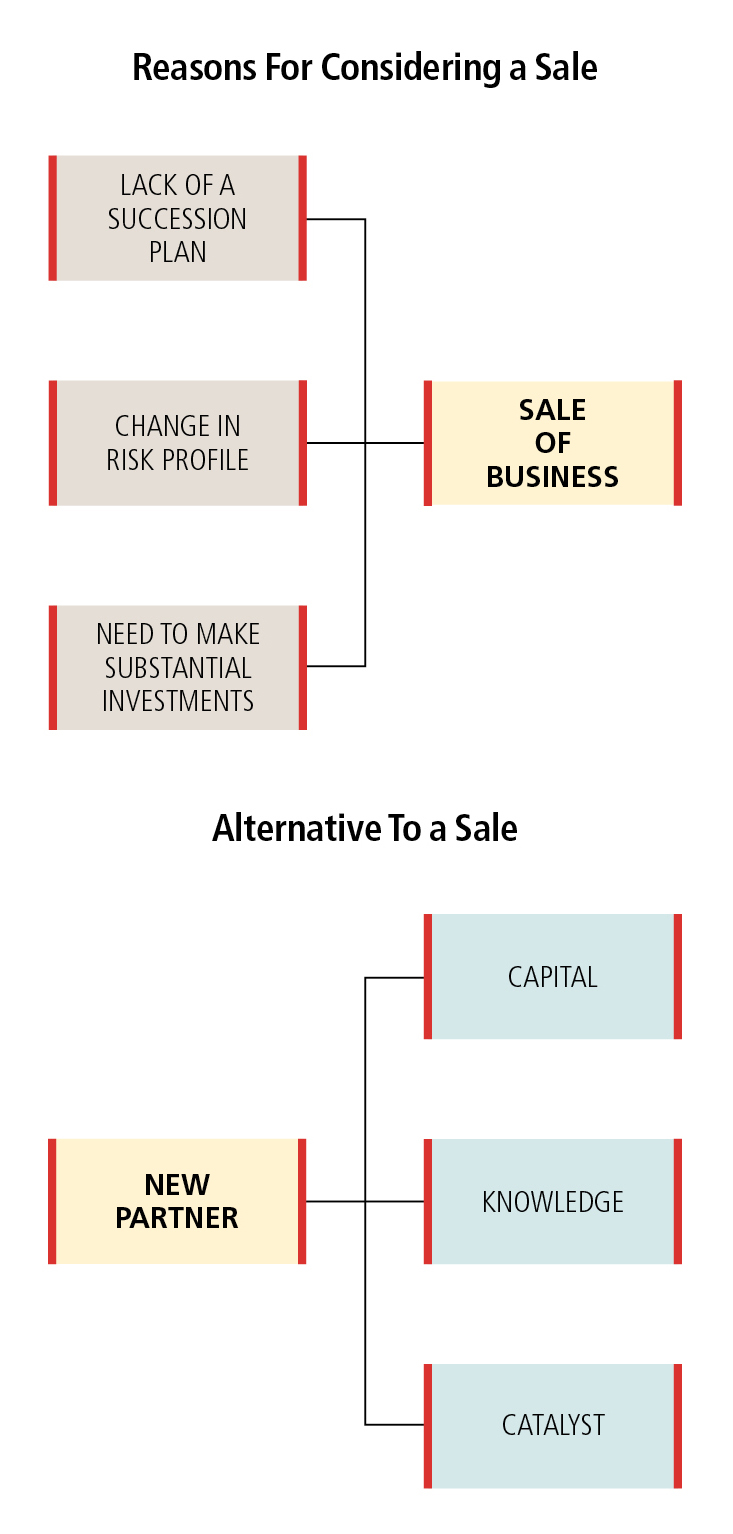

Owners of closely held businesses, especially those who are nearing retirement, have many reasons for considering a sale of the business.

Often the lack of a succession plan, a change in risk profile, or the need to make substantial investments in or changes to the business are as important as simply generating liquidity, and the need to solve these very real business problems drives owners to consider a sale as an answer. There is, however, an alternative to the full sale that can often address the issues faced by the entrepreneur in a manner that allows for retention of control, continuity of legacy, and the potential for greater future financial returns.

Often the lack of a succession plan, a change in risk profile, or the need to make substantial investments in or changes to the business are as important as simply generating liquidity, and the need to solve these very real business problems drives owners to consider a sale as an answer. There is, however, an alternative to the full sale that can often address the issues faced by the entrepreneur in a manner that allows for retention of control, continuity of legacy, and the potential for greater future financial returns.

A recapitalization, or a “recap,” as it is often referred to is merely swapping one source of capital for another. The transaction can be achieved with debt, equity, or a combination of the two. We have previously written about the mechanics of a recap transaction [See: Anatomy of a Leveraged Recap, Winter 2002] and the cost of different financing options [See: Building a Middle Market Leverage Structure, Winter 2017].

Beyond the corporate finance exercise that balances the financial needs with appropriate risk, using the capital structure as a tool to solve certain business problems can help an owner affect needed change in the organization and extend the current owners’ time horizon when an outright sale felt like the only option. It is the addition of a partner to help shoulder the risk, take the initiative on culturally difficult issues, and to add a new skill or knowledge set that can change the equation and revitalize the business and the owner. Depending on the circumstances and the owner’s objectives, the recap can result in a new minority or majority partner.

The Fork in the Road

Middle-market businesses, especially those owned by families or by a very limited ownership group, often face the proverbial fork in the road where the risk profile of the business and that of its owners begin to diverge. The fact that the owners may be approaching their horizon and therefore are reducing their tolerance for risk, there is no law that says the same factos apply to the business.

Take for example, a hypothetical company that enjoys a protected niche with a history of stable cash flows. Short-term capital expenditure requirements are significant and consolidation throughout the value chain is beginning to exert pressure on all smaller market participants (e.g., agriculture or niche manufacturing). In the short term, this business is on solid footing. It is operating as it has for years but storm clouds are developing, and to compete long term, either consolidation or a large capital expenditure outlay is required (i.e. a new plant, a new vessel, or new equipment). This scenario presents a dilemma. Ownership does not wish to take on additional risk by investing the required capital into this business, nor does it want to part with the business that has long been part of the family. Doing nothing in these situations often becomes the de facto solution; thereby increasing risk further, as the business slowly becomes less competitive. The choice does not always have to be one of extremes, and bringing on a partner (equity or debt) to shoulder some of the burden can provide the business with needed capital that is structured in a way so that the current owner retains control over business decisions.

Capitalizing on Opportunities

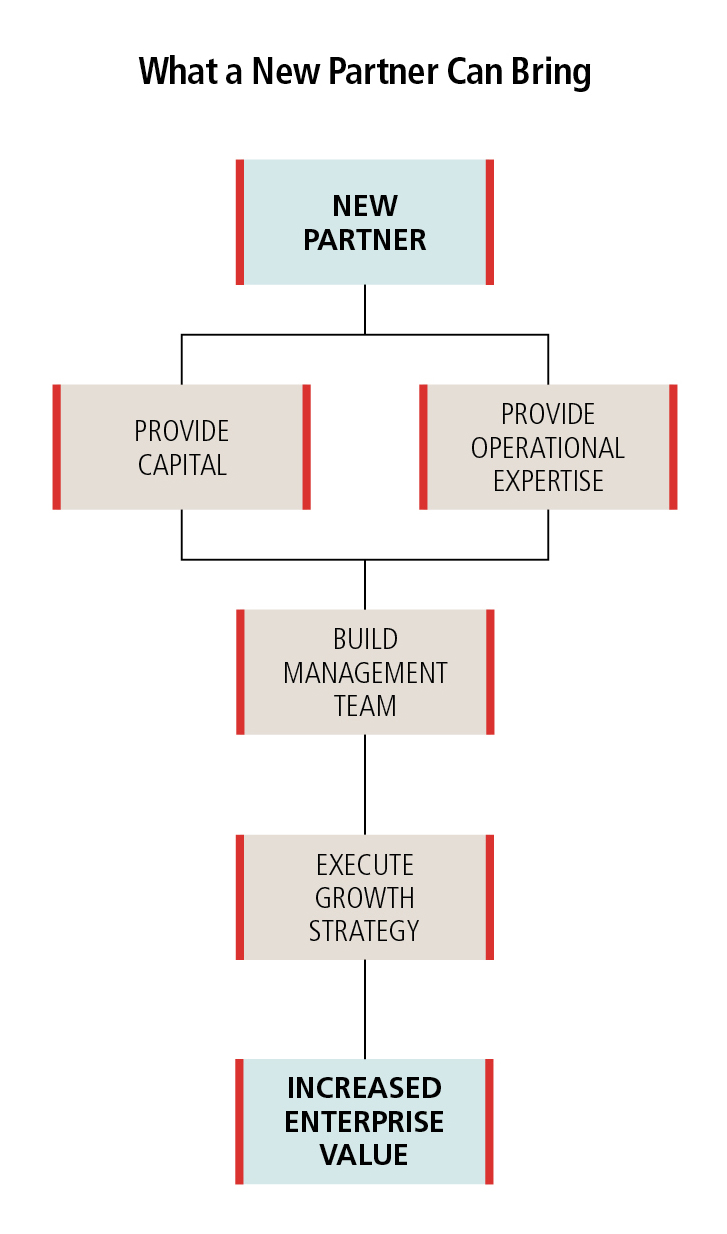

Now, imagine a consumer products company with several growth opportunities in front of it. Current management is led by the founder with no clear succession plan in place. The owner, who is critical to the business, believes he or she can comfortably sit at the helm for another five years but has neither the capital to execute the growth strategies nor the time horizon to see them to fruition. This owner is currently reaping healthy annual distributions that will need to be curtailed in order to fund the incremental investment required to assure the long-term health of the business.

In this case, there is a solution that can solve all three issues. A new partner can be brought in to provide the capital and operational expertise to help build the management team and, ultimately, choose a successor. This allows the owner to remain firmly in control but begin to take his or her hands off the wheel, de-risking the future cash flows of the company by making it less reliant on a single individual. Furthermore, the capital and strengthened team better-positions the business to execute its growth strategies, increasing the enterprise value of the business, and the founder’s stake.

Multiple Shareholders Increase Complexity

As the number of shareholders expands, the forces of divergence are even stronger, with each party having its own investment horizon, appetite for risk, and goals for the business. This makes reaching consensus very difficult and can cause the business to stagnate.

A new partner offers the opportunity to consolidate viewpoints around a single future direction by giving dissenting shareholders an option for liquidity without compromising the goals of the other partners. This will allow ownership to give clear guidance to management and allow each shareholder to deploy his or her capital in investments with an appropriate level of risk.

Inactivity Generally Destroys Value

In a dynamic business world, the biggest, and often the most overlooked risk to the business is the inability to innovate and adapt to change. With family or closely–held businesses that are not subject to public shareholders or fund-driven time horizon constraints, we find that the need to react quickly is often outweighed by ownership dynamics and an emotional attachment to the status quo. This leads to indecision or delayed decisions, which are almost always to the detriment of the long-term value of the business. When faced with these business problems, the answer should always be to act. Although all situations are nuanced in their own way, a recapitalization of the business should be considered as an effective way to align interests and drive strategic growth.