Most of the business owners we know are intimately involved in the day-to-day operations of their businesses. Each makes operational and financial decisions that impact the future success of the business. Longer- term success, however, requires management to take actions that position the business to respond to events and conditions further away from the field of play. The indirect connections to a business are those that sometimes deliver the biggest effects – a windfall benefit, or a devastating blow. Taking into account secondary or even tertiary linkages is important to achieving long-term success. No business operates in a vacuum.

Understanding the Value Chain

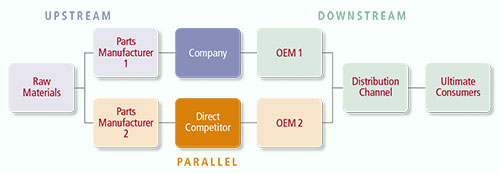

All businesses exist because they play a role in a sequence of operations that ultimately solves a problem or fulfills a need for a customer—a sequence called the value chain. Problems can be solved with value chains as simple as a single direct link, like the hiring of an electrician to fix a wiring problem. Some problems, such as getting gas into a truck’s tank, necessitate a value chain of thousands of companies and millions of employees in a highly complex global web of operations. To conceptualize the possible network of a value chain, one can think about them as upstream links (material suppliers, property, labor, sourcing, or other inputs to the business), downstream links (immediate customers and ultimate consumers), and parallel links, which represent alternate channels to satisfy the ultimate consumers’ needs. An example value chain, for a fictional industrial parts company, can be found above.

The owner of this fictional parts business produces subsystems for original equipment manufacturers (OEMs), using engineered parts from manufacturing suppliers. The OEM projects the timing of and amount of demand so that our fictional business and its direct customer can plan efficient use of its resources and maximize profits.

But, what of the other links in the chain? The competitive balance between the two major OEMs, or the purchasing power of the ultimate consumers of the final product, or forward integration by the OEMs into the distribution channels may be further removed from the visibility of the owner, but they are no less influential in determining the future profitability of the company.

Sources of Disruption

Disruption can come from as many sources as there are links in the chain. Consumer products companies that relied on Asian raw materials suppliers experienced disruption as their suppliers emerged on a parallel link as competitors. Building on their market position as materials originators, they forward-integrated into product manufacturing, bypassing their traditional customers, pursuing customers further downstream in the channel. The resultant disruption to existing businesses was sometimes fatal.

Sometimes, the substitution of materials can significantly change the balance between parallel value chains. For a real-world example, we can look to the Alaskan whitefish industry and how the introduction of new species from fisheries across the globe has affected demand and prices for existing whitefish such as pollock, cod, and mackerel. As an example, pollock is mostly processed into either blocks of fillets or into surimi, a relatively flavorless slurry of finely shredded fish meat that serves as a base for artificial color and flavoring in downstream products. Pollock has been a stable source of whitefish as a result of its protein characteristics and availability to the market. Owners became comfortable with and expectant of continuation of the considerable profit margins earned based on pollock’s role in the protein market. Of course, the demand was not actually for pollock, but for white fish protein. An unexpected quick return to health of the Atlantic cod fishery, which brought cod prices lower and more competitive with pollock, and the emergence of high volume harvesting of other species such as pangasius, a catfish-like river fish found in Southeast Asia, was found to be substitutable as a white fish protein for making surimi at a lower cost than could be achieved by catching pollock. Competition between parallel chains, not within the pollock chain itself, has been responsible for initiating realignment of customers, protein sources, and profits in the global whitefish industry.

Operators of distribution businesses are acutely aware of the importance of the value chain in which their businesses operate. Their livelihood is based on understanding several interactions that exist beyond the scope of their own operations: the demand by the end consumer for the product or products they distribute; the supplier’s volume and pricing strategies; and the importance of an intermediary in between the upstream and downstream links. What happens when, through technological advances, it is no longer difficult for suppliers and consumers to coordinate on their own? There are numerous examples of industries in which distributors saw their previously attractive margins evaporate when manufacturers consolidated and developed internal logistics capabilities to reach end-users, reducing or eliminating the need for the distributor’s previously valuable services.

Mitigating the Risk

The value chain is ever-changing as a result of supply and demand of raw materials and the substitution effect of competitive materials, delivery efficiencies, and technological innovation. Operating a company without a full understanding of its position in the value chain and an awareness of parallel chains leaves the company vulnerable to the dynamic nature of the links.

The value of a business is a function of the relationship between expected future cash flows of the business, and a hurdle return appropriate for the risk of the business. Changes in competitive position of the business can alter and permanently change this relationship, thereby affecting the long-term value of the business. Innovation and disruption cannot be predicted or avoided, but staying aware of and proactively reacting to ongoing developments throughout the entire value chain can minimize risks. It is a major undertaking to keep one eye on the business and the other looking out the window, a use of time and resources that many small businesses find difficult to justify. In these situations, it is important to have a relationship with an advisor that has a broad awareness of industry trends along the entire spectrum of the value chain and understands how those trends can impact business value.