Asset-based lending, “ABL” in the trade, refers to business loans in which collateral value and liquidity of working capital assets are the predominant credit considerations. From its origins as the financing source of last resort, ABL has evolved to be an attractive alternative for well-performing companies. Twenty years ago, most ABL lenders were independent of banks. Since that time, banks have acquired and/or built their own ABL units and now dominate the market. Borrowers have benefited as the lower cost of bank capital has been passed on to the borrower. With the surplus liquidity in the banking system and weak credit demand, ABL credit spreads have been compressed to levels comparable to middlemarket bank loans.

ABL differs from normal commercial bank lending. Corporate credit is based on consideration of operating earnings and equity balances, in essence, reliance on the long-term success and stability of the business. ABL credit, on the other hand, is more concerned with asset liquidity (i.e. the ability to convert the asset to cash) and the factors that may impair that conversion. This keen focus on the short-term cash cycle relies on the premise that an asset-based loan is invariably repaid from the proceeds of liquidated collateral, no matter the state of the business.

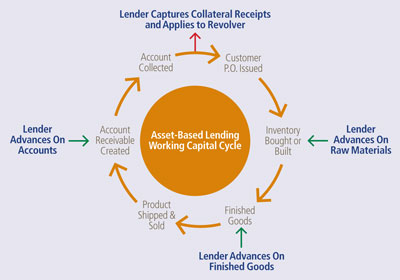

The concept of advancing credit against working capital assets is predicated on the continuous turnover of the cash cycle such that advances against the most liquid assets of the business–inventory and accounts receivable– become self-liquidating as a matter of course. As illustrated in the adjacent diagram, ABL lenders provide credit at different points in the working capital cycle with advances being paid down with cash receipts. Among ABL’s most attractive attributes is the lack of a set amortization schedule. Credit availability expands as sales grow and excess cash flow automatically reduces the credit line.

Confidence in the value of the collateral, robust monitoring of asset turnover, and capture of the collateral proceeds in a control account or lock box to pay down the credit line combine to allow the lender to have a near real-time understanding of both the state of the borrower and the loan. Unlike its commercial bank brethren, when a borrower stumbles, the ABL lender can meter its risk by adjusting its advances against the collateral to set the loan on a path of self-liquidation.

Credit availability on an ABL facility is formula driven against specific asset balances on the balance sheet, most notably accounts receivable and inventory, but the formula is often customized to the specific assets and the situation.

Accounts Receivable

Much of the business–to-business commerce in this country is conducted on an open account basis, where payment for goods and services is due within 10 to 90 days from the date of the sale transaction. Accordingly, a steady flow of sales generates a pool of accounts receivable that can be used as collateral for a partial credit advance against the balance of the accounts. As individual accounts are collected, proceeds repay the credit line.

For the lender underwriting a loan on accounts receivable, there are three basic considerations that affect advance rates:

For the lender underwriting a loan on accounts receivable, there are three basic considerations that affect advance rates:

- Account eligibility: Lenders exclude certain accounts from the receivable pool based on a variety of risk factors, including: delinquent accounts (more than 60 days past due); contract receivables where payment is subject to non-time based criteria; uninsured foreign accounts; Federal Government accounts subject to the Assignment of Claims Act; cross-age accounts where a significant portion (10% to 30%) of the outstanding accounts with a single customer are ineligible; account concentrations in excess of 25% of total receivables, and contra accounts—when customers are also suppliers, payables are netted against the receivables to establish the borrowing base.

- Dilution: The discrepancy between actual cash receipts from customers relative to the book value of the accounts. Average dilution over time is the central factor to setting an advance rate against an eligible receivable pool. There are a host of reasons why collections fall short: customer discounts and allowances, warranty claims, returns, and credit losses. Dilution of less than 5% commonly translates into an advance rate of 85% or higher if account quality and diversity are acceptable.

- Reserves: Any borrower obligation that could threaten to impair the lender’s first call on collateral is usually dealt with by effectively setting aside a portion of the borrowing capacity to assure sufficient liquidity to cover the potential liability. Common reserve situations include past-due tax obligations and supplier lien rights.

- Inventory: There are generally four buckets of inventory: raw materials, work-inprocess, finished goods, and obsolete stock. The first and third categories tend to be potent ABL collateral, while the other two buckets rarely provide much borrowing capacity. The underwriting of an inventory loan tends to be a careful estimate of the likely value of salable inventory on a net orderly liquidation value (“NOLV”)1 basis. If the proposed collateral is a commodity product with an active secondary market (e.g., corn, 2×4 studs, steel, resin, etc.), the valuation is straightforward and can be tracked in the secondary market. When non-commodity manufactured goods are involved, lenders typically rely on third-party appraisers to determine NOLV. Inventory appraisals are assembled with an aura of precision, yet they often prove to be subjective. As might be expected, the subjective judgment bias swings along a track that emulates the general optimism/ pessimism of lenders. Advance rates are quoted in terms of book value amounts but are adjusted based on NOLV conclusions. For example, if the specific asset is appraised at a value that is 50% of book value and the lender agrees to advance up to 80% of NOLV, the “advance rate” for the asset becomes 40% of book value.

Conclusion

ABL credit structures have a number of attractive attributes, including enhanced credit access and higher advance rates, greater tolerance of variable operating performance, more covenant flexibility, and rare requirements for personal guarantees. The tradeoffs for these benefits are the time and expense of collateral reporting and lender audits, and lender dominion over cash. With the recent spread compression, the cost premium has been reduced, allowing ABL to become attractive to a growing share of the market for corporate credit.