The evidence is in—the U.S. economy is staging a full-throttle turnaround. Virtually every economic indicator reflects strong and sustained momentum. Real Gross Domestic Product growth was an extraordinary 8.2 percent in Q3 and a respectable 4.0 percent in Q4 of 2003; major corporations are announcing solid profitability gains, capital spending is growing; and business and consumer confidence have steadily strengthened. Moreover, job growth seems to be rebounding. In contrast to the election year political hyperbole regarding two million “lost jobs” and outsourcing, household employment has hit an all-time high, according to the U.S. Labor Department. Large corporations that shed jobs during the downturn have been slow to recall laid-off workers or create new jobs, but the payrolls of small and medium sized businesses are expanding. Personal incomes are growing, as well. The Pacific Northwest is a little less glowing, but we are on the upswing, nevertheless.

Credit Demand Remains Weak

Given the widespread positive economic tidings and bullish expectations, it would be reasonable to expect that the demand for capital would be burgeoning. Corporate borrowers typically tap the loan market when activity is hopping, in order to invest in working capital (receivables and inventory), people, facilities and equipment needed to sustain growth. Even with the strong economic news, demand remains rather anemic for business capital or, more specifically, bank credit.

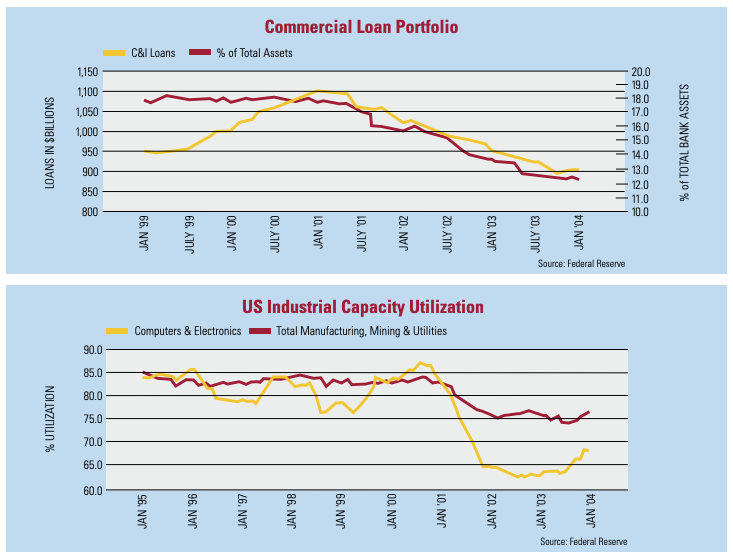

According to the Federal Reserve, commercial banks reported $898 billion in outstanding commercial loans as of the end of February. As indicated in the adjacent chart, commercial loan portfolios have steadily dwindled for the past three years— from $1,100 billion three years ago. Commercial credit averaged 17 to 18 percent of total banking assets in the latter years of the 1990s. It now amounts to a little less than 12 percent of the total banking balance sheet.

The question is why credit demand is so soft at a point in the cycle when it should be robust? There are a couple of contributing factors. First, there is an issue of excess capacity —an enormous amount was put in place during the boom, not only in the U.S., but worldwide. This has led to a slow recovery in overall industrial capacity utilization, which remains below 80 percent. In certain sectors, such as computer and electronics manufacturing, utilization is less than 70 percent. The accompanying chart only reflects the U.S. situation; however, excess capacity is a worldwide phenomenon.

A second factor contributing to weak credit demand is the sizeable productivity gains that are being realized. It is clear that businesses continue to figure out how to produce more with less. In large part, the surge in productivity is the real fruit of the improvements in communications and logistics that internet and wireless technologies have provided. The majority of the benefits were not reaped by flash-in-the-pan dot.com firms, but by mainstream businesses, large and small, that have adopted technology to become closer to suppliers and customers. Productivity also has been enhanced by short-term cost cutting behaviors that inevitably happen when times are tough. As the economy grows, these kinds of behaviors tend not to keep pace. This productivity growth has slowed the absorption of excess capacity and muted credit demand. As long as business needs can be funded from internal resources, bank credit demand will remain weak.

Finally, this trend of weak bank credit demand is due, in part, to large corporate borrowers tending to their capital needs with other sources. Given the very favorable interest rate environment, the public bond and commercial paper markets have been an attractive alternative to bank debt for those companies that have the size and scale to gain access.

It’s a Borrower’s Market

In the span of just two years, the tide has turned again for bankers and borrowers. It was not that long ago that a new lending opportunity could not be gold-plated enough to get a banker’s pulse racing. These days, bankers are raring to go. They all seem to have significant loan growth goals that they are attempting to fill. The shift in bankers’ appetites for commercial credit is clearly evident in the Federal Reserve’s January 2004 Senior Loan Officer Opinion Survey on Bank Lending Practices. In the survey, 18 percent of domestic banks, on net, reported easing lending standards for large and middle-market firms. For the same period, 11 percent of domestic banks, on net, reported easing lending standards for small firms. While, on its face, this may not seem like much of a shift, it is in fact the largest reported net easing since 1993. Senior loan officers credited the relaxation of standards to more aggressive competition from other lenders, as well as improvement in the economic outlook. The survey also notes that the majority of banks are experiencing improved commercial credit quality. Loan defaults have dropped sharply and problems that surfaced during the economic downturn have largely been cleaned up. This turn of events is having, and will have, a favorable impact on the rates and terms that borrowers can expect to see in new financings this year. It is fair to say that it is a borrowers’ market for the first time in three or four years.

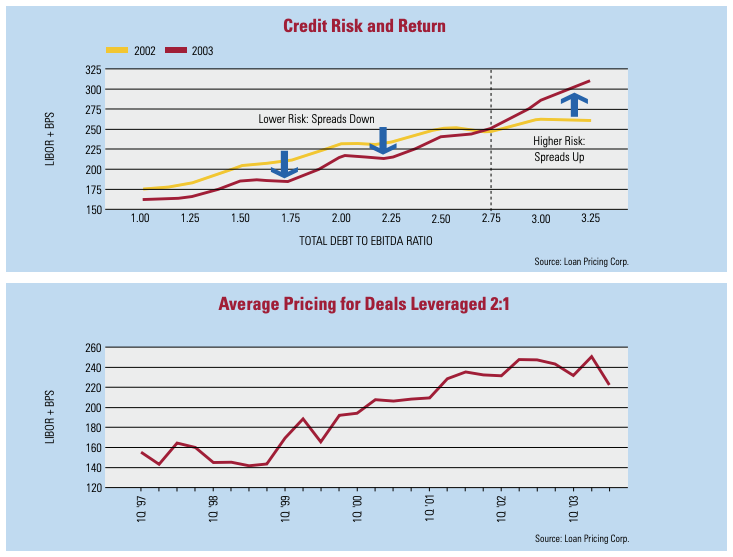

Loan Pricing Corp., which closely monitors corporate lending activity, confirms that middle-market loan demand was soft last year, but strengthened by 53 percent in the fourth quarter, compared to the prior year. They expect that credit demand will pick up in 2004, as the economy strengthens further. However, the balance between credit supply and demand should continue to favor borrowers, particularly in moderately leveraged financings (i.e. total debt / EBITDA < 2.75:1). As illustrated in the adjacent chart, Loan Pricing Corp. reports that the average credit spread over LIBOR slipped last year, relative to 2002, except for highly leveraged deals. In transactions with total debt to EBITDA in excess of 2.75:1, borrowers paid more of a premium in order to get lenders to take the incremental risk. While borrowers are paying more at the leveraged end of the market, these are deals that would not have received much lender consideration 12 to 18 months ago.

In our view, the trend established last year is likely to continue for the balance of 2004, and probably longer. For “middle of the road” financial-leverage deals (debt to EBITDA of 2:1) the average spread over LIBOR peaked in the second quarter of 2003 at 250 basis points, as shown in the accompanying chart. By the end of the year, the average credit spread had slipped about 10 percent. The current imbalance between credit supply (eager lenders) and demand (willing borrowers) suggests that pricing will soften further. Clearly there is a ways to go before credit spreads drop back to the level that prevailed in 1997-1998.

We expect that the acceptable limit on financial leverage will creep up and credit spreads will slide further, even on more highly leveraged transactions. Lenders are generally eager to provide financing. Most of the bankers that we talk to regularly are not seeing the volume of opportunities that is necessary to meet their portfolio growth objectives— so they are hungry.We have always been proponents of building close relationships with bankers, but these relationships need to be broader than just with a single institution, in order to get some competitive benefit. Now that lenders again are willing to compete for credit, prospective borrowers can expect to reap structure and pricing benefits, if they cultivate competition for their business.