It is a routine challenge for a financial officer to arrange the most flexible and affordable financing for the equipment a business needs to produce its products or services. Equipment leasing is perennially one of the more important sources of funding for the capital investment needs of U.S. businesses. According to the Equipment Leasing and Financing Foundation, over the past five years, equipment leasing financed nearly one-third of business fixed investment. Essentially, there are three basic equipment financing alternatives:

- Rent

- Rent with an option to purchase

- Buy and finance with conventional debt

Because lease structures are flexible, each of these alternatives can be accomplished with a lease. Decisions to lease or buy are typically veiled in complexities associated with tax attributes, options and risk-shifting. Leasing, particularly tax-oriented leasing, is a product that never seems to be well understood, even by the people that market it. So what exactly is a lease? Simplistically, it is a customized debt financing with potentially unique tax features and either a fixed or fair market value residual. There are two considerations that are fundamental to most lease contracts:

- Who has the right to use the tax shields (depreciation and investment credits), the lessor (owner) or the lessee (user).

- When, and if, title to the equipment changes hands.

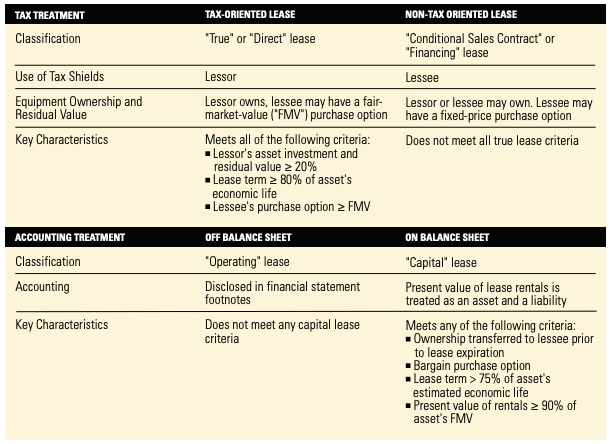

In the absence of these tax and ownership concerns, a lease is essentially a secured term loan. Lease contracts are commonly defined by both the tax and accounting treatments.

The terms “true lease” and “operating lease” are often used interchangeably; however, the tax and accounting criteria are not identical. In practice, most, but not all, operating leases are true leases. Only a small percentage of capital leases actually qualify as true leases; most are financing leases. These four tax and accounting categories encompass an enormous variety of lease structures that are customized to the needs of individual equipment users. Contracts for the use of equipment are written for periods as short as a few hours to as long as 20 to 30 years.

Why Lease?

When reality is separated from marketing hype, the benefits of leasing fall into the following categories:

Tax Savings: Leasing is an efficient mechanism for transferring tax shields from equipment users to lessors (equipment owners). If the difference between the expected marginal tax rates (“MTR”) of the lessor and lessee is significant, savings can be realized for both parties at the expense of government tax revenues. The lessor profits from lower taxes and the lessee enjoys a lower rental expense. As a consequence, low-tax-paying firms tend to favor leases and high-tax-paying firms gravitate towards debt financing.

Capital Access and Affordability: Although rarely touted by leasing companies, a key benefit is the manner in which leases are treated in default and/or bankruptcy, as compared to debt. If leased assets are to be used while in bankruptcy, the lessee must continue to make scheduled lease payments. In contrast, payment of most other financial obligations, including most secured-debt payments, is suspended until the bankruptcy is resolved. Lease obligations effectively enjoy priority in bankruptcy on par with administrative expenses. The bottom line is that it is generally cheaper and easier to recover on a lease default than a loan default. That advantage is manifested in better access to lease credit for financially volatile businesses and lower leasing costs. This is a principal reason why small companies can often lease when they cannot borrow and why leasing is consistently a major component of small business finance.

Cost of Capital: One of the most widely promoted advantages of equipment leasing is 100 percent financing, which is purported to preserve capital for other uses. Economists would argue that this benefit is illusory. It is reasoned that if a firm can arrange 100 percent lease financing, it can also find 100 percent debt financing at a market-determined price (perhaps not all from a single source). Nevertheless, experience suggests that leasing is a lower-cost source of 100 percent financing than conventional debt alternatives. The disparity between real-world lending and leasing practices seems to be an example of the fabled economic “free lunch.”

Another well-known justification for leasing is the off-balance sheet treatment of operating leases. By keeping the obligation off the balance sheet and relegated to the financial footnotes, it is presumed that capital providers will be inclined to view the lessee as financially stronger. In the post-Enron era of financial transparency, it seems unlikely that sophisticated analysts and capital providers will fail to account for operating leases in their assessment of financial leverage. However, even today, borrowers are frequently not restricted from incurring significant operating lease obligations by routine bank covenants, such as fixed-charge coverage and leverage ratios, or capital expenditure limits. Lenders are often adamant that borrowers generate sufficient cash flow to cover their annual debt service obligations, by a ratio of 1.25:1 or greater. Yet the treatment of fixed lease rentals as a deduction from cash flow in these covenant calculations means that these obligations need only be covered on a 1:1 basis.

One situation where off-balance sheet lease financing can be an imperative is when capital investments have been financed by the issuance of tax-exempt industrial development bonds. These bond issues limit capital investment to $10 million (including the bond-financed investment) within a three-year window. Off-balance-sheet leasing is a standard way to exceed these capital investment limitations without jeopardizing the tax-exempt status of the bonds.

Risk Sharing: One of the most compelling arguments for leasing is that it helps to avoid many of the risks of ownership, particularly the risk of equipment obsolescence. A well-tailored lease allows the lessee to pay for the asset value that is actually used and provides an option at, or in some cases prior to, the end of the contract to buy the asset, return it to the lessor, or extend the rental. How the lessee uses these options depends in large measure on the economic value of the equipment to the business at that time. For example, equipment with predictable replacement cycles (e.g. forklifts, trucks, or computers) is commonly leased for a period that closely matches its useful life. If the equipment is worn out or technically obsolete at the end of the lease, it is frequently cost effective to return it to the lessor and replace it with new equipment. Often a lessor, with superior equipment knowledge and better access to secondary markets than the lessee, can maximize the equipment’s residual value when it comes off lease. The disparity between the residual value to the lessor and the lessee can be reflected in more favorable rental rates for the lessee.

Risk Sharing: One of the most compelling arguments for leasing is that it helps to avoid many of the risks of ownership, particularly the risk of equipment obsolescence. A well-tailored lease allows the lessee to pay for the asset value that is actually used and provides an option at, or in some cases prior to, the end of the contract to buy the asset, return it to the lessor, or extend the rental. How the lessee uses these options depends in large measure on the economic value of the equipment to the business at that time. For example, equipment with predictable replacement cycles (e.g. forklifts, trucks, or computers) is commonly leased for a period that closely matches its useful life. If the equipment is worn out or technically obsolete at the end of the lease, it is frequently cost effective to return it to the lessor and replace it with new equipment. Often a lessor, with superior equipment knowledge and better access to secondary markets than the lessee, can maximize the equipment’s residual value when it comes off lease. The disparity between the residual value to the lessor and the lessee can be reflected in more favorable rental rates for the lessee.

Lease or Conventional Debt?

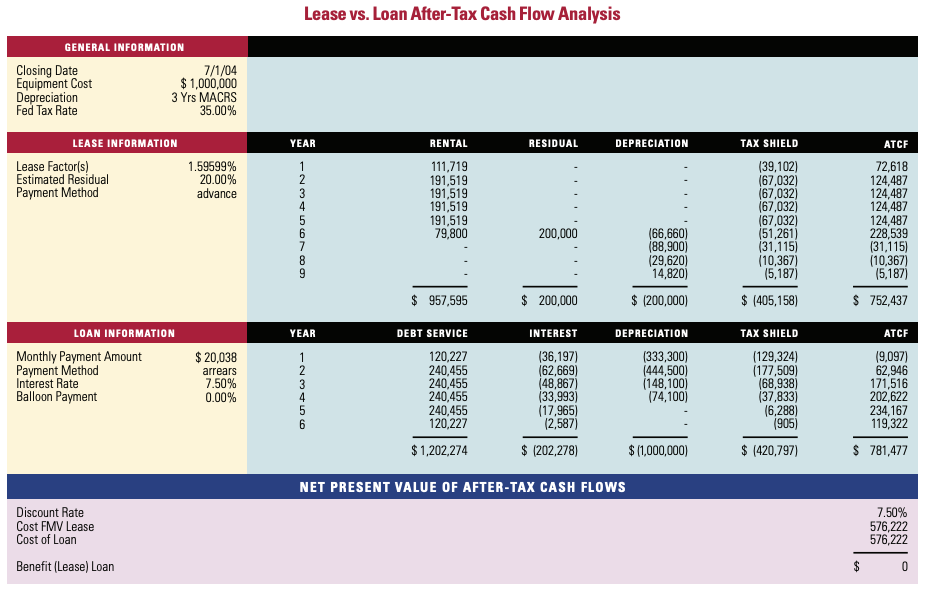

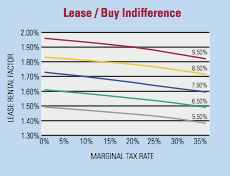

The basic lease or buy decision is a comparison of discounted after-tax cash flows over the term of the lease and loan based on the expected marginal tax rate. The table on the previous page compares the after-tax cash flows (“ATCF”) of a $1.0 million, five-year lease contract to a five-year term loan at 7.5%. It is assumed the lessee will acquire the equipment at the end of the lease for 20% of original cost. Assuming a marginal tax rate of 35%, the lease is more attractive, if the lease factor (monthly rent as a percent of equipment cost) is 1.596% or less. The loan is more attractive if the lease factor is greater than 1.596%. The curves on the adjacent chart reflect the points of indifference between a lease and a loan based on marginal tax rates between 0% and 35% and loan rates between 5.5% and 9.5%. A lower MTR favors leasing and a higher MTR favors conventional debt financing.

Conclusion

In the pursuit of an efficient and flexible capital structure, it is paramount that business managers carefully consider the tax impacts and corresponding economic and qualitative benefits of leasing relative to buying. The key benefits of leasing—affordability based on the use of tax shields and default treatment and the sharing of obsolescence risk—ensure that it will remain a flexible and attractive alternative to conventional debt financing.