EBITDA multiples are easy to calculate and a lazy way to approximate a valuation of a business. We have written in the past about the shortcomings of ratios of enterprise value to any current business metric, be that EBITDA, sales or unit volumes (“What’s in a Multiple?”, Summer 2014). Regardless of current metrics, the value of a business is the sum of all of the future cash flows generated by that business, discounted by the appropriate risk rate associated with those cash flows. One situation in which this reality diverges from EBITDA multiple shortcuts is where businesses have a very long-lived asset that is critical to the generation of the cash flows of the business. Since EBITDA multiples are agnostic to the amount and timing of capital expenditures, the point in time of the economic life of these assets can make a huge difference in the value of the business and, therefore, the EBITDA multiple.

Many industries require significant capital investments in long-lived assets with useful lives exceeding 30 years. These investments can range from large fishing vessels in the seafood industry, to crop re-plantings in the agricultural and forestry industries, to manufacturing businesses requiring large investments in equipment. Valuing businesses in these circumstances using standard valuation metrics such as EBITDA multiples may ignore a fundamental timing issue related to those capital-intensive, long-lived assets, resulting in erroneous conclusions of value. These “valuation traps” are too often exactly what we observe when discussing value with owners of businesses with relatively expensive, long-lived assets. When valuing such a business, the expected cost of maintaining and eventually replacing that asset must be considered.

It is fairly intuitive that a business with newer assets will be more valuable than a similar business with older assets (all else being equal). Extending this logic, it is clearly wrong to apply a single value metric, such as EBITDA, to each of these companies. The expected cash flow requirement to reinvest in the long-lived asset comes much sooner to the company with the older asset then the newer asset and will impact the value accordingly. For companies requiring relatively expensive and long-lived assets that are required to carry out the business enterprise, these assets can comprise a significant (or in certain cases, almost all) portion of the value of the underlying business.

We particularly observe this in companies that have rights to harvest a certain resource, but wherein the process of converting that resource to a finished product requires investment in expensive and long-lived assets. We have found it is common for owners of these businesses to view the value of their businesses as a multiple of EBITDA, regardless of the age of the long-lived assets. Typically, this view is based on a comparison to other, similar businesses where the overall value was translated into a ratio of a deal value relative to EBITDA. The critical flaw in this logic is the failure to disaggregate the value into two components – the implicit value of the operational cash flows and the value of the remaining life of the critical long-term assets .

This allocation of value to these two components can best be demonstrated by using two extreme examples. In the first instance, the business produces a certain level of EBITDA by using a long-lived asset to process a resource with an asset nearing the end of its useful life (e.g. a 20-year old processing asset that has a 30 year expected life). In the second instance, a competing business earns the same EBITDA but has just recently invested in a new processing asset with a full 30-year expected life. Are the values of these two companies equal? Of course not! – but using a valuation metric such as a multiple of EBITDA without consideration of the value of the long-lived asset would imply that they were.

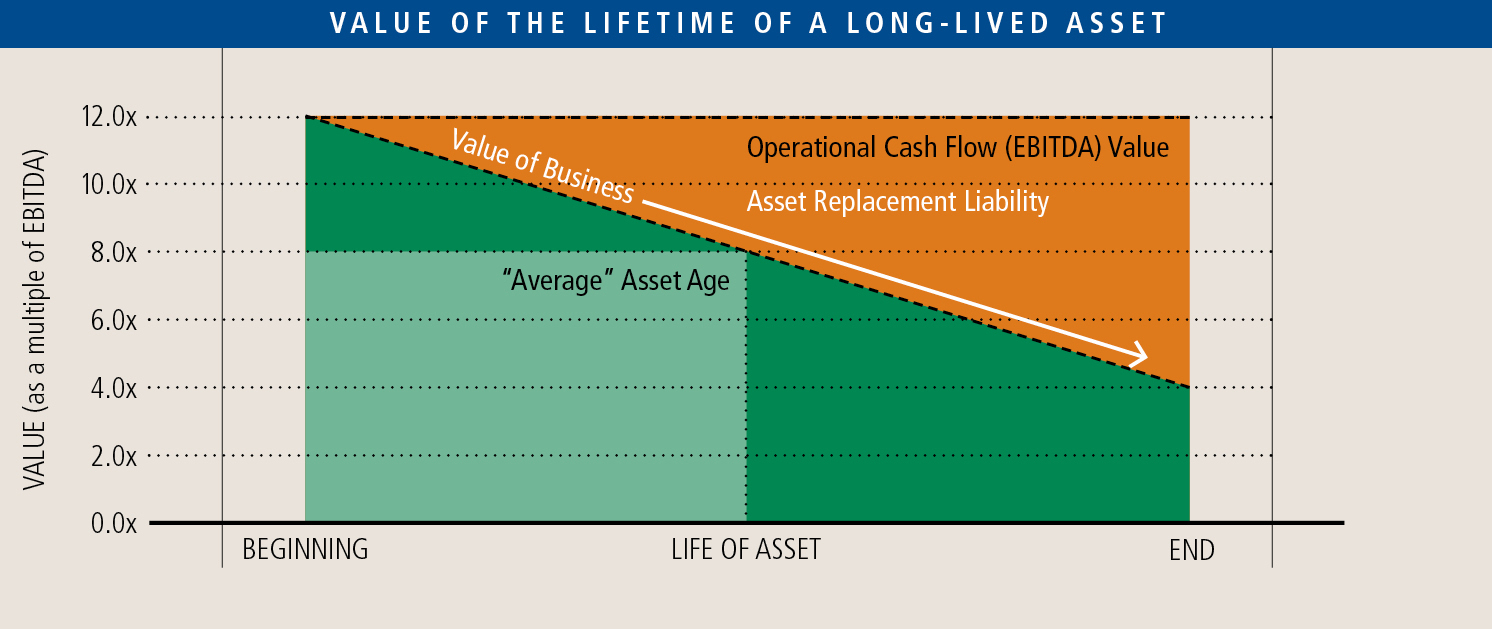

In the exhibit below, the two components of value are plotted over the lifetime of the long-lived asset. In this case it is assumed that business volume and prices are stable, generating a constant EBITDA over the expected life of the asset. As the long-lived asset ages, the present value of a needed replacement future capital expenditure increases in value and detracts from the operational value, thereby reducing the effective EBITDA multiple over the life of the asset.

The danger is assuming the “average” condition, which is the mid-point, and applying that constant EBITDA value multiple regardless of the age of the long-lived asset. At any other time, the effective value multiple will be different, with higher multiples on newer assets and lower multiples on aged assets. After considering the total cash flows necessary to run the business over a long period (which would include having to replace the long-lived asset) an investor or buyer would pay a higher multiple for a business with a new long-lived asset and a lower multiple for the same business that required near-term investment in the long-lived asset.

Could a strategic buyer value the opportunity differently? Yes – another business in the same industry might be willing to pay more as a multiple of EBITDA if (and only if) the volume of the acquired business can be added to an existing long-lived asset thereby allowing it to earn a higher marginal EBITDA, or where it can avoid making a large capital expenditure. Put differently, a buyer might be willing to pay a marginal value for additional volume that “optimizes” use of an existing long-lived asset or avoids having to invest in a new long-lived asset.

Ignoring the impact and age of long-lived assets in determining a business’ value is a classic trap for buyers and sellers. Assuming an “industry” multiple for these businesses ignores the particular factors that determine the value of the long-lived assets necessary to generate the cash flows of that business. Savvy investors understand this relationship where operating cash flows and capital expenditures are both part of the same value equation.