“The wise adapt themselves to circumstances, as water does to the pitcher.”

-Chinese Proverb

Borrowing money from banks and non-banks over the past three years has been relatively easy. Lots of capital and aggressive competitive lenders have buoyed the buyout market with cheap abundant debt, accommodating historically higher prices paid for businesses and a large volume of deals completed.

Anecdotally, we have recently heard from various sources in the marketplace that credit is tightening. That is important, as a tightening credit market is often a leading indicator of how robust the M&A market will be. While it is not a surprise—given the slowing of the economy, high inflation, and rising general interest rates—that the pendulum is swinging from greed to fear in the credit markets, we wanted to have a better handle on what this means for borrowers and investors in privately-held middle market companies. The answers to our three questions of “are credit standards tightening?,” “is credit more expensive?,” and “will this affect the ability to get a transaction done?” are a unanimous “yes,” “yes,” and “maybe.”

Survey of Bank and Non-Bank Markets

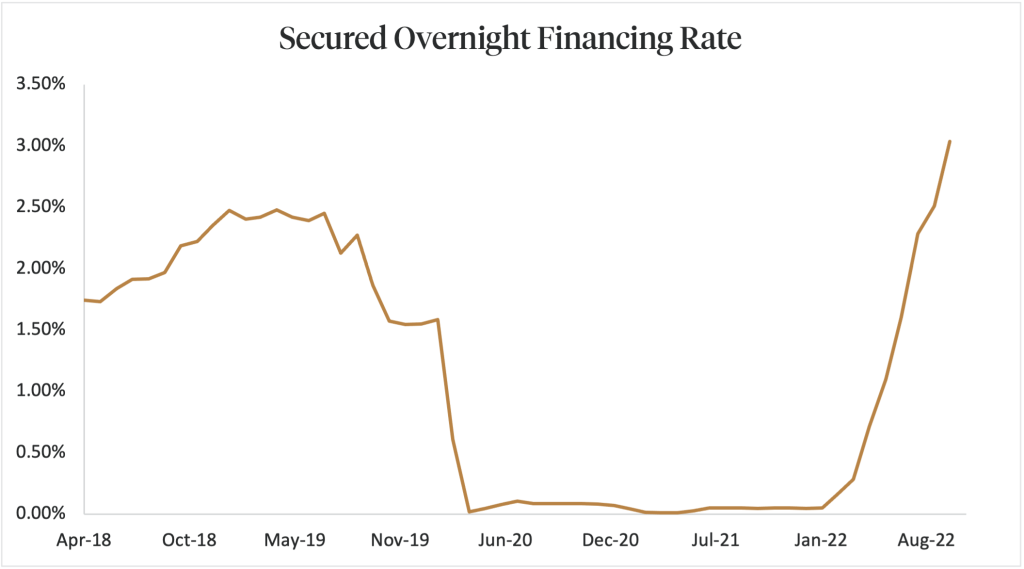

Borrowers are experiencing a double whammy, with general interest rates rising and credit spreads increasing. As can be seen in the following chart, SOFR has increased dramatically (following the Fed’s rate increases) throughout this year.

SOFR is the borrowing base for most corporate borrowers, upon which credit spreads are tacked. One of the best summaries of the state of the private market is offered by SPP Capital Partners, and to paraphrase SPP’s read, markets are tightening quickly. Pricing is up across the credit spectrum: commercial banks are increasing credit spreads by 50-100 basis points, and non-bank lenders by 100-300 basis points. Not all borrowers are treated equally but even the best quality borrowers are being nicked. The combination of SOFR increases and increased spreads make for substantial increases in interest rates, leading to tighter fixed charge coverage and a consequent inability for a borrower to support the same amount of debt as compared to a year ago.

Availability is also being reduced due to lenders being more cautious in economic uncertain times. Lenders are less lenient on adjusted EBITDA add-backs and are pulling back on several structures, namely amortization and term. Covenant-lite structures are going by the wayside. As would be expected in an economic contraction, industry sectors that exhibit cyclicality or discretionary consumer spending are getting special attention. Construction, retail, and consumer discretionary products are in the crosshairs.The reason for borrowing is also gaining scrutiny with share repurchases and recapitalizations on the “avoid” list. The overall result is that maximum debt multiples of EBITDA have come down by as much as 1.5 turns in the last quarter.

All our banker friends have indicated that their organizations are showing no cracks in the portfolio. A few have indicated an increase in credit downgrades, and that is consistent with larger corporates, where corporate debt downgrades have accelerated starting in September with downgrades outnumbering upgrades by a 3:1 margin.

Here at home in the Pacific Northwest, lenders are telling us that credit spreads have come off the bottom and there is a lot of pressure internally to increase pricing. They confirm that the same pressure is on reducing overall leverage from the recent formula of 3x senior and 4x total debt/EBITDA. Nevertheless, all the knives are out when a quality piece of business is available, pushing aside guidelines in order to be competitive.

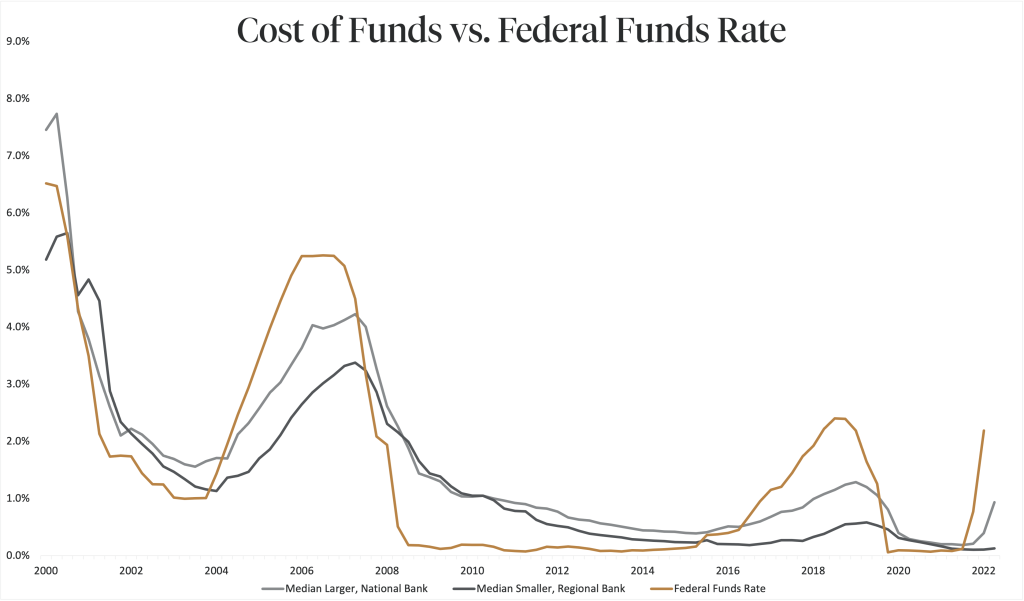

Where we have noticed a difference among bank lenders is between national banks and regional banks. While national bank representatives are more consistent in the message of increased pricing and lower leverage, some of the regional banks are claiming no changes other than shortening up term and amortization commitments. Our thesis for explaining this dichotomy is there is a difference in funding source composition and therefore a difference in cost of funds among national and regional banks.

As can be seen in the following chart, national banks have deposits as a smaller percentage of loans outstanding, meaning that they are more likely to price on the margin and reflect the trend in rising interest rates (i.e., the Fed funds rate). Regional banks, on the other hand, have a larger deposit base with a close-to-zero cost. The cost of funds of these banks is less volatile and may explain why they react more slowly to changes in underlying market interest rates. This cost of funds differential may be driving the differences in pricing strategy right now as national banks are reacting to rising costs, but it is a temporary advantage; as personal savings shrink and deposit holders begin to demand competitive rates, the cost of funds advantage will be driven away.

Impact on M&A Transactions

Strategic or corporate acquirers are adjusting their costs of capital upwards to reflect the rise in interest rates and its impact on the cost of debt. The same is true for private equity funds. As the cost of debt increases and more equity is required because of reduced leverage, the math doesn’t work to uphold promises made to investors unless acquisition prices decline.

What does this all mean? In general, acquisition loans will be more expensive and less available than we have become accustomed to, buyers will react to these changing conditions with lower prices, and sellers will be frustrated that they cannot get the same deal they could have had last year. This often causes a “bid-ask” spread to widen and will slow the number of transactions until the two parties come together. In certain pockets, these themes will be thrown out as extremely attractive companies will be just as attractive in a market that has fewer deals competing for the available money. Lenders and investors will break their rules when jewels become available. In other situations, sizeable combination synergies can outweigh general market conditions. Although the overall market may cool, it is the specific situation that will drive how the market will treat it.