It is common to hear from business owners and managers that they wish to exclude certain buyers from a sale process. Reasons include a bad cultural fit between the companies (often as a result of a long period of intense competition), perceived limited financial capability because of size perception, and fear of misuse of confidential information. While these may be valid assessments, restricting the buyer universe during initial outreach restricts receipt of important information that can be used to optimize decision making. If mitigating measures can be put in place to protect the business from damage as a result of engaging with a party, a seller will benefit from the information obtained and may find new information that will cause a reassessment of initial impressions.

Impact of Constrained Market Information on Decision Making

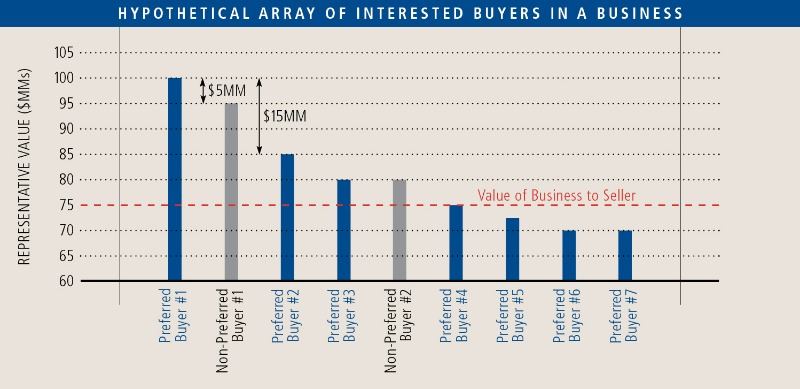

Constraints on composition of the buyer universe can put holes in the market information about buyer interest in the seller’s business. The following chart provides a hypothetical example of the most logical buyers for a certain business.  Each column represents a different buyer and the price they have indicated they would pay for the business. In this example, there are five parties that would be willing to pay a “premium”, meaning an amount in excess of the value to the existing owner. The “grayed” bars indicate buyers who have been suggested to be excluded from consideration. Without the information from the excluded parties, the seller has less visibility into the optimal result. In this case, excluding buyers leads the seller to believe their best alternative to no action (BATNA) is $15MM lower – but including all buyers would have lowered that difference to $5MM. That difference could lead a seller to conduct a different negotiating strategy to assure closing a deal with the buyer offering the highest price.

Each column represents a different buyer and the price they have indicated they would pay for the business. In this example, there are five parties that would be willing to pay a “premium”, meaning an amount in excess of the value to the existing owner. The “grayed” bars indicate buyers who have been suggested to be excluded from consideration. Without the information from the excluded parties, the seller has less visibility into the optimal result. In this case, excluding buyers leads the seller to believe their best alternative to no action (BATNA) is $15MM lower – but including all buyers would have lowered that difference to $5MM. That difference could lead a seller to conduct a different negotiating strategy to assure closing a deal with the buyer offering the highest price.

Reassessing Preconceived Perceptions

Before a seller can become comfortable with discussions with these parties, it is important to address how to control the process to reduce the possibility of negative outcomes.

Concerns about buy-seller fit stem from deeper worries about the buyer after closing a deal. Often this concern comes from a long-term developed perception of the other party as a competitor. Owners often have an impression of their toughest competitors as having evil intentions. Will the new owner keep current personnel? Will they close operations? Will they run it differently than it is now? These concerns are valid and important to consider. But two viewpoints should be considered.

First, there is a difference between obtaining pricing information and closing a deal. A seller is never obligated to consummate a transaction with a buyer until a purchase agreement has been signed. Allowing all supposed “bad fit” buyers to submit offers gives the seller an important advantage of being able to review all alternatives prior to deciding on which deal is best.

Second, it is important to understand the long-term implications of a sale. Just like water always finds its level, companies will eventually be sold to the owner that values them the highest. Excluding a buyer because of how it will run the business is likely just delaying the inevitable – if the rejected buyer can realize the highest value in the company (usually because of operating synergies), the buyer you choose will eventually discover this and negotiate a transaction at the higher price, capturing the value for themselves.

Clients typically have a strong understanding of the markets they participate in and know the relative sizes of their competitors and make decisions based on that information. We find that, in some cases, business owners overestimate their understanding of the size and nature of their competitors. While buyers without access to adequate financial resources to complete a transaction should be excluded from a sale process, that should only be done following an investigation of its owner. A small company owned by a private equity firm or a larger company may be a perfectly suited buyer.

Especially with direct competitors, information that is shared during a transaction can be extremely confidential. Even the fact that the seller is considering a transaction can be potentially harmful if it is known in the marketplace. While it is impossible to fully mitigate the risk of confidential information leakage, a hands-on investment bank and an experienced legal team can minimize the risk with the use of strong non-disclosure agreements. In a previous Insight article (“Navigating Highly Confidential Transactions”, Sum 2020), we discussed techniques and procedures to mitigate unwanted disclosure risks.

A decade ago, our client, the owner of a business with a proprietary market position that was earned as a result of its technology was approached by a company that wanted to enter that market. Discussions had progressed to the point that a price that had been proposed. On the surface, it appeared reasonable. We suggested that several other parties be contacted as we thought they would benefit even more from the use of the technology. One buyer was a very large acquisitive public company. The owner was adamant not to approach that company as he had a very negative impression of it. We were successful in allowing that company make a proposal and we and our client were pleasantly surprised to find a premium of 75% offered. The difference was significant enough to lead to a number of discussions. Eventually, the sale was consummated with the higher bidder and, our client completely changed his view of the company and its people, ending up working prior to retirement as an executive in the buyer’s organization for five years following the transaction.

At the beginning of every engagement, it is important to talk with financial and legal advisors about concerns that would lead to excluding buyers from the process. The seller always has the final say but the outreach process can be modified to mitigate concerns. It is always in the seller’s best interest to know all options so that the most knowledgeable decisions can be made. By maintaining the optionality that comes from approaching all possible parties, the seller can keep the process as competitive as possible and weigh the downside of individual concerns relative to the benefits of a higher valuation.