As counterintuitive as it may sound, a recession actually might be an appropriate time to procure additional capital. Raising new capital is the right decision if that capital is used to invest in growth opportunities that create economic value (owning a smaller proportion of a business that is worth more), or if the new capital reduces financial risk (owning part of a stable business that will survive to fight another day is better than 100% of a business that fails). Even in these difficult economic times, equity capital remains available for either situation.

How Much New Capital Is Needed?

Underlying the careful determination of how much capital should be added is the basic trade-off between the value created and the price that investors demand for each incremental dollar of investment capital they provide.

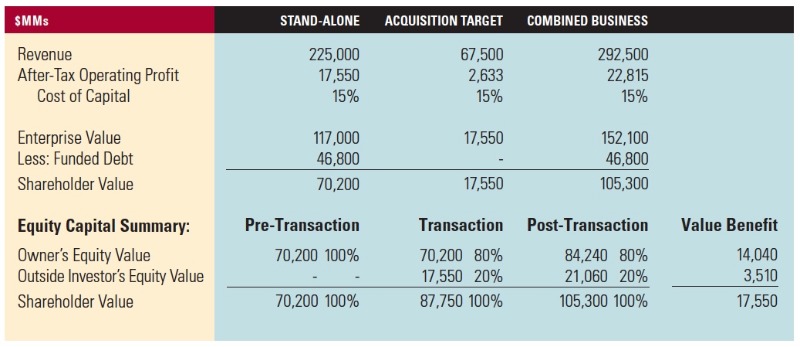

To illustrate the potential benefit, consider an opportunity that was recently presented to a distributor of industrial products. A competitor in an adjacent market fell on hard times and was offered for sale. The buyer was able to negotiate a purchase price of $17.6MM and felt that it would be possible to incorporate the seller’s assets into its own infrastructure, thereby doubling after-tax operating earnings to $5.2MM. An additional benefit was the elimination of a significant competitor, which was expected to both accelerate revenue growth and strengthen the company’s strategic position.

Not too long ago, this entire acquisition could have easily been funded with additional debt. However, today’s more stringent credit underwriting has dialed back the availability of new credit to the point that new equity capital would be required to complete the transaction. Not wanting to let an attractive opportunity slip away, an investor was brought in to fund the purchase price. The adjacent table summarizes the essence of the transaction.

This business combination created in excess of $14.0MM of additional value for the original owner, which resulted in a 20% increase shareholder value even after selling equity to the new investor. And, in the process, a larger business was built that very likely will result in a higher sale multiple when the combined business is eventually sold.

The Value of Risk Reduction

Our present downturn hit hard and fast. Companies that did not react almost instantaneously to the reduction in demand have seen faltering performance, and, in many cases, operating losses. Often, the proceeds from declining sales volume mask the fact that performance has begun to wane; after all, cash flow is still positive. Over time, the business is hollowed out, as working capital is stripped to fund operating losses or debt service, and the business becomes more leveraged in relation to its cash flow. The margin for error is gone.

In the past, lenders might have willingly financed the reinvestment in working capital, as demand rebounded. Not now; equity will be required. In fact, for companies limping along on working capital through the bottom of the cycle, the point of greatest peril is reached when demand begins to take off. If sales growth opportunities outstrip the ability to generate cash, an undercapitalized business may well be on the road to a permanent impairment of its strategic position.

Partner Up

If you have selected your equity source carefully, you gain far more than just cash – you gain a partner. Good equity partners bring, among other things, experience, strategic decision-making, networks of contacts, and energy to your enterprise. The other side of the equation is adjusting to dealing with an expanded decision-making group and an obligation, sometime in the future, to provide a liquidity event for your new partner.

Conclusion

Raising capital is always the inexorable struggle between greed and fear. Greed urges owners to maximize leverage in order to avoid sharing ownership, while fear insists that one must prepare for the unexpected. In the current environment, it is decidedly better to have more capital than barely enough. On the upside, if access to capital allows the company to take advantage of strategic opportunities to grow, or means the difference between surviving or perishing, the cost of fresh equity will be worthwhile.