Bankruptcy once predominantly served as a safe haven for under-performing businesses to reorganize their affairs and financial obligations in a process that favored them regaining their financial footing. The generally creditor-friendly revisions to the bankruptcy code in 2005, coupled with the dearth of debtor-in-possession (“DIP”) financing in today’s troubled credit markets, have resulted in the sale of businesses (and assets) as the preferred exit strategy from Chapter 11.

The bursting of the real estate and finance bubbles unleashed “creative destruction,” in which all manner of inefficient or distressed corporate assets will be revalued and reshuffled to achieve greater economic efficiency. This restructuring process likely will accelerate over the next several years as the economy is reconfigured. Astute owners and managers familiar with the rudiments of Chapter 11 should be able to take advantage of significant opportunities to enhance their competitive position, further corporate strategy, and ultimately build value.

Buying Assets Through Chapter

Section §363 of Chapter 11 of the bankruptcy code sets out procedures for the sale of tangible and intangible assets. A sale of assets pursuant to §363 can provide purchasers with a variety of benefits, as well as a number of challenges, particularly for the unfamiliar.

The Benefits

Assets acquired in a §363 sale are delivered free and clear of all liens, and are not subject to fraudulent transfer claims and/or contingent liabilities (e.g., successor liability and warranty claims). Moreover, upon court confirmation of a sale, the purchaser can be certain about the enforceability of the transaction documents, relief from the need to obtain consent to the assignment of certain contracts, a shortened Hart-Scott-Rodino Antitrust Act waiting period, and exemptions from state laws regarding bulk sales and stockholder approval.

The Challenges

Rules designed to assure that a public auction process provides the highest and best value for the assets are typically at the root of buyer apprehension. Contrary to a privately negotiated deal, in a §363 sale it is not possible to arrange exclusivity or lock-up provisions prior to the bankruptcy court’s final approval of the sale. The rules also tend to inject time limits into the sale process. And, of course, final court approval can depend on resolution of creditor objections. Success remains uncertain until the gavel falls.

The Stalking Horse

The Stalking Horse

The initial bidder with whom the debtor negotiates a purchase agreement is called the “stalking horse,” an old hunting euphemism referring to either a real horse or an animal- like screen, behind which a hunter would conceal himself to get closer to his prey. Don’t be misled by this term, because almost nothing will be concealed in a bankruptcy proceeding.

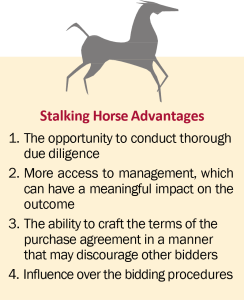

While a potential buyer’s initial reaction might be to wait to bid at the auction, when the prices and terms will be known with certainty, there are distinct advantages to being the stalking horse bidder that can greatly improve the likelihood of emerging as the successful buyer. The advantages are listed in the adjacent table.

Expense Reimbursement

Fees and expenses that the stalking horse incurs for legal and financial advisers, due diligence, and other reasonable expenses related to the deal, are generally reimbursed if the stalking horse is outbid, so long as they do not amount to an unreasonable drain on the debtor’s estate. To qualify for reimbursement, the stalking horse should insist that its expenses are included as administrative expenses, the highest-priority creditor claim in bankruptcy.

Break-Up Fees

Break-up fees are a common protection offered to stalking horse bidders, but are controversial in many jurisdictions. Essentially, a break-up fee is incremental compensation to induce the initial bidder to establish a “floor” for other potential bidders in an auction. However, approval requires the court to find that the break-up fee is “necessary to preserve the value of the estate,” which, outside of unique circumstances, can be a tall order.

Bidding Procedures

In order to be qualified to participate in the auction, other interested buyers will be required to deliver proof of financial capability and to submit a good faith deposit, conditions that the stalking horse already would have satisfied. The auction procedures will specify an amount for any initial overbids and subsequent minimum bidding increments. Obviously, the stalking horse bidder will want the initial overbid to be substantially greater than its own offer, thereby creating a threshold that other bidders will be reluctant to overcome. The stalking horse bidder also will want to establish steep bidding increments to discourage competing bids and will want “matching rights” to minimize its costs to stay in the auction.

The stalking horse also has the opportunity to impose its form of asset purchase agreement, preferably in a manner that will not be easily adaptable by other bidders. For example, the stalking horse will select which assets it wishes to acquire and/or which obligations it wants to assume, limit any subsequent bids for those same assets and obligations, and limit the form of alternative consideration (to the extent it is not all cash).

Conclusion

As we enter into a phase of rapid economic adjustment and restructuring, there will be significant opportunities for firms to meaningfully enhance their competitive positions by prudently acquiring distressed assets and businesses. Although the processes and procedures of a §363 bankruptcy sale can be a bit rigid and messy, competent legal and financial advisers can be invaluable guides during the process. As a result, strategic-minded business owners and investors should not turn away from attractive, albeit distressed, business assets, simply because they bear the taint of bankruptcy.