An ongoing debate in M&A circles is why strategic buyers often pay more than financial buyers. The prevailing consensus is that strategic buyers can more easily identify synergies and have lower costs of capital. However, an important factor often ignored is the investment time horizon. More specifically, buyers with a long-term focus can take advantage of the benefits of compounding returns, making transaction prices less of a factor in investment return.

Long-Term VS. Short-Term

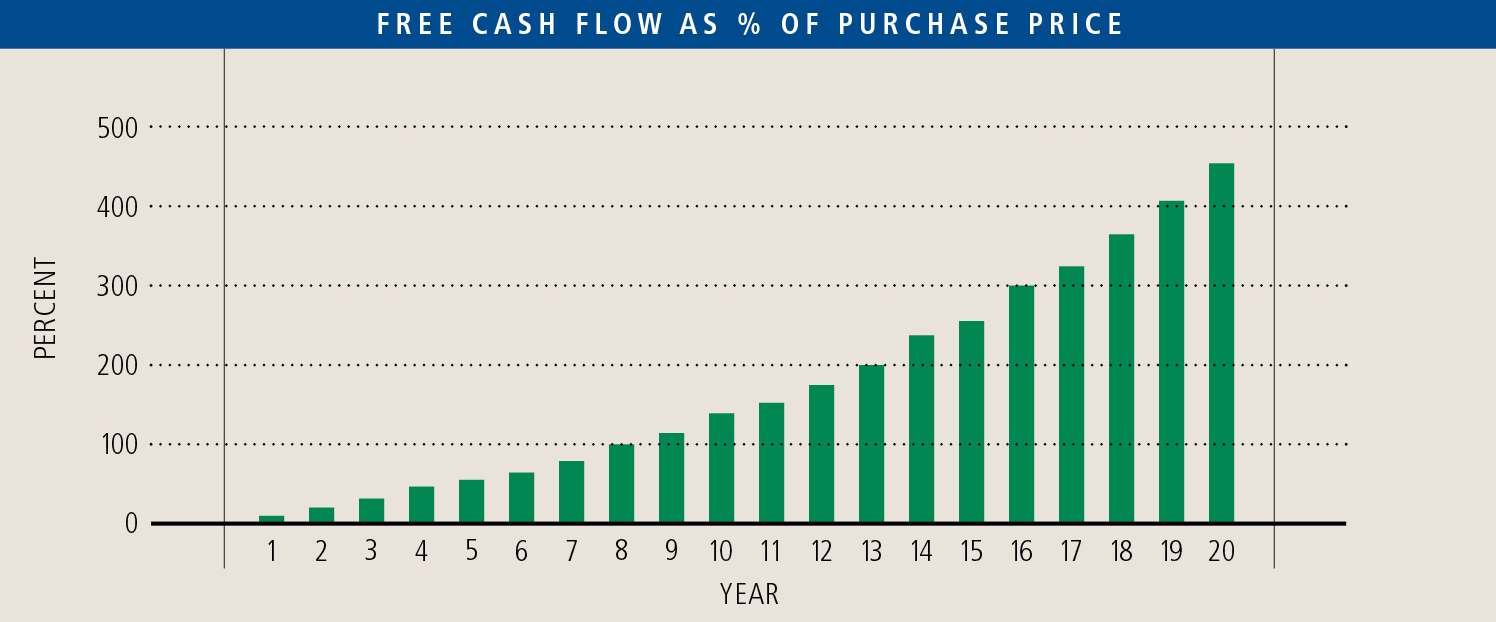

Consider a hypothetical company generating EBITDA of $15 million and free cash flow (FCF) of $10 million, with both growing 10% annually. At an 8x multiple of EBITDA ($120 million enterprise value), the initial free cash flow yield is 8.3% ($10 million FCF / $120 million enterprise value). As the FCF stream grows over time, compounding really kicks in, and the FCF proportion of the initial purchase price becomes astonishing. By year 10, the annual FCF is 133% of the initial purchase price, and for the true long-term holders, FCF in year 20 is nearly 500% of the initial purchase price. Indeed, patience can be the ultimate determinant of a wonderful acquisition.

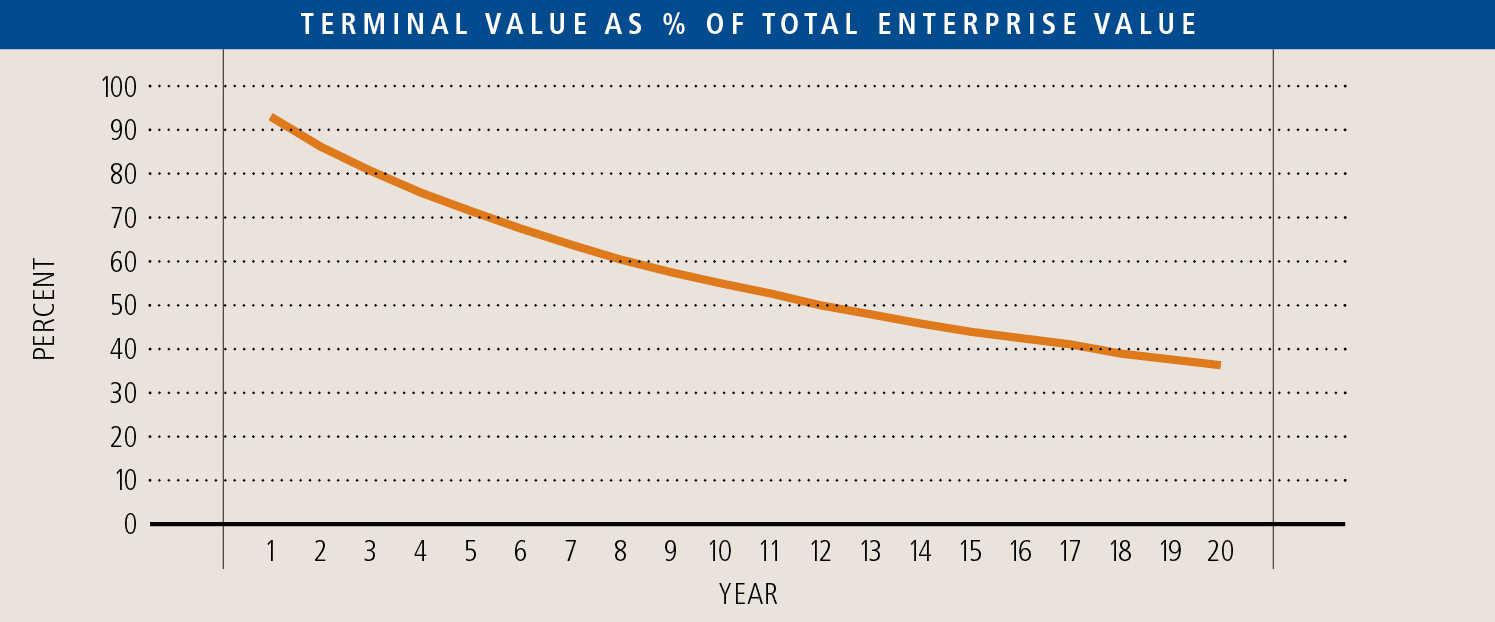

For short-term investors, the sale price becomes the most important factor in determining return. The following chart shows the percentage of enterprise value represented by the terminal value in any given year after a transaction. The terminal value is the proportion of a discounted cash flow analysis outside of the near-term, estimated cash flows. The terminal value can be equated to the business sale. For example, a sale in year five results in a terminal value comprising more than 70% of the total value.

When the investment period extends to 20 years, the terminal value contributes less than 30% of total enterprise value, meaning that more than 70% of value is captured by owning the business and reaping the benefits of a growing cash flow stream.

PE Industry Constraints

Now consider how the constructs of the private equity (PE) industry affect the arithmetic. Most PE funds are structured with a 7-10 year life. Within that window, an investment must be sourced, run through due diligence, and negotiated to close. Repeating this process for a sale can easily eat up two years. Finding deals is hard, so an individual investment may not be made until a year or two (or more) into the fund life. The structure of the private equity industry requires PE groups to always be prepared to sell, ideally as soon as possible. Time is the enemy of private equity returns, and the importance of terminal value in determining investment success gives credence to the old adage that “there are only two important decisions made a by a private equity firm, the price it pays and the price at which it sells.”

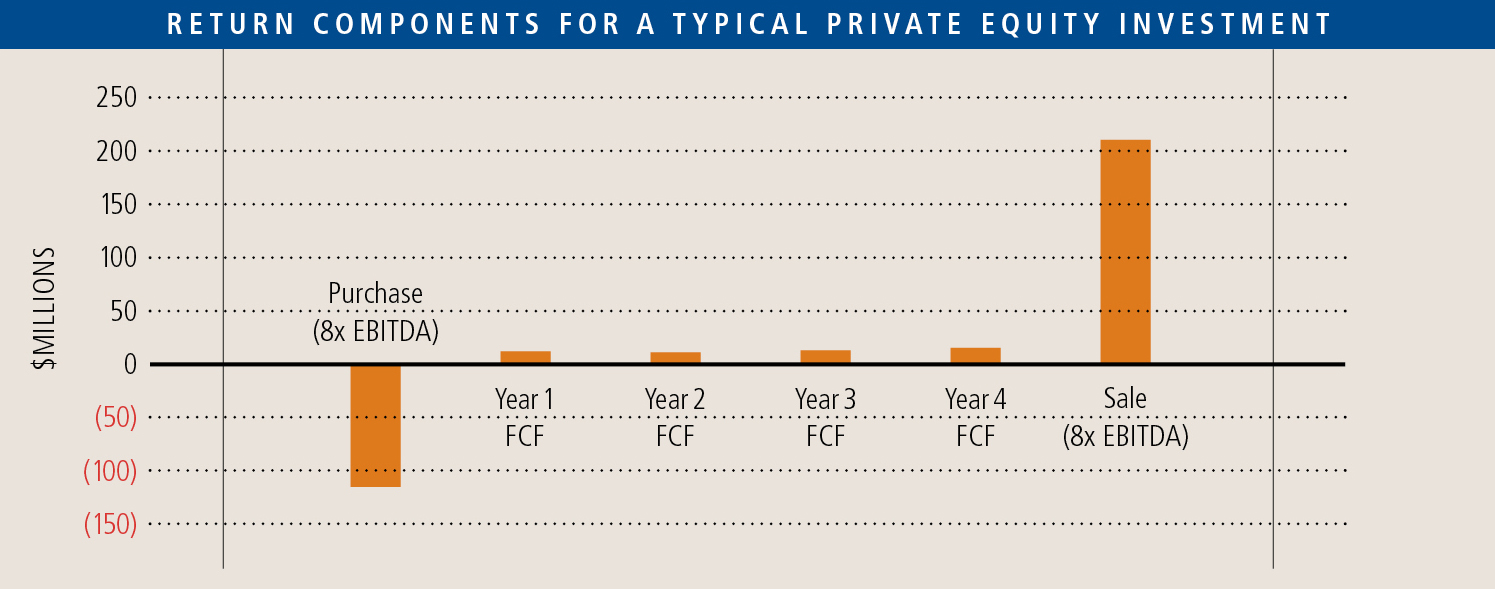

The drivers of return are ultimately the cash inflows and outflows generated by the investment over its lifetime.  In that regard, it can be instructive to think about an acquisition similar to a corporate project in terms of internal rates of return (IRR) and net present value. IRRs are the standard measure of PE performance. Equity IRR depends on the price of the acquisition, how it is financed, cash generated during the investment term (a function of growth and returns on invested capital), the investment term, and the sales price. The graph below illustrates these return components for a typical private equity investment. This example assumes the business is acquired for 8x EBITDA and funded with a mix of 50% equity and 50% debt. Cash flows generated during ownership are used to pay down the debt, and the business is sold for 8x EBITDA in year 5. This simplified example yields a favorable 27% IRR for the PE group.

In that regard, it can be instructive to think about an acquisition similar to a corporate project in terms of internal rates of return (IRR) and net present value. IRRs are the standard measure of PE performance. Equity IRR depends on the price of the acquisition, how it is financed, cash generated during the investment term (a function of growth and returns on invested capital), the investment term, and the sales price. The graph below illustrates these return components for a typical private equity investment. This example assumes the business is acquired for 8x EBITDA and funded with a mix of 50% equity and 50% debt. Cash flows generated during ownership are used to pay down the debt, and the business is sold for 8x EBITDA in year 5. This simplified example yields a favorable 27% IRR for the PE group.

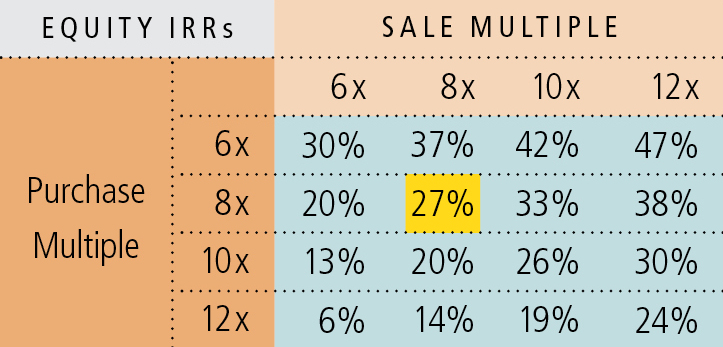

Cash flows during the investment period do not significantly affect IRR so long as the investment achieves the desired sales price. However, IRRs can decline dramatically if a PE group overpays for a company that does not maintain its “market multiple” upon exit. Expanding our example above results in a range of IRRs illustrated below, which depend on the purchase and sale multiples. The 27% IRR generated by the base case is highlighted. If that same business, growing its cash flows at an enviable 10% a year, is purchased for 12x EBITDA, IRRs decline substantially. Indeed, for short-term investments, buying right and selling right often matters more than what is bought.

Timing markets is hard. Therefore, basing an investment decision on an assumed exit multiple within a short time window introduces an element of risk that undoubtedly impacts the price a PE group is willing to pay.

Buying Good Businesses at Fair Prices

In the early years, purchase price has a significant influence on IRR, but over time, IRRs converge to returns on invested capital. This is what Warren Buffett and Charlie Munger mean when they talk about buying good businesses at fair prices – in the long run, what you initially paid is far less important than what you purchased. Of course, PE groups want to acquire “good” businesses as well. Businesses that are able to substantially grow their cash flows create more value during the ownership period and make the businesses more valuable upon an ultimate sale. However, for a private equity firm looking to exit an investment in 3-5 years, time is not on their side to significantly benefit from the qualities of the business. A short-term investor has to take whatever actions appropriate to maximize the sales price within a narrow window. Initiatives need to pay off immediately.

It is useful for business owners to understand these dynamics as they speak with prospective acquirers. The investment arithmetic impacts investment stewardship. While a strategic party usually has a long investment horizon, it can afford to build businesses and reap the rewards of improved profitability. Strategic buyers don’t often pay more just because they believe they can cut costs or have access to cheaper capital. Their long-term focus enables them to be less dependent on initial purchase price, and focus more on buying the right businesses to achieve their long-term strategic goals.