Traditional banking revenue is in decline while operating expenses are not. As a consequence, profitability has been faltering as major banks are confronted with the drag of legacy credit problems, expanding compliance costs, and higher capital requirements.

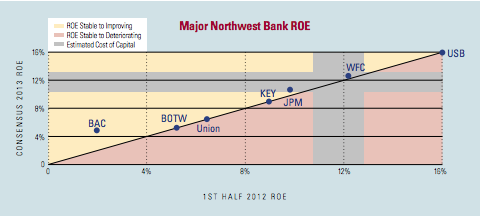

The ability for banks to earn their cost of capital has become a challenge within existing banking models. In absence of a clear impetus for an earnings rebound, there is good reason to believe that major changes in the way banks do business lie ahead.

Talk to virtually any middle-market banker at a major institution and you will hear about double-digit commercial loan asset growth goals that most banks struggle to achieve. Not enough opportunities exist in today’s environment. Many businesses are deleveraging in response to flat or slow customer demand.

Banks have ample resources to lend. When the supply of capital greatly exceeds credit demand, a two-fold response is predictable. Libor rates, hovering near all-time lows, and credit spreads (margin over Libor), beaten down by competition, combine to reduce the cost of credit. A renewed embrace of riskier assets in pursuit of higher yields has also developed. Permitted leverage, collateral advance rates, debt-service coverage, and maturities, have all bent to the borrowers’ favor.

While our advice over the past several years may sound like a broken record, for well-performing companies with value enhancing investment opportunities, there has rarely been a better time to arrange debt capital.

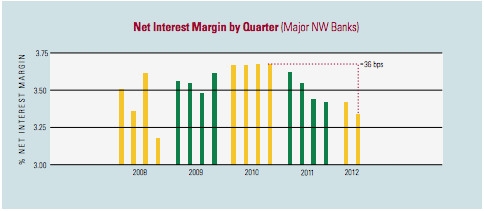

Despite this favorable borrowing environment, it is important to understand the forces being imposed on banks. Profitability erosion, as reflected in weakening net interest margins and higher operating costs, combined with higher capital requirements, make for an unsustainable business model.

Regulatory Impact

The myriad new financial regulations, arising from the Dodd-Frank Act, have begun to wash over the banking industry. This complex regulatory regime caps or eliminates a host of consumer deposit and payment related fees, a traditional mainstay of large and regional bank earnings. Moreover, it is driving regulatory compliance costs up sharply.

Legacy Credit Challenges

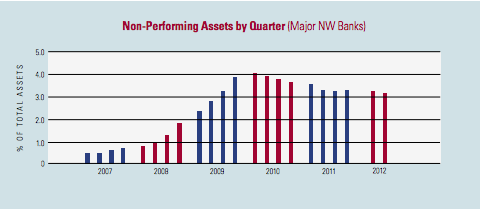

Legacy credit exposures continue to cause problems. The housing market and broader economy are in the midst of a tepid recovery, yet many banks are still taking significant charges related to credit portfolios, shadow and foreclosed real estate inventory, and potential mortgage put-backs. The capital associated with these assets is essentially dead, and costs of servicing these assets are punitive. Although nonperforming assets are gradually abating as the foreclosure backlog winds down, this process is unlikely to be put to rest for several more years.

Capital Mandates

The benefits of leverage are being curtailed as the scale of any given banking enterprise (both on and off balance sheet exposures) will be metered by a leverage test set at a $1 of capital for every $33 of assets. Moreover, the third installment of the Basel Accords (Basel III) will much more narrowly define capital as common equity and retained earnings. Effectively, capital requirements will more than double as Basel III is fully implemented.

Banks have until 2019 to be fully compliant. But, the process is moving ahead on an expedited basis, as many banks perceive early compliance as a competitive imperative. Goldman Sachs estimates that the top 25 U.S. banks still need to add more than $80 billion in capital, much of it in the form of common equity, to fully comply with Basel III. The implementation of these new capital requirements will expand the number of risk weightings for various bank assets from five categories to more than a thousand. This whole new level of real-time regulatory complexity will expand banks’ already significant compliance overhead expenses. More than half of the 25 largest U.S. banks are currently unable to cover their cost of capital. The requirement for additional capital will only magnify the challenge. This condition cannot be sustained, and will set an industry transformation in motion. It is not yet clear how this will play out, but a series of changes necessary to bring costs in line with revenue will squeeze the most out of every dollar of capital. Although individual banks might choose to approach the challenge a bit differently, few levers exist to navigate this transformation, most notably divesting or winding down non-core activities and capital intense business lines and cutting costs from existing operations.

Experts following the industry agree that banks are beginning to reconfigure themselves as the regulatory and capital requirements are sorted out. This may not mean much to the typical middle-market borrower in the short term. In the absence of a broad economic crisis and, given the abundance of lenders competing for middle-market credit opportunities, not much near-term change will occur in the prevailing borrowers’ market for C&I loans. Only after excess capacity is wrung out of the market or economic growth is rekindled, will credit terms and pricing begin to tighten.

As we move forward, there are a couple of considerations that merit attention. While an overall banking industry transformation is already underway, not all institutions will respond at the same time or in the same manner. Large and small banks, on occasion, make policy changes that have far-reaching consequences for credit dependent middle market clients. When borrowers have limited options, policy changes at individual institutions pose significant risk. In our view, it is an excellent time to hedge against the unexpected by developing alternatives – broadening banking relationships, building flexibility into credit terms, and honing pricing.