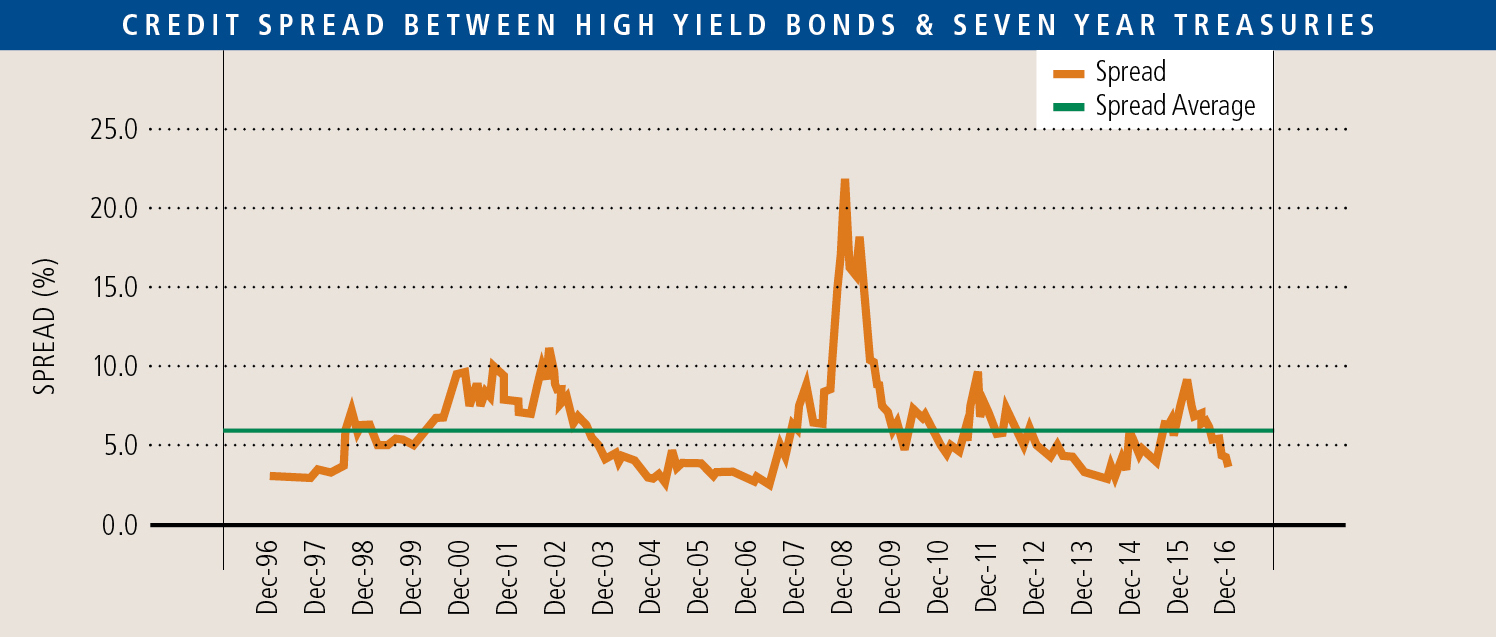

The high-yield bond market is a source of capital to maximize  financial leverage. For those who can access it, allowable leverage has varied between 4x and 5x EBITDA, cresting the top of that range since 2015. Over the past twenty years, spreads on high-yield bonds have averaged 5.5% over treasury bonds of the same maturity, varying from as high as 10% to as low as 2.6% (outside the credit crisis of 2009). Spreads in the current market are around 4%, yielding rates of approximately 6.25% with today’s low treasury rates.

financial leverage. For those who can access it, allowable leverage has varied between 4x and 5x EBITDA, cresting the top of that range since 2015. Over the past twenty years, spreads on high-yield bonds have averaged 5.5% over treasury bonds of the same maturity, varying from as high as 10% to as low as 2.6% (outside the credit crisis of 2009). Spreads in the current market are around 4%, yielding rates of approximately 6.25% with today’s low treasury rates.

Middle market private companies can’t access the high-yield market, but there are private sources that allow companies to attain similar leverage at comparable costs. Bank loans. Asset-based loans. Second-lien loans. Mezzanine loans. Unitranche loans. These are the tools used to structure the debt of private companies. Each targets a different segment of the risk spectrum. By layering different sources, a private company can build the type of capital structure that fits its unique situation.

Background on Lender Sources

Credit providers view credit risk from several perspectives: primary dependency on asset values vs. cash flows and priority in the capital structure are the most important.

Both senior and junior cash flow lenders typically provide loans based on a certain multiple of profitability (usually EBITDA) of the borrower with priority rights over all other capital providers to that cash flow. These lenders are concerned with cash flow stability and the overall enterprise value of the business. Senior lenders, both bank and non-bank, manage their risk position through covenants that are designed to catch a knife before it falls. Mezzanine lenders (See “Middle Market Mezzanine: The Evolving Product”, Summer 2013 IN$IGHT) are similarly focused on cash flow and enterprise value but are willing to take a junior (or subordinated) position with regard to rights to that cash flow, meaning that senior lenders are allowed to restrict payments should the borrower fall out of covenant. In addition, mezzanine lenders require little or no amortization, allowing senior lenders to get their loans repaid off. For that, they extract a higher price.

Asset based lenders (see “Working Capital Finance with Asset Based Loans”, Fall 2013 IN$IGHT) represent another form of senior debt. Although interested in cash flow, these lenders focus more so on the value of the underlying assets (e.g., receivables, inventory, and equipment) and obtain first priority liens on those assets to protect their rights to obtain value from their sale, if need be. Asset based lenders require regular detailed reporting and inspections of collateral to assure quality and to measure their exposure relative to these assets.

Second lien loans are the junior form of asset based lending. Like mezzanine loans, second lien loans have little or no amortization. Unlike mezzanine, second lien lenders require a lien on the company’s assets (although subordinated to the senior lender) and generally do not accept payment subordination to a senior lender. Because of the differences in type of subordination and rights to tangible collateral, second lien loans are considered slightly less risky than mezzanine with consequent lower pricing. As a result, the emergence of this product in the last ten years has eroded a portion of the traditional mezzanine market.

Unitranche lenders are the newest form of capital for the middle market. Unitranche capital providers are one-stop sources of capital willing to take the whole right side of the balance sheet, most commonly replacing senior, second lien, and mezzanine providers in a single loan that blends the attributes of all of these sources. Unitranche lenders often take security interests in assets. As with their junior debt brethren, unitranche lenders are quite flexible on amortization, sometimes agreeing to no amortization, instead allowing the borrower to use cash flow normally directed towards debt reduction to fund growth of the business. The unitranche structure results in the lowest amortization of any funding source combination and, for that, additional compensation is required. Besides the amortization flexibility, stated benefits over a layered structure are reduced closing and administrative costs, speedier closings, less syndication risk, and easier compliance and administration. Many private equity investors like unitranche structures because the after-tax cost of debt is still low and the minimal amortization allows the business to fund its growth even under a leveraged balance sheet. Unitranche lenders are particularly suited for asset-lite businesses that have low senior credit borrowing capacity.

Choosing the appropriate structure for a company requires knowledge of both the business and the unique characteristics of each source. Not all sources or combinations are appropriate in every situation. Exceptions are made all the time, but generally asset intensive businesses align with senior cash flow or asset based lenders and second lien junior loans, while asset-lite or higher growth businesses match up with cash flow senior debt and mezzanine, or with unitranche lenders. In fact, because senior credit capital is sometimes limited for lower middle market asset-lite businesses, unitranche offers a compelling alternative to the senior/mezzanine structure.

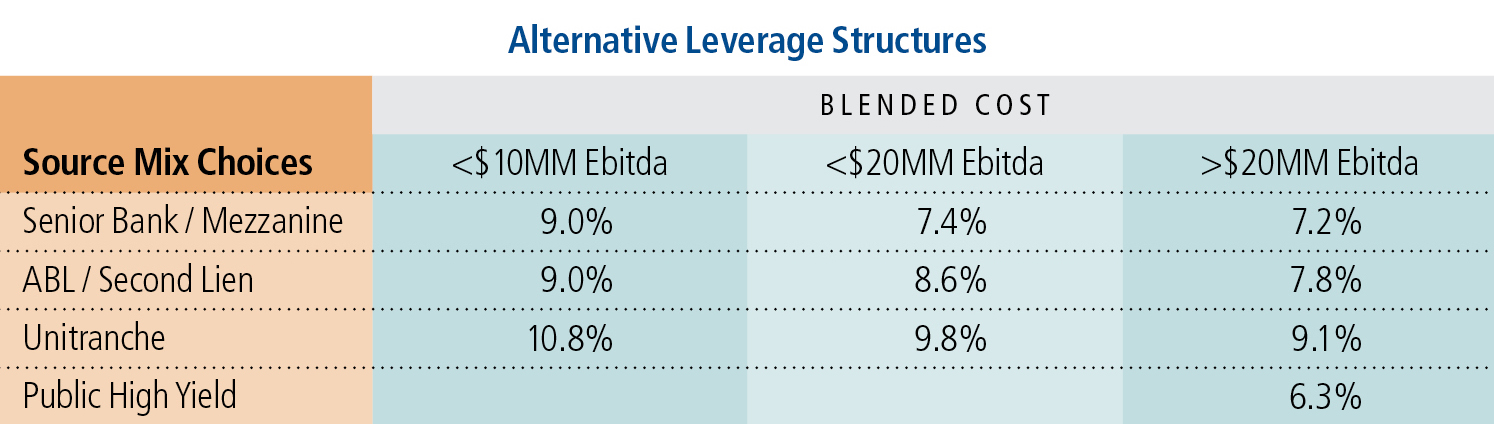

The following chart on the right shows a current representation of the weighted cost of debt in several combinations over different business size categories. The costs presented represent average mixes with floating rates adjusted to fixed rates for a seven-year period.

Not all of these apples are equal. Allowable leverage is lower for companies under $20MM in EBITDA. Approximate limits are 3.75x EBITDA for companies with less than $10MM EBITDA and 4.75X EBITDA for larger companies approaching $20MM of EBITDA. When companies move above $20MM in EBITDA, leverage can expand to 5.75X.

The public markets remain the cheapest source of leverage if the borrower is large enough and has sufficient borrowing needs, but a combination of senior and junior debt comes close. Unitranche debt appears the most expensive for companies under $20MM in EBITDA but the characteristics are different. Completing the capital structure puzzle is dependent on the unique situation of the borrower and the answer may not fit neatly into the cubbyholes defined herein. When a leveraged capital structure is desired, there are many tools to consider.

Leverage serves to fund growth, fund buyouts, and enhance equity returns. Cost is an important factor, but it is extremely important to match the capital structure and terms to the requirements of the business plan. Ultimately, achievement of the business plan creates the most value. Having access to the required amount of capital structured flexibly to allow room for error trumps cost.