Making money is hard, and private equity investing is not exempt from that reality; not all investments turn into bags of gold for the investors. The difficulties of investing, combined with typical private equity fund structures, can cause the incentives for a private equity investor to change dramatically over the course of a fund’s life. Understanding fund economics and the unintended consequences is important for potential economic partners, including entrepreneurs, lenders, and co-investors.

Fund Structure

The basic structure and economic model of private equity funds has largely remained stable since the early 1980s. This model consists of two entities, the investment manager (general partner, or GP) and the investors (the limited partners, or LPs). LPs commit a specific amount of capital for a specific period of time such that the fund manager can draw on this capital to fund business acquisitions. The LPs agree to fund the operating expenses of the fund manager and share in the profits resulting from the eventual sale of the businesses. Once invested, capital cannot be reused, so when a sale occurs capital is returned to the LPs in accordance with the agreement. The fund becomes a liquidating entity such that once the portfolio companies are sold, the fund ends. If successful, the fund manager then attempts to entice investors to repeat the process with a new fund. While appearing straightforward, the alignment between manager and investor can change over time.

Funds typically have a life of ten years, which covers everything from the search for investments, negotiating and conducting investment due diligence, ongoing management of the portfolio businesses, and ultimately the sale of the fund’s investments. Fund managers typically have five years to put the LPs’ money to work, after which the unused capital is no longer committed. Management fees generally are 2% of committed capital. Fund managers generally share in 20% of the profits of the entire fund, not individual investments, wherein profits are calculated after covering all management fees, with sharing subject to LPs earning a minimum internal rate of return (IRR) of 8%. While often referred to as the “2% and 20%” formula, the model really means “2% advanced against 20%.”

The management fee is intended to cover the fund manager’s expenses. As the fund increases in size, more employees are typically required to source, invest, manage, and realize the investments. Operating expenses generally consist of labor, office leases, and other operating expenses. Management fees more than cover operating expenses in the fund’s early years. However, during the later fund years – when the firm is assumed to have fully invested the capital and is now harvesting these investments – management fees typically scale down dramatically, exposing the firm to operating losses that must be covered from reserves built during the early years. The payday for the fund manager is the share, or carried interest, in the profits on realized investments.

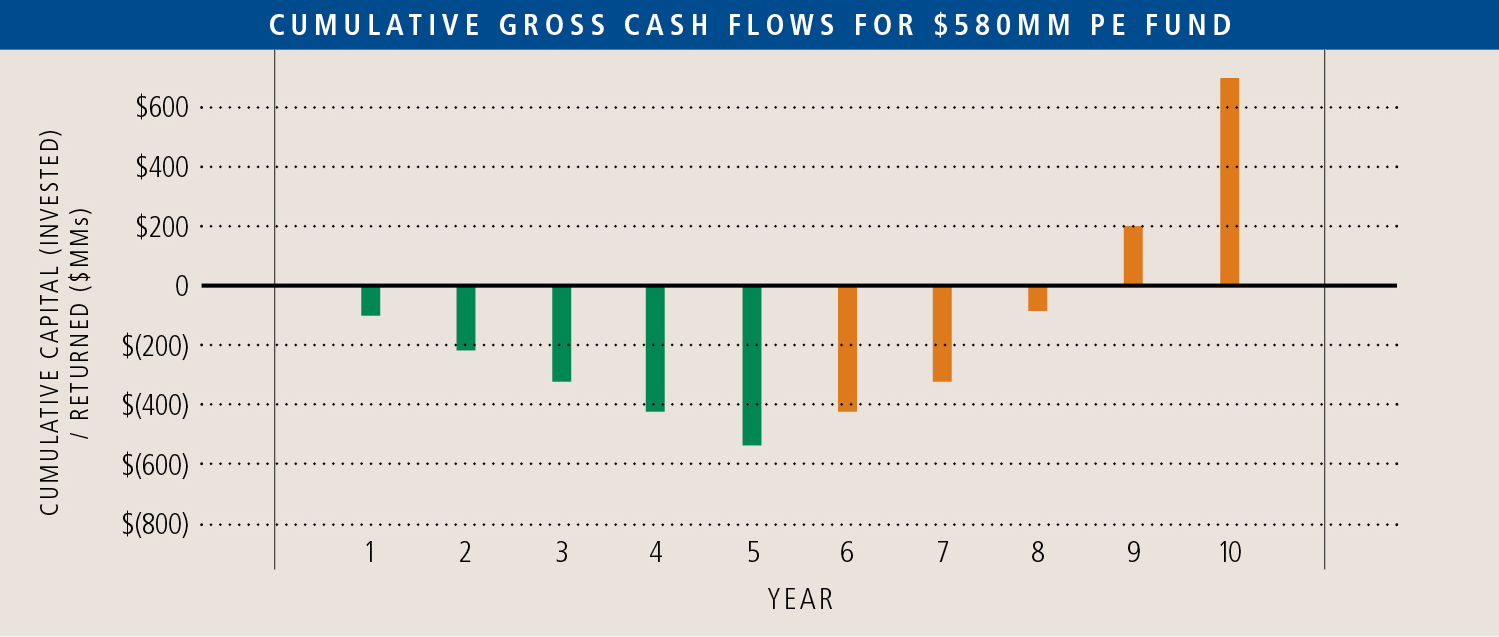

This structure works out very well for everyone if all goes well. The top chart above shows the cumulative cash inflows and outflows for a $580 million fund in which the entire fund is invested within the required period and each investment is realized at 2.5x the original investment (a general hurdle that is considered “good performance”). In this case, the LPs receive a net gain of $542 million on their $580 million investment, which equates to a 13% IRR over the 10-year period. In this scenario, the fund manager’s carried interest is $66 million, which is generally split among the partners and select other senior people.

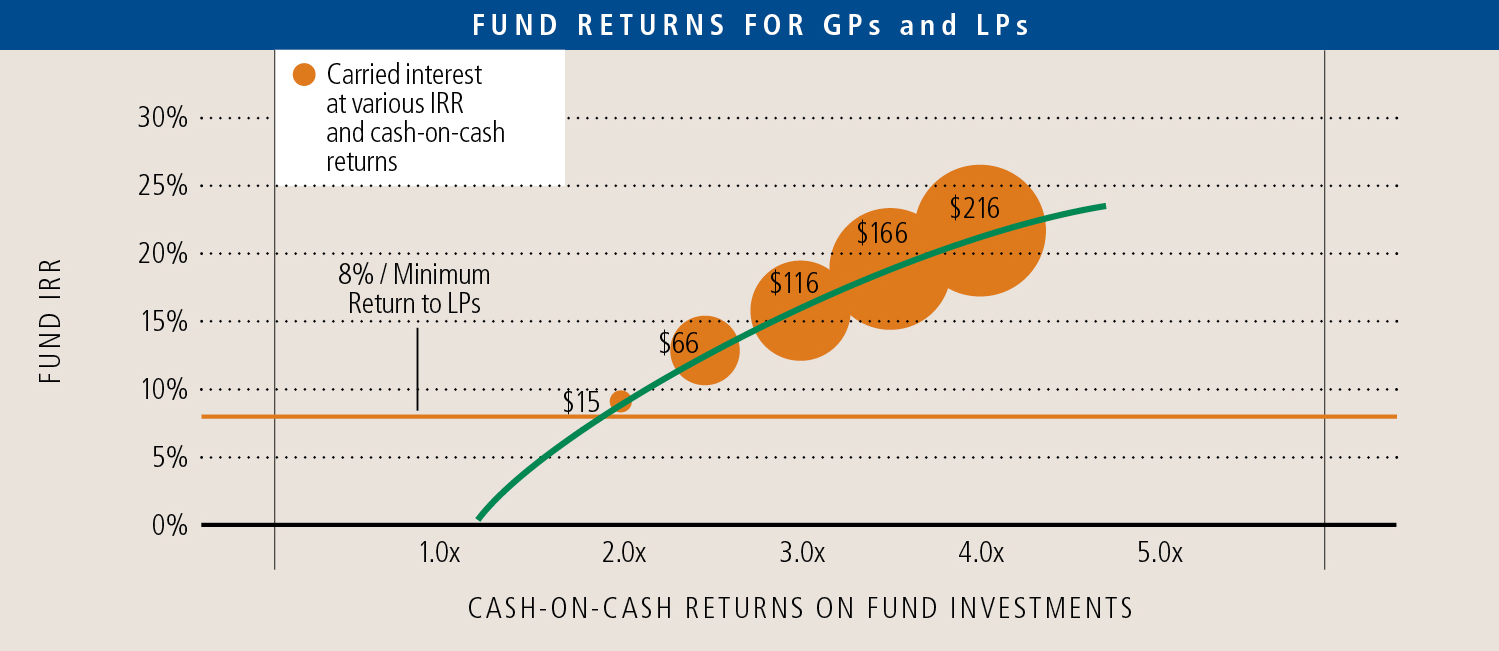

Fund returns for GPs and LPs are a direct function of the sale proceeds generated from the fund’s investments. As the second chart above illustrates, net IRRs to LPs move roughly in lockstep with aggregate cash-on-cash returns on fund investments. The return to the GP is zero until a hurdle is achieved, but accelerates dramatically thereafter. Cash-on-cash returns in excess of 2x the original investment typically put the GP “in the money,” as they have achieved an IRR to the LP in excess of the typical 8% minimum required return.

Unintended Consequences

The private equity landscape has become increasingly crowded and competitive, making historically robust IRRs increasingly hard to achieve. Additionally, the standard private equity fund framework introduces certain unintended consequences and divergent incentives. Significant pressure to invest committed but uninvested capital or having to overcome poor investments made early in the fund life can lead to the fund manager taking greater risks with the remainder of the commitments.

As a fund ages, and current investments either have or are expected to yield lackluster results, a number of potential conflicts emerge that often are not intended. To illustrate the effect of a bad deal on fund performance and the return to the GP, a loss of capital on one deal (representing 20% of the fund), implies that the rest of the investments need to return more than 3.25x on all other investments to make up the difference. Likewise, if the funds commitments cannot be invested in the prescribed timeframe, management fees can decline, thereby creating pressure to shrink the organization and compromise the overall business plan. The choices to the GP in these situations are to take more risk (through leverage or execution risk related to high growth plans), or accept the prospect of having worked for 10 years only for a salary.

Conclusions

What are the implications of all of this for business owners? Knowing where a fund is in its life cycle can provide insight into how the firm will view your company and help predict how soon the investment needs to be “turned,” how hard the organization will be pushed to execute a plan, and how much patience can be afforded when the future turns out different than anticipated.

As is often our parting advice, running a competitive process enables a choice of the best set of circumstances, many of which don’t become evident until too far down the road when negotiating leverage has been surrendered, save for the ability to say no.