Following the completion of any project, we like to check back in with our clients to get their perspective on how it went. Just like most of these clients, we strive for continuous improvement and that requires soliciting direct feedback. Common questions we ask are “What surprised you about the process?”, “Is there anything you wish had gone differently?”, and “What can we do better moving forward?”

To the first question, almost unanimously, our clients are surprised at how intense and thorough a buyer’s due diligence process became. It is for this exact reason that we try to set expectations up front so the company can be technically and emotionally prepared. That is also the reason we’ve written on this topic so many times in the hopes that our clients can be better equipped heading into a diligence process. See Due Diligence – A Survival Guide, Preparing for a Successful Transaction – Beyond the Due Diligence Checklist, or Due Diligence: Investigate What Matters for a few examples of our thoughts over the years.

We understand why this surprise persists. Even from our perspective having supported our clients through hundreds of due diligence processes, the intensity and depth has increased over the last 18-24 months to a level we have not previously seen. This opinion is shared by many in the market. In June of this year, a Deloitte study revealed that nearly half of M&A professionals surveyed expected the level of due diligence requested on target acquisitions to increase over the next year. Anecdotally, through our own projects and conversations with active private equity buyers, confirmatory diligence is taking on average 15-30 days longer than before. In light of this shift, we think it is important for anybody considering a transaction to understand the origins and implications of this new period of extra scrutiny.

What Has Changed?

Some of the recent changes are specific to certain workstreams, while others are changes in overall approach and thought processes with due diligence. One tangible workstream is the Quality of Earnings (“QOE”) report that a buyer conducts to verify the historical earnings of the business. While not a new trend, these reports have become standard in nearly every transaction. But today’s buyers are asking their QOE teams to go much deeper than just verifying the accounting. Today’s QOEs often involve more complex customer, pricing, volume, and margin trend analysis in an effort to uncover any hidden risks that might not be apparent at first glance. That additional analysis requires more data, more Q&A discussions, and more time.

Buyers are also looking deeper and deeper on every question, with initial responses to questions often generating four or five follow-up questions. On one recent transaction of ours, what started out as a 225 item due diligence list had grown to over 800 requests by the end. These questions span a litany of topics across finance, tax, insurance, legal, HR, and IT. Each original question and the related follow-ups are specifically targeted at improving the buyers’ understanding of an actual or perceived risk in the business. And with most buyers using different consultants to assess different areas of risk, it can often feel like a seller is being asked to answer the same question multiple times, just with a slight twist.

Why the Change?

This increased diligence intensity is the result of several factors. The first, and potentially most impactful, is the simple fact that the M&A market has slowed down. According to a McKinsey report earlier this year, 2023 global M&A volumes declined to the lowest level since 2013, and volumes in the Americas have declined by 32% year over year. Most experts are seeing similar volumes in 2024. With fewer deals to review, buyers have more time to review each one, and the opportunity cost associated with that extra time is lower. The frenetic market of 2021-2022 pushed buyers to make investment decisions, verify the diligence information, and close transactions very quickly. Now there is more time for caution.

Fear is an important psychological driver to keep in mind. Most buyers are investing other people’s money, so even if they are personally comfortable taking a certain level of risk, they need to go through all the appropriate steps so they can defend their decisions as needed later on. Buyers are also afraid of overpaying, causing them to look deeper and deeper for a reason they might be able to defensibly reduce the price. These factors drive the need to “look under every rock” no matter how unlikely it may be that there is something surprising hiding under there.

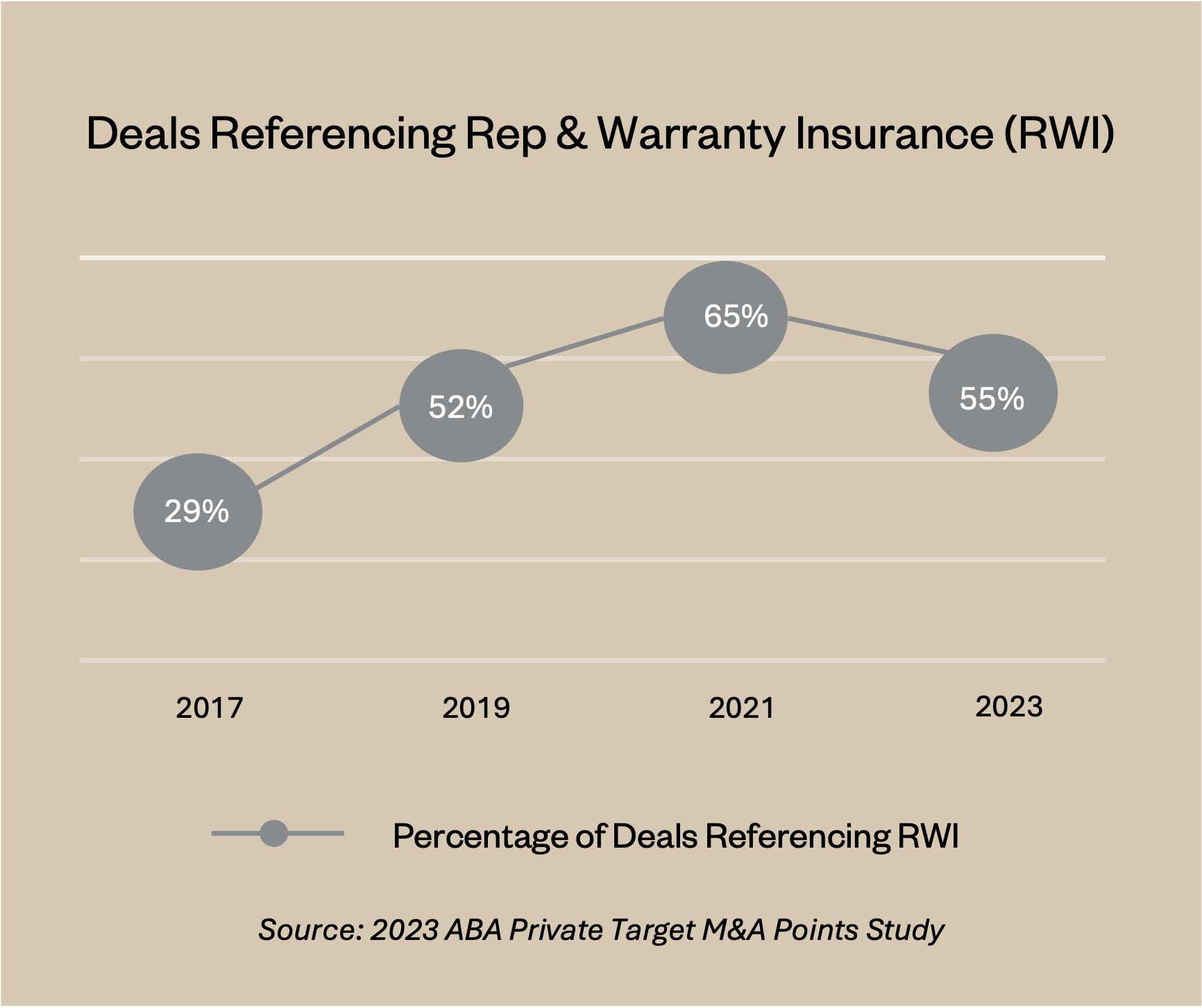

Increased usage of Representations and Warranties Insurance (“RWI”) has added another seat at the table during the diligence process. The most recent American Bar Association M&A Deal Points Study showed that RWI was used on 55% of transactions in 2022-23, nearly double the 29% from 2016-17.

For transactions involving RWI, buyers no longer just need to get themselves and their lenders or investors comfortable, they also need to demonstrate to the insurance company that all potential risks have been adequately investigated. It is not uncommon for the RWI underwriter to present their own follow-up diligence requests near the end of a process because, ultimately, they are the ones taking much of the risk that something hasn’t been disclosed or uncovered.

Is There Anything You Can Do About It?

To paraphrase Parkinson’s Law, work expands to fill the time you give it. The best way to limit expanded diligence is to hold buyers to a tight timeline with specific milestones that must be achieved in order to move forward. When people are working with a shorter timeline, there is a natural inclination to focus their energy on the most important questions, rather than the long tail of minutiae. It isn’t fair to say that a 45-day confirmatory diligence period will have half as many questions as a 90-day period, but it is reasonable to say that the diligence list will be shorter and more targeted in the first scenario.

A shorter timeline also puts more pressure on the business to be fully prepared ahead of time to answer any questions that might come up. It is not practical to hold buyers to a fast timeline if the information is transmitted slowly or incompletely. This presents sellers with a clear decision to make. Many sellers prefer to wait and “see if we really have a deal before I go gather all that information.” The decision to delay preparation is at the same time a decision to allow a drawn out and likely more painful diligence process.

As uncomfortable or frustrating as it might be for a seller who already knows everything about their business, a certain level of diligence is always going to be involved in a transaction. In today’s market, that level of diligence is likely to be greater than in the past. We recommend working with a team of advisors who can help you prepare for an intense diligence process, can develop a process that keeps buyers on a tight timeline, and can hold the line with a buyer when it is time to say enough is enough.