Every bank employs a formal system for rating the credit risk associated with the commercial and institutional loans in its portfolio. Lenders use risk-rating assessments in approving credit, portfolio monitoring, pricing and profitability analysis, setting loan-loss reserves and allocating capital. Knowledge of a firm’s risk rating can provide owners and managers a fairly accurate picture of how they are perceived within the bank, particularly by key decision-makers who may not have had any personal contact with the company. Some lenders are reluctant to share specific conclusions of their risk rating assessments with their clients. These ratings are, however, important to borrowers for a couple of reasons.

First, they are a key factor in determining:

- Extensions of additional credit;

- Loan pricing (higher risk = higher pricing)

- The level and frequency of review;

- The amount of credit held vs. sold;

- The approval level required for changes, renewals or new credit;

- Covenant flexibility; and

- Guarantee requirements.

Risk ratings also are central to regulatory oversight, since periodic inspection of internal risk-rating processes is the principal leverage that bank supervisory agencies have over the lending practices of an individual bank. The conclusions reached in the Office of the Comptroller of Currency’s (“OCC”) annual credit review greatly influence the risk appetite of most banks and the overall availability of commercial credit. In fact, many bankers privately will say that the OCC’s heightened concern and criticism, during the past 12 months, of leveraged-lending activities is a major reason for the recent tightening of the credit markets.

Among larger banks (assets > $1 billion), there has been a trend toward standardizing risk-rating systems in order to simplify regulatory oversight and facilitate the market for loan syndications. Most banks’ internal systems closely parallel the credit-risk rating scale used by the OCC and other bank supervisory agencies. The accompanying table on page 2 summarizes a typical risk-rating system for a large bank. There are six risk tiers (1-6) for credits that qualify as a “Pass,” or acceptable credit, according to bank regulators. The remaining four tiers (7-10) correspond to the regulatory definitions of problem assets. The number of “Pass” rating categories and the specific criteria for each tier vary among banks, depending on the bank’s size, mix of business, and level of sophistication. For example, a bank with significant exposure to the large corporate loan market is likely to have more grades corresponding to investment grade1 risks. Banks focused on middle- market or small business lending may make finer rating distinctions among credits at the higher risk end of the “Pass” spectrum.

Fundamentally, bank risk-rating systems provide a means of defining the probability of default (“PD”) and the likely loss in the event of a default (“LLED”) across a portfolio of loans. In other words, if grade 5 credits have a PD of 3.0% and the LLED is 30%, then the bank can expect to sustain losses of 0.9% or 90 cents on every $100 of grade 5 loans in the portfolio. Banks independently calibrate PD and LLED, based on their own historical loss experience. It is also not uncommon for the LLED to vary depending on the type of collateral supporting the loan.

Determining Risk Ratings

Assigning risk ratings is the subjective distillation of a variety of quantitative and qualitative risk factors that occur when the loan is first approved, and then is subsequently reviewed and adjusted as new information emerges. Important considerations include: financial condition, company size, industry position and outlook, quality of financial information, management competence, loan structure (e.g., collateral, monitoring requirements, guaranties), and vulnerability to external events (e.g., changes in interest or foreign exchange rates, commodity markets, environmental regulations, energy availability).

Although all risk rating systems use objective standards as a foundation, the process is, by definition, an exercise in human judgment. Biases, attitudes and perceptions influence rating conclusions. For example, the Federal Reserve, OCC, and other regulators have expressed concerns about the expansion of cash flow (business value) lending, which up until last year was a cornerstone of leveraged buyout financing activity. As bank examiners have made their rounds, they have taken a very conservative view in risk rating these loans. These attitudes have infiltrated the credit-risk-management thinking within many banks and are, at least in part, responsible for the recent credit tightening.

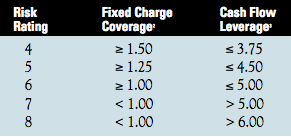

In most systems, and particularly among bank regulators, the most influential rating consideration is the adequacy and sustainability of cash flow. Some banks use specific financial ratios as criteria for assigning risk ratings. The above chart outlines the criteria that would typically correspond to grades 4-8, which are applicable to most middle-market borrowers.

Bankers and regulators know from experience, the difficulties associated with determining and realizing upon the value of collateral. Consequently, a loan that is well-secured by readily marketable collateral, but has weak cash flow support, is likely to have a higher risk-rating than a similar loan with stronger cash flow coverage and marginal collateral support.

Grade 4 credits are typically strong performing, privately held regional or local firms that display many characteristics of an investment grade credit risk, except for size and access to public financial markets.

These firms are often able to borrow on an unsecured basis. Most profitable middle-market, privately held companies that borrow on a secured basis will be grouped in grades 5 and 6. Firms with asset-based credit facilities and fairly low debt service coverage ratios (1.0 to 1.25 times) will generally carry a risk rating of 6 or 7. Companies within category 8 are likely to be either supervised by the bank’s workout or special asset group, or working with an asset-based lender, such as Foothill Capital, CIT, or Heller Business Credit. Because asset-based lenders are more comfortable evaluating collateral, many specifically target companies that would rate as a 7 or 8, even though the current bank is looking for a way to end the relationship.

Current Implications

In the current tight credit environment, some banks are making far-reaching policy decisions based primarily on risk ratings. New or increased borderline (grade 6) deals are generally discouraged and are now primarily the province of asset-based lenders. At least one major Northwest bank has a blanket policy of moving all grade 7 and 8 credits to the workout, or special asset, group. Some institutions now hold the view that loans in these categories either must be upgraded or moved out of the bank within a relatively short time. To enforce that desire, special asset groups at some institutions are aggressively increasing pricing and ratcheting down credit availability and flexibility. In some quarters, there seems to be little patience for a protracted turnaround.

Recommendations

As a general rule, bankers abhor surprise. Likewise, business owners/managers should never be surprised about where they stand with their bankers. Now is a good time to have a candid discussion about how your credit is currently risk-rated and the specific basis for that rating. Knowing the risk-rating should help you work with your lender, anticipate requirements and determine the optimum source of debt capital.

If you find that the rating is borderline or worse (grade 6 or higher), then you should explore the triggers that would cause the credit to be downgraded, the likely implications of that action, and what can be done to improve the rating. Armed with specific knowledge, owners and managers will be better positioned to weigh alternatives that may help preserve financial flexibility, such as:

- Seeking alternative lenders;

- Restructuring operations;

- Selling non-essential assets;

- Raising capital (equity or mezzanine); or

- Consulting with a financial advisor to determine the best course of action.

- i.e., public debt ratings of AAA/Aaa through BBB-/Baa- by independent rating agencies S&P and Moody’s.

- (EBITDA—unfunded capex—cash taxes)/(interest + CMLTD)

- Total funded debt / EBITDA