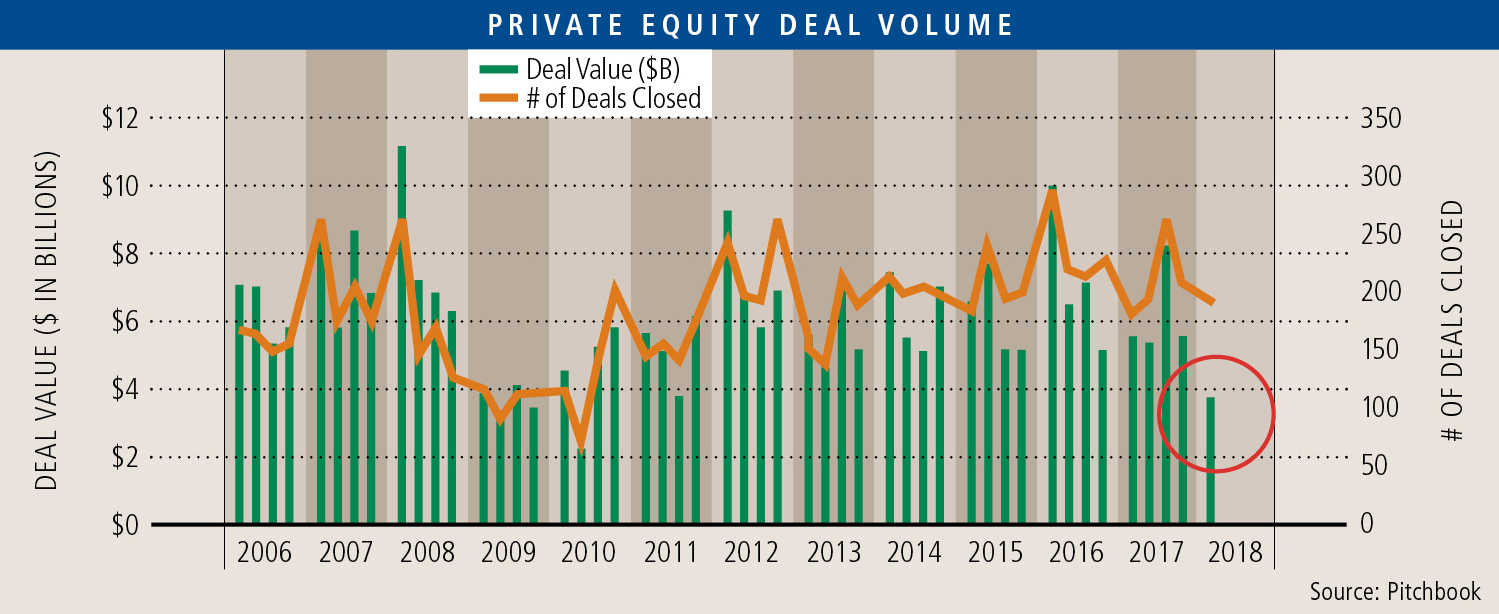

Private equity deal volume in the lower middle market has continued at relatively steady levels for the past five years but dollar volume has declined with Q1 of 2018 being the lowest dollar amount since 2011. It is too early to say that deal size has dropped as capital sources need to go smaller to find opportunities, but it is a trend worth watching.

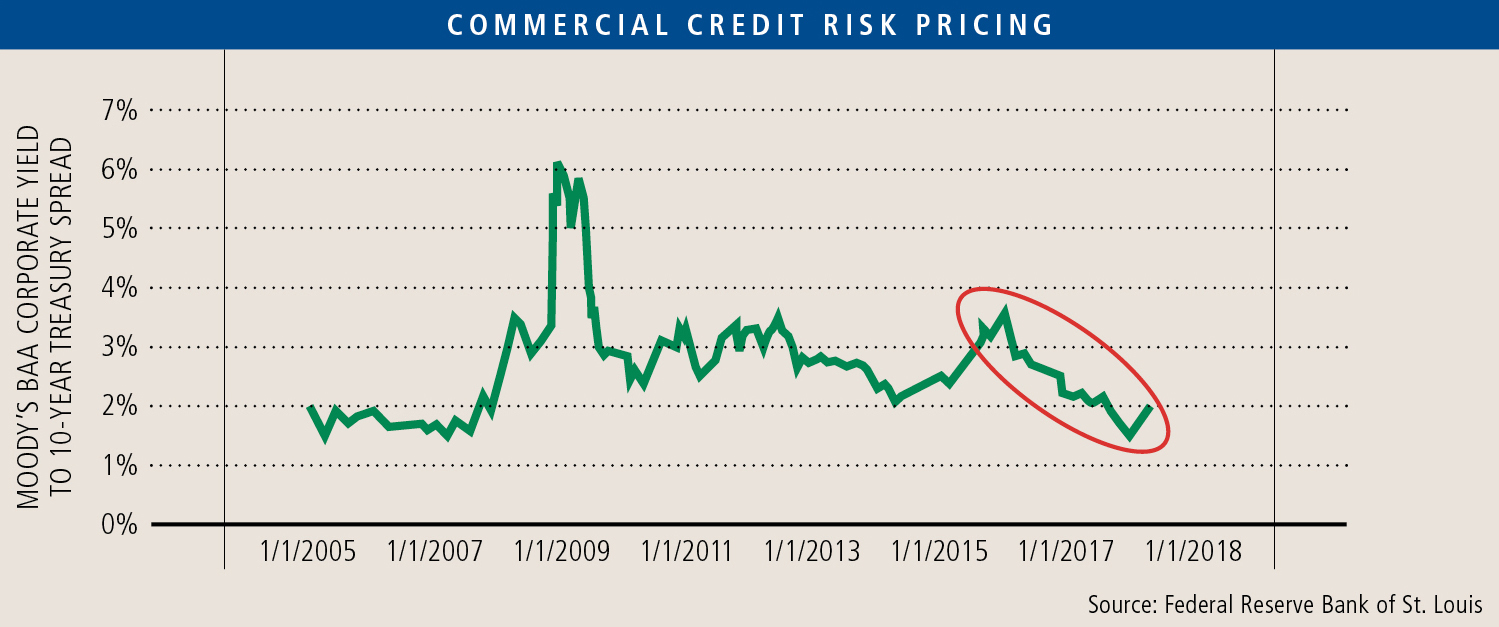

The consequence of too much capital chasing too few deals is that pricing on capital has declined. The following graph shows the spread between commercial credit and treasuries of like term (the amount paid for credit risk). Commercial bank loan spreads have been compressed over the past two years to a level that is on par with the period right before the 2008 crash. It is difficult to show how equity is being priced in a private market other than to see what returns are actually earned at a later date. Anecdotally, private equity investors are worried about high purchase prices and the consequent effect on actual returns. We will have to wait for a few years to determine how cheap their money really was.

The consequence of too much capital chasing too few deals is that pricing on capital has declined. The following graph shows the spread between commercial credit and treasuries of like term (the amount paid for credit risk). Commercial bank loan spreads have been compressed over the past two years to a level that is on par with the period right before the 2008 crash. It is difficult to show how equity is being priced in a private market other than to see what returns are actually earned at a later date. Anecdotally, private equity investors are worried about high purchase prices and the consequent effect on actual returns. We will have to wait for a few years to determine how cheap their money really was.

Anecdotal Local Commentary

Our friends at local banks indicate that these trends are also playing out in the Pacific Northwest. The additional flavor they add is that not only is pricing continuing to get squeezed but also that smaller credits are getting the best terms and pricing. For credits large enough to require multiple banks, pricing seems to have stabilized, but where a single bank has the opportunity to bring in-house an entire relationship, competition is the toughest. These same bankers also tell us that credit terms are still loosening. Amortizations, term, and covenants are all becoming more favorable to borrowers.

Capital is currently cheap and readily available under advantageous terms. Continuation of a strong economy and liquidity is required to have this condition continue. For the time being, the skies are clear. If not done already, borrowers should review their loan commitments to make sure they are receiving the most favorable treatment.