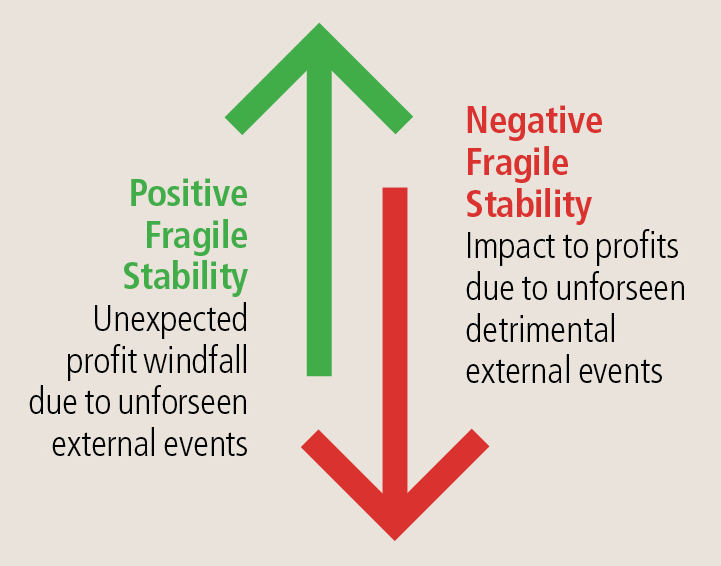

We have employed many words over the years discussing the importance of owners understanding the competitive environments of their businesses in order to make educated forward-looking decisions, but this past year has illustrated as clearly as anything how an unpredictable external force, in this case COVID-19 and the world’s subsequent responses, have introduced incredible instability. The purpose of this article is to present some examples of how businesses have been impacted—not implying that these impacts could have been foreseen or prepared for, but to illustrate the fragility of “stability.” Sometimes “stuff just happens,” and it’s for this reason that wealth managers stress the dangers of not diversifying away from a highly concentrated personal investment portfolio, like owning a business.

Positive Fragile Stability

Revenue windfall is what happened to one of our close friends in the agribusiness sector. The business buys product from farmers and creates products that are sold to consumers on grocery and club store shelves and to other food manufacturers as ingredients in other consumer products destined for the same shelves. When the COVID pandemic hit, many people stayed home, and adjusted their food consumption patterns accordingly. Instead of going to restaurants, people bought food and ingredients from grocery, club, and direct-to-consumer channels. Supermarkets were overwhelmed with demand and reached out to their suppliers to try and buy more. Interestingly, suppliers to restaurants almost immediately lost their customer base and tried to pivot to sell to grocery and club; but these companies had different product forms and retailers preferred to sell through SKUs they already managed, rather than onboarding new suppliers and adding SKUs.

Companies such as the one owned by our friends were the beneficiaries of the concentration of demand through these three channels. Historically a very stable business with consumer-staple-style growth dynamics and cycle resiliency, the impact was a revenue increase of 40% YOY, maximizing utilization of facilities that generated outsized bottom-line profits. The secondary effects of this windfall included expanded supplier relationships, improved customer relationships as a result of delivering under high pressure conditions, and a stronger balance sheet, which has led to more investment in facilities. Although a very good company at the end of 2019, in 2021 it has become a powerhouse. The growth would not have occurred without great management, an able workforce, a long-term positive reputation in the supplier community, and strong connections throughout the whole supply chain (e.g., trucking, cold storage. They were well-positioned for the sudden challenges, but the instability would not have occurred but for a series of events and conditions totally out of the company’s control.

Negative Fragile Stability

There are many stories of revenue shifts that created winners and losers, but the effects of COVID also caused unexpected changes in cost structure and profitability that have had devastating effects on some companies. A good example is what has happened in the “head and gut” (H & G) sector of the Alaska seafood industry. Also referred to as the “Amendment 80” or “multi-species” sector, companies in this sector utilize catcher-processor vessels to harvest and process pacific cod, atka mackerel, ocean perch, rock sole, yellowfin sole, and flathead sole fish. The H&G companies had developed an efficient system wherein fish that were caught in Alaskan waters and primarily processed on the vessel were then shipped to China where the product was further processed and packaged for sale into markets all over the world. This has been a very profitable sector in recent years, as evidenced by the price paid in 2017 to buy one of the sector participants. A key to profitability has been the low-cost value-added processing in large efficient plants in China. But in 2019 and 2020, these H&G companies were impacted by two detrimental external events; first, a 25% tariff in September of 2019 related to political tensions with China, which immediately took a bite out of profits as the H&G companies had to absorb a portion of the tariff. Then, primarily as a result of COVID, worldwide trade declined in 2020, resulting in the largest decline in global GDP since the Great Depression in the 1930s. With declining demand for shipments, containers ended up being stored in different delivery ports around the world. The ready availability of containers and frequent container ship trips, critical to H&G companies, were disrupted by the impacts to the global supply chain. What had been a delicate and efficient system of ship and container movement across the globe, was disrupted. As economies are beginning to recover and demand for shipping has rebounded, ships and containers aren’t where they are supposed to be, exacerbating supply chains, resulting in an increase in freight rates. The H&G companies, which depended on that efficient global system to ship product great distances, have been hit with outsized freight costs. What was a very profitable sector through mid-2019 now labors under the burdens of higher tariffs and freight rates, neither of which could have been anticipated or avoided by good management.

Simply a Matter of Luck?

When we hear owners express with certainty how they expect the future to unfold, we can only point to these and other examples to say that there are forces beyond the control of the company and its owners and managers. Fortunes can be gained and lost simply as a matter of luck. Nobody can predict the future, and nobody knows which butterfly effect is going to have the next global impact – but even decades of stability should not be taken for granted when preparing for the next ten years.