After 25 years of negotiating complex business transactions with many different people having varying degrees of negotiating skills and styles, it is clear to us that successful deal making relies heavily on the skill of the negotiator. A common assumption entering a negotiation is that parties will act in their own best economic interest. In fact, they do not.

Demonstrating that people do not always behave in an economically logical manner won Daniel Kahneman a Nobel Prize. He earned that honor for demonstrating that humans are highly susceptible to being influenced and, as a result, do not always pursue the most economically rational outcome. Understanding this phenomenon can provide ways to potentially influence counterparties’ decisions in a negotiation.

Influence Based on Diminishing Marginal Losses & Gains

Consider for yourself – which of these two situations would make you happier?

Scenario A: You are walking down the street and find a $20 bill.

Scenario B: You are walking down the street and find a $10 bill. The next day, as you are walking on a different street, you find another $10 bill.

And, which of these two situations would make you less happy?

Scenario X: You open your wallet and discover you have lost a $20 bill.

Scenario Y: You open your wallet and discover you have lost a $10 bill. The following day you lose another $10 bill.

Obviously, both scenarios have identical payoffs (each one results in gaining or losing $20). Various studies have shown that people prefer to receive money in installments but would rather lose money in one lump sum. The majority of people indicate that they would be happier in Scenario B and unhappier in Scenario Y.

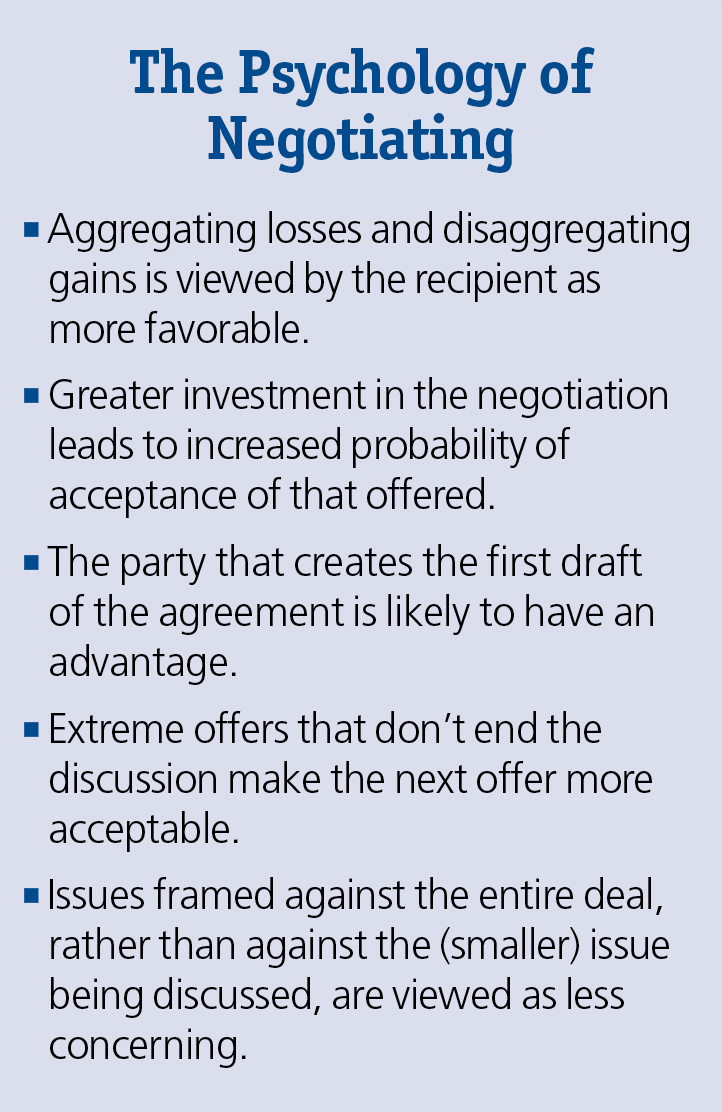

An “additional” gain is more pleasurable than the initial gain and an “additional” loss is more painful than the initial loss. The lesson for negotiators is that a counterparty is more likely to accept an offer that includes two small gains rather than one gain that is equal in magnitude to the two small gains. If there is a loss, introduce it all at once. That is, disaggregate gains to maximize total pleasure and aggregate the losses to minimize total pain.

Influence Based on the Escalation of Commitment

Behavioral studies consistently demonstrate that the willingness to agree with one request leads to an increased commitment to agree with additional requests that are consistent with the principles underlying the initial request.

This “Foot-in-the Door” technique is commonplace for sales people – after the buyer has agreed to a smaller initial purchase, chances meaningfully improve for obtaining a larger commitment. Understanding this behavior, a negotiator might strategically draw out the negotiation, forcing the other party to invest large quantities of time and energy. The more a negotiator has invested in the negotiation, the more willing he will be to accept the agreement offered.

Influence Based on the Bias for Status Quo

People contemplating a change are likely to be more concerned about the risk of change than the risk of failing to change.  The motivation to preserve the status quo occurs even when people regard the consequences of the change to be a net improvement to their circumstances.

The motivation to preserve the status quo occurs even when people regard the consequences of the change to be a net improvement to their circumstances.

In negotiations, one of the parties is responsible for introducing the starting point. In the case of a merger & acquisition transaction, it is the first draft of the purchase and sale agreement from which the two sides then make revisions. Understanding that people are generally persuaded by the status quo suggests that the party who introduces the initial contract will have the advantage in a negotiation. Therefore, strategically placed defaults on important contractual elements (such as the maximum amount and duration of indemnification) are likely to be “stickier” when they are written into the draft contract than when they are explicitly left open to negotiation. Therefore, the party that creates the first draft of the agreement is likely to have an advantage.

Influence Based on the Norm of Reciprocity

The norm of reciprocity operates on a simple principle: people feel obligated to return favors after others do favors for them. Research shows that this behavior is heuristic (a learned mental shortcut) rather than a rational behavior and suggests that the reciprocity can be activated – and compliance achieved – even when the influencer has not actually incurred a cost or provided a benefit. That is, it even occurs when it goes against one’s self-interest.

Marketers and salespeople routinely make use of this social norm by offering a free item in return for listening to a sales pitch. This “free” item creates a sense of obligation to buy something else.

In the realm of negotiations, studies show that this desire to return a favor can be used to influence counterparties to agree to more favorable outcomes than would otherwise be judged reasonable by an independent party. Therefore, negotiators will be more likely to have an offer accepted when they have previously made a more extreme offer which was not accepted, but which did not end the discussion.

Influence Based on the Effect of Reference Points

Peoples’ perception of value is also subject to psychological influence. Driving across town to save $20 may seem irrational to purchase a $2000 computer. But, a $20 discount on a $100 price tag is very attractive. In other words, people do not objectively evaluate the cost of an item or an issue; rather, they evaluate costs in comparison to salient reference points.

Similarly, negotiators making judgments regarding the value of an item or idea search for salient reference points. Because participants often have the ability to influence which reference point is made salient to others in the negotiation, psychological influence of this type is likely to be prevalent at the bargaining table. It suggests that negotiators are more likely to agree to a proposal when it is framed against the entire deal than when it is framed against the (smaller) aspect of the issue being discussed.

While it may seem unethical or exploitive to utilize psychological “tricks” to influence the outcome of negotiations, we argue that understanding the logic of human decision-making simply improves the probability of reaching a negotiated agreement. Rarely is negotiation a zero sum game. Rather, skillful negotiators attempt to create value (increase the size of the pie) by searching for mutually beneficial outcomes and exploiting counterparties’ differing risk perspectives. At the end of the day, wise negotiators understand that it is important for both parties to leave the table with the perception that they did well.