Prices paid for privately-held businesses in today’s market can surprise anyone who has been in the deal business for a long time. The confluence of a number of factors has driven up prices, most commonly for “growth” businesses, to levels not seen historically. As discussed in the nearby article, “Thoughts from the Combat Zone”, private equity investors, in particular, are trying to balance the competing objectives of winning deals to allow them to put capital to work, while earning high returns for their investors. The purpose of this article is to create a framework to explain how investors are expecting to achieve both objectives by investing in growing companies and applying maximum leverage to the capital structure.

The Value Impact of Growth

Value is a function of future performance. Therefore, companies believed to have good growth prospects deserve and receive premium sales prices, as evidenced by higher multiples of current EBITDA as compared to prices paid for steady businesses with limited growth. The amount of the premium depends upon the perception by the buyer of the likely rate and duration of the growth curve, how the buyer thinks the business will be valued in the future, and how capable the management team will be in executing the growth strategy.

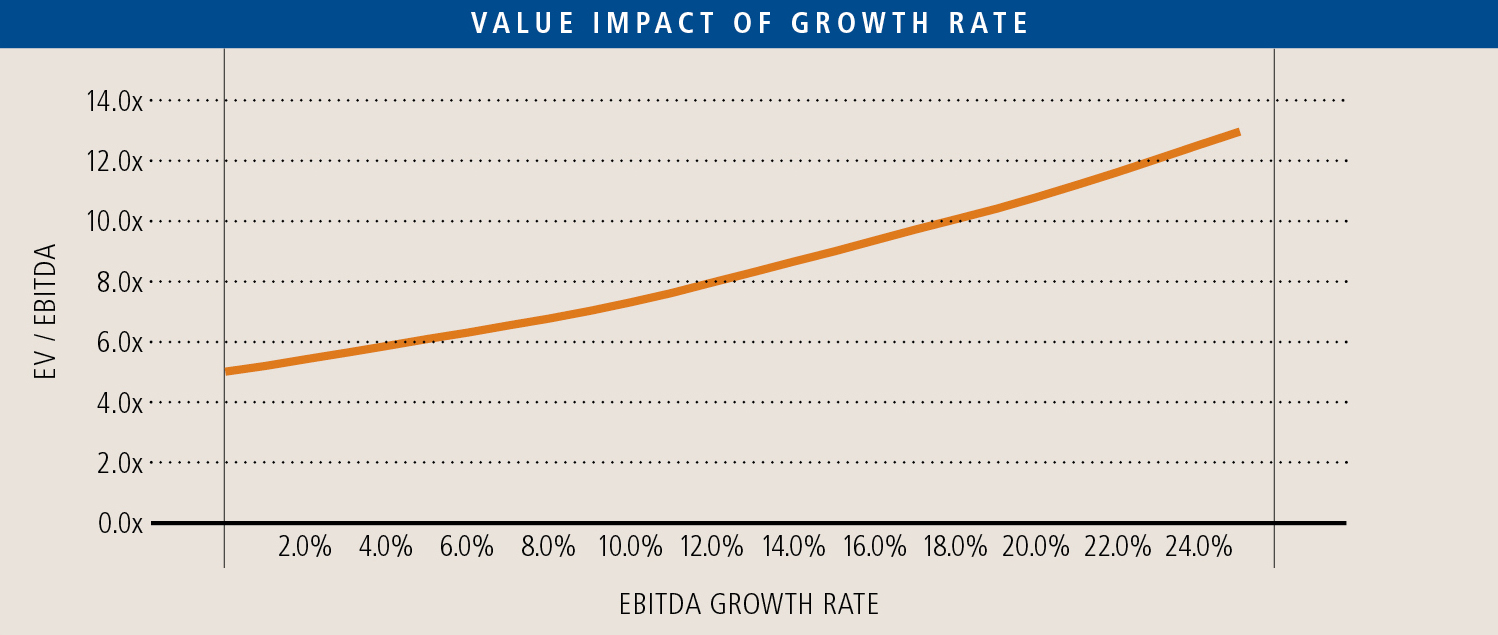

The summation of all future cash flows to investors is what determines value, therefore it stands to reason that as the future cash flow stream grows, it is more valuable than one that remains constant or grows at a lesser rate. To illustrate the relationship between future rates of growth and current ebitda multiples, we analyzed the impact on both value and multiples for identical businesses but with different expected future growth rates.

The basis of this analysis is a hypothetical service business that does not require significant capital or working capital expenditures (rendering ebitda a close surrogate for free cash flow). We looked at different futures for the company expressed in terms of growth of ebitda from zero to 20% per year. We then valued each cash flow stream and translated that to a multiple of current ebitda. The nearby graph shows the impact of growth on multiples, implying that expected growth in the range of 20% per annum translates into a business worth twice that of a similar business with no expectations for growth.

The value ascribed to the business with stable consistently profitable performance and no growth would yield a multiple of ebitda in the range of 5x. As higher expectations of growth are factored into the equation, value, and the resulting multiple of current year ebitda, rises at an increasing rate, reaching nearly 11x when annual compounded growth rate expectations reach 20%.

Leverage Adds “Juice”

Most private equity investors evaluate their investments based on the expected return earned on their invested capital. Leverage is a tool employed by many private equity firms to increase the return the invested equity. When the expected return on total capital is in excess of the borrowing rate, greater leverage yields a higher return for the equity.

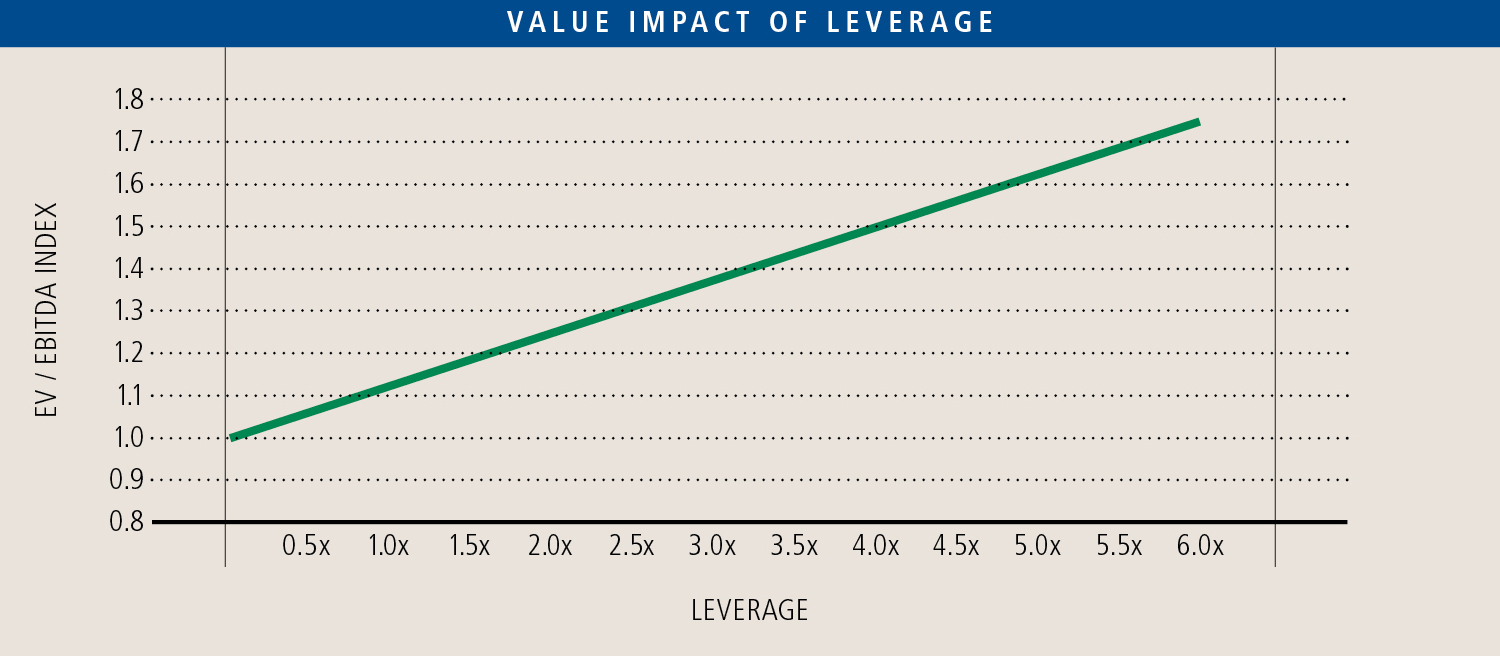

The effect on returns and, therefore, prices that can be paid for our hypothetical service business, is illustrated in the following graph. This analysis demonstrates the relationship between leverage (as expressed in debt/ebitda) and value (as expressed by enterprise value/ebitda) when expected returns on equity are held constant.

The intent of this graph is to show that a multiple can vary substantially depending on the amount of leverage assigned to the acquisition target capital structure. When equity returns are held constant (we chose 20% for our example) regardless of leverage, multiples of current year ebitda increase linearly as more leverage is added. The difference between a conservatively leveraged acquisition structure (say, 2x ebitda) and a highly leveraged capitalization (say, 5x ebitda) results in an ability to pay almost a third more in purchase price.

The Tasty Cocktail of Perceived Growth and Leverage

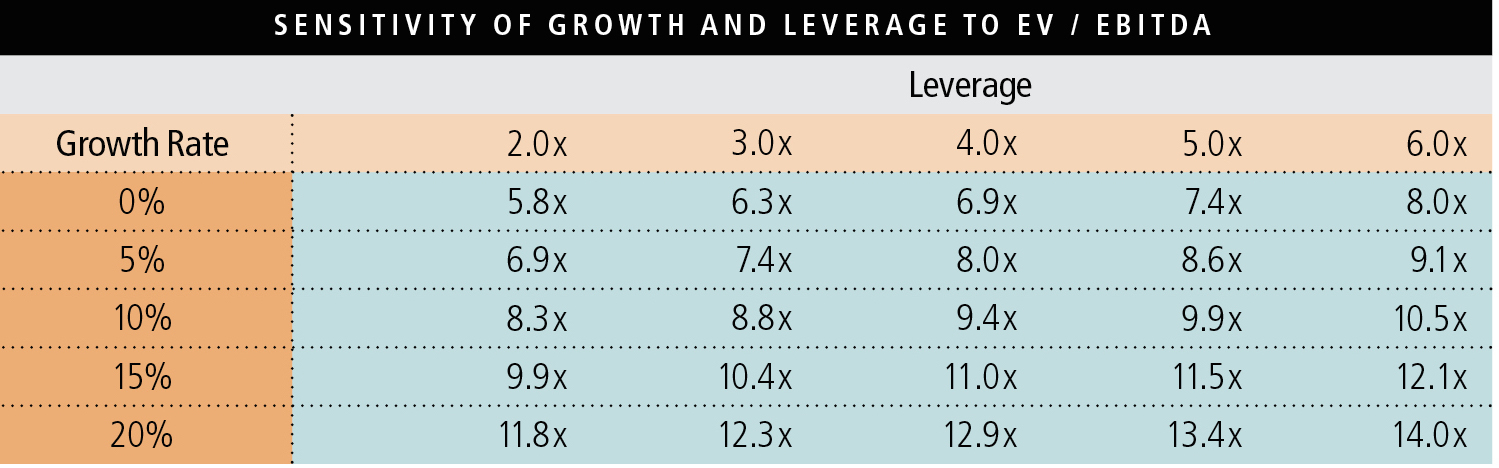

Some of the eye-popping valuations that have been announced in today’s robust M&A market have been the result of combining high growth expectations with ample amounts of borrowed money. The following table illustrates the combined effect on potential value of a business under different growth and leverage combinations.

The accompanying table explains why we’ve seen businesses with attractive growth prospects realize such high prices. A business with a great management team that has a good understanding of the company’s market and a well-conceived plan to take advantage of future opportunities attracts investors in the bunches. If lenders also view the business deserving of an aggressive credit structure, the ingredients are present to achieve a high price. This is why when acquisitions by private equity funds are announced at double digit multiple prices, almost for certain the business has very well defined growth prospects, a stable underlying business model (to attract credit), and a great management team to lead the way. When competition among buyers is fierce, a scenario can be visualized that will allow the two conflicting forces – high prices and attractive returns to investors – to merge in the eyes of the buyer.

Risk, the Forgotten Element?

Anyone who thinks that private equity investing is easy hasn’t done it, at least not successfully for any length of time. Today’s managers of private equity capital are in a tough predicament. There is pressure to put capital to work in a period when too much capital competes for the same opportunities. Winning deals leaves no room for pessimists. The certainty of failure if an investor sits on the sideline (who needs a manager to sit on cash?) is weighed against the uncertainty of failure (low returns on capital) in the future.

All of the arithmetic in the graphs and tables presented in this article are valid, so long as assumptions about the future are “reasonable.” Optimism wins in this environment. The future is not knowable at the time of a transaction so, whether execution of the growth plan can be achieved as imagined or whether stalls in the development of the business conflicts with obligations under the capital structure, time will tell.

Only a few times over the past thirty years has there been a time like today where the combination of optimism over future growth and abundant, low cost capital have been present. These conditions have driven private company business values to unprecedented levels. It is the best of times for sellers and borrowers. Waiting for better conditions is a bad bet.