What to make of the current private market for business sales? On the one hand, private equity fund raising just had its best year yet. The coffers are full and managers are looking for investments. On the other hand, median transaction multiples have fallen by 22% since 2021. We may be experiencing a shift in “normal” again as prices adjust to an increase in cost of capital. In 2014, we declared a new normal in business valuations (referring to EBITDA multiples) with the aptly titled article, “8 is the New 6.” Today, we observe a reversion of sorts—six is the new eight.

It’s Private Equity’s World Now

Over the past decade, private equity has taken the middle market by storm. Since 2020, private equity groups have accounted for over two-thirds of all middle market acquisitions. The inventory of private equity-backed companies has expanded by 50% since 2013, and more importantly, the number of private equity exits has doubled over that same period, sometimes in sales to other private equity firms.

Private equity portfolio company sales play an outsized role in market dynamics despite only making up between 15 and 20% of middle market transactions in any year, because those exits signal to other investors what a “fair” purchase price is in any given industry. Private equity investment committees are naturally data-oriented and are influenced by other known transactions, underwriting investments with an entry and exit valuation that reflects real, precedent exits. Since private equity buyers are one of the most important constituents in middle market deals, they provide an important signaling function to ground other potential acquirers’ valuation analyses.

The Tyranny of the IRR

Meanwhile, over the past year, private equity firms have reined in deployment of all their aforementioned dry powder. The culprit is the cost of capital and its consequent effect on internal rates of return.

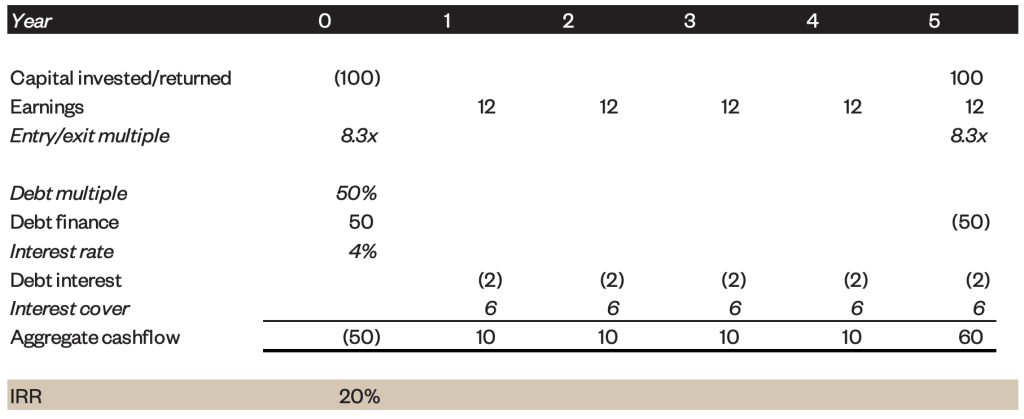

In the “old” normal world of 4% interest rates, buyers could underwrite acquisitions at 8x EBITDA for businesses with reasonable returns on invested capital and 50% debt-to-capital ratios, assuming no growth and no fundamental business model changes.

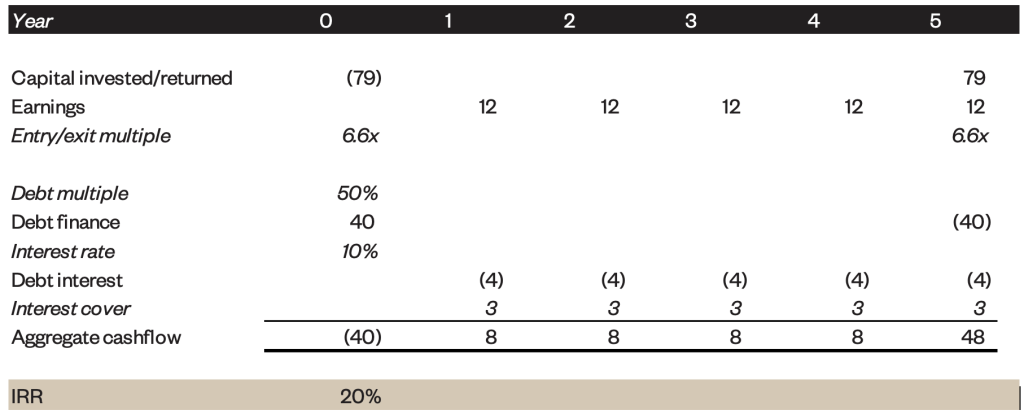

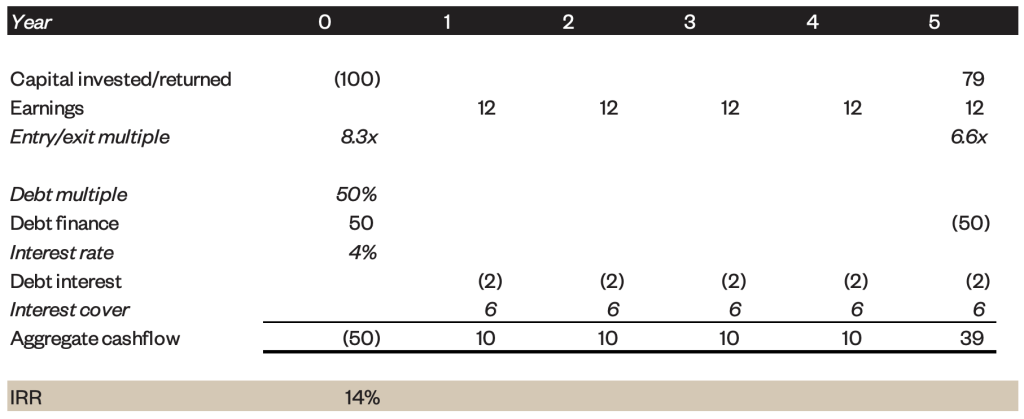

Today, however, things are different. Interest rates are no longer in the mid-single digit range, but rather have climbed to double digits as the Federal Reserve has increased the Federal Funds rate to combat inflation. That same representative investment can only achieve an equivalent return on equity if the purchase multiple is reduced by roughly two turns of EBITDA, therefore, eight is the new six.

It goes without saying, but we’ll say it anyway: the investment thesis in these two examples is identical. The only driver of the decline in price this fictional investor can underwrite is the change in the cost of capital available to borrow.

A Subdued Market

The market has definitely slowed from early in 2022. Fourth quarter 2022 transaction volumes were far off of an earlier pace, and investment banks are reporting revenues down by 50% while preparing (and begun in some cases) to lay off thousands of workers in an industry bloodbath that is predicted to be the largest contraction since 2008. The problem is not liquidity. Rather, it is partly family business owners at impasse with buyers not willing to pay 2021 multiples and private equity firms curtailing exits to avoid recording a score below investor expectations. Family business owners are suffering from the psychological pain of realizing a “loss” from the deal they could have had a year ago. Private equity firms are more logical and the math is simply that a mark-to-market on multiples brings the expected return down dramatically. What’s preferable to locking in a low return on investment? Waiting. Consequently, private equity firms are choosing to delay exits until absolutely necessary or market conditions change. Consequently, middle market private equity exits have fallen by 43% from 2021 to 2022.

The Fallout

Family owners will take some time to adjust until personal circumstances drive a market need for liquidity or the disappointment of missing a market peak gets further in the rearview mirror. Private equity sellers will delay exits until time runs short on fund lives. At some point, the dam will break and will likely be led by private equity firms, whereupon those transactions will again become the signal of pricing normality.In the meantime, until and unless inflation and interest rates abate, increased costs of capital to private equity buyers will dictate the middle market valuation arithmetic that determines multiples.