The economy is recalibrating after a shock to the system—so is private equity.

The last four years have seen the post-collapse effects ripple through the business landscape, spurring survivors to rethink their business models to encourage future success. The private equity industry is no different. For some time, our friends in the private equity industry have predicted a shakeout of their industry. During the heady 90s and recovery in the early 2000s from the dot-com boom, money flowed too easily into new funds, hiding the inefficiencies of the model.

Shockingly, it is difficult to make money. Investors, realizing this truth, are exercising more care in choosing private equity groups (“PEGs”) to back. A tougher fundraising environment has forced a period of rationalization in the private equity industry, and fund managers are focusing on raising manageable amounts that they can place into businesses they understand and to which they can add value. Although adjustments take time because of the term commitments to individual funds, the fat is being trimmed.

PE Activity the Past 20 Years

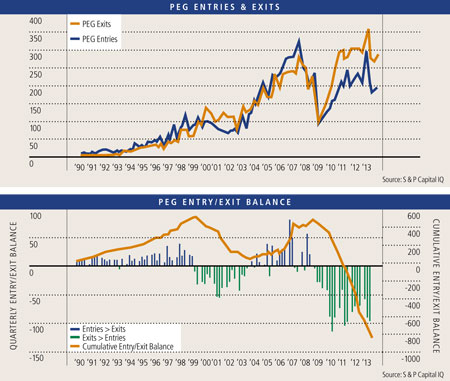

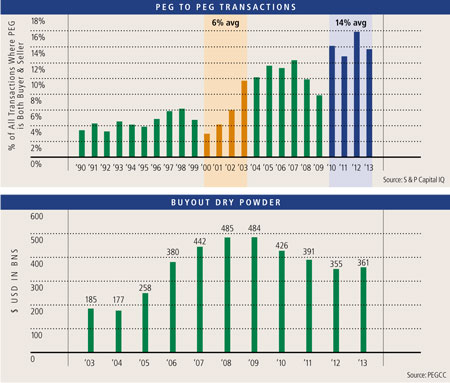

We looked at private equity activity over more than 20 years to see whether the period from 2009-present showed any change from previous periods. We found that over that time: exits far outpaced entries; the volume of PEG to PEG transactions shot up; and dry powder declined from its peak in 2008. These findings in and of themselves do not offer proof, but might suggest that the ballyhooed PEG activity of 2012—in which the fourth quarter experienced more portfolio company positions sold by US PEGs than in any other quarter in the last 20 years—might be less indicative of short term tax effects and more indicative of a larger undercurrent of industry rationalization.

This rationalization has resulted in a net contraction of US private equity portfolio companies since 2009 on a scale unprecedented over the past 20 years. The decade of the 1990s only saw three individual quarters that had fewer entries than exits, indicative of the ability of private equity firms to find opportunities to deploy capital. The pendulum swung in the opposite direction over the next four years from 2000-03 as firms tried to rationalize their investment portfolios following the dot-com bust. Another recovery prompted additional investment in the mid-2000s, with entries again outpacing exits and expanding the number of portfolio companies under the PEG umbrella. But starting in 2009, a sharp imbalance in favor of exits has continued in every quarter. The combination of high turnover and continued imbalance means that 1,185 more exits than entries have occurred since the beginning of 2009, a drop in the total quantity of US private equity portfolio companies by roughly 4%.

It is also worth noting that transactions between PEGs have risen as a percentage of overall transactions. The last time private equity went through a rationalization period, in 2000-03, only 6% of transactions involved a company moving from one private equity portfolio into another. Since 2009, however, that share has risen to 14% (reaching 16% in the 4th quarter of last year), more than double the observed rate of a decade ago. It appears that private equity firms are using each other more often to trade in and out of companies as the companies move through different growth stages, and can benefit from a different set of expertise or platform add-ons.

The last four years have represented a drawdown in private equity involvement in the US economy. It is revealing that during this contraction period, dry powder has also declined from its peak in December 2008. Declining available funds, combined with the net sell-off of portfolio companies, suggests that the recent contraction of private equity might be an indication of a long-term readjustment of its role as an investment vehicle.

Handling Additional Pressure

Managing a successful fund has never been an easy venture, and the financial crisis and subsequent economic slowdown has put additional pressure on managers to extract value for their investors. To combat this pressure, many private equity firms are tightening their investment criteria to focus on narrower niches. The value proposition a potential investment brings to a PEG portfolio must be clear and defensible, and the PEG managers must likewise be able to target exactly how they will be able to add value. We would expect the application of these more stringent investment criteria to continue to result in a realignment of portfolios, shifting companies among funds to find better management fits.

The changing role of private equity does not mean there will be a shortage of private equity funds to participate in successful liquidity and change-of-control transactions in the future. However, it does mean that while the industry continues to adapt in size and composition, extra care will be taken by both potential investors and liquidity seekers to find mutually beneficial matches. Liquidity seekers must be able to communicate their value propositions to increasingly choosy investors, as well as navigate among funds with varying levels of success with similar situations and investment sizes. In these cases, the role of a knowledgeable and experienced advisor is invaluable.