The credit markets have been a consistent source of intrigue in recent years. As each new chapter to the story unfolds, we check in with sources in the marketplace to develop our own perspective on what it all means. Our last update was one of tightening; higher rates, widening credit spreads, and tighter terms. As we approach the anniversary of the last increase in the federal funds rate, we asked the market a new set of questions—

“Have credit terms stabilized?”

“Have banks tightened their approach elsewhere?”

“Has stability allowed the M&A market to improve?”

What we found is a budding sense of trust in reduced credit market volatility. Lenders have established boundaries in their lending parameters, leading to a sense of optimism among M&A market participants.

Similar Terms Compared to a Year Ago

To many people, the period of tightening credit feels like it was yesterday. In reality, we are approaching a year without significant change. Our observation is that there has been minimal movement in the terms borrowers receive. Subordinated debt has become slightly more expensive but more notably, senior debt has become less expensive. Altogether (via a unitranche note), it could be argued credit has “loosened”— at least in the leveraged loan market.

Source: SPP Capital Markets

The Opaque Side of Credit

In our November 2022 Insight, “Tightening Credit Markets,” we highlighted other ways availability to borrowers was being reduced. Lenders were more strict on EBITDA add-backs, avoiding covenant-light structures, and scrutinizing the reason for lending. Some banks reduced their appetites as they concentrated on shoring up balance sheet liquidity. Credit standards have not materially changed, but those who sat on the sideline have now joined the party, as the Silicon Valley Bank collapse is in the rearview mirror and deposits have returned to normal.

Cyclical industries continue to be the usual sticking point. Entire pockets of the economy have been left without bank assistance for over a year now, having been forced to look beyond debt to the more expensive option of equity to fund their operations (with many not finding willing suitors).

Banks are hesitant to lend to anyone unless it is the sole-source provider of all things banking. The lack of exclusive control over treasury services can now be a reason to turn down a lending opportunity. This has had the side effect of a major reduction in syndicated loans, which now look like an instrument only used in large credit facilities. These multi-bank facilities continue to be more expensive than single bank credits as the marginal bank participant, which has no other sources of revenue other than the loan, drives pricing.

These are important points to highlight, but they are not new to the underwriting process of a bank. Markers that lenders were looking for in an opportunity a year ago are nearly the same as what they are looking for today. Matched with relatively consistent credit terms, we would argue that the market has stabilized considerably.

The question now becomes—“How has a year of stability has impacted the ability to negotiate and close an M&A transaction?”

What We Have Seen in M&A

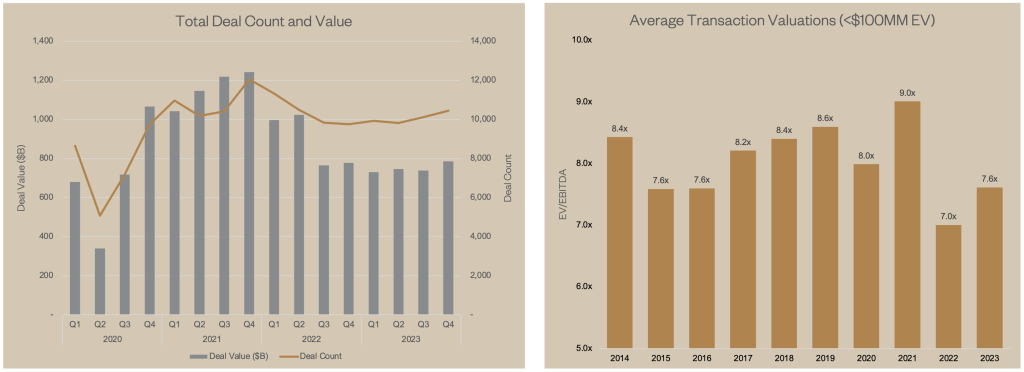

Perceived credit market stability could lead someone to believe that M&A markets should be roaring back but that is not the case. True to our worry in previous credit market updates, tightening credit contributed to slower M&A markets with lower valuations. After 2021, deal values, volumes, and valuation multiples all declined. Higher interest costs take cash from equity holders, thereby requiring a lower price to rebalance returns to capital providers.

Sellers don’t typically adjust mental valuations as quickly as do buyers, resulting in fewer overall transactions until expectations adjust. It appears this is what has occurred over the last 18 months. The most recent data indicate a slight rebound, giving hope that equity markets will stabilize, as credit markets have.

Continued Future M&A Uncertainty

Despite the drop-off in 2022, Q4 2023 data “hints” at optimism going forward. In 2023, we saw an uptick in both deal count and valuations as the year progressed. Throwing back to our concept of stable credit markets, this makes sense— deals take time to finalize; often between six and twelve months. If the expectation is that the credit markets are going to be significantly different at the end of the process than they were at the start, it makes underwriting difficult. Investors take to the sidelines rather than wasting their time. Instead, we are seeing the first set of deals finalized where the credit terms that were underwritten at the beginning of the process were consistent with the ones that were closed on.

Credit volatility is an important factor in how well the M&A market functions. The relative stability recently in how lenders are thinking hints at a stronger future. While the market certainly remains in a “trough” relative to what was witnessed in 2021, comfort with the terms being offered by banks should allow sellers and investors to step back into the M&A ring. Unfortunately, anecdotal information hasn’t yet confirmed this trend. There appears to be a supply/demand imbalance—there are more lenders ready to provide credit but fewer attractive opportunities to actually extend credit. Ironically, the result has been shrinking credit margins and consistent credit terms. Still, borrowing costs are high relative to recent history and transaction prices are bearing the load. There appears to be a continuing bid/ask spread between buyers and sellers that has not yet been absorbed. Until that does, or interest rates decline, M&A volumes are unlikely to bounce back.