Privately held businesses are typically organized as pass-through entities (e.g., S-corporations or limited liability companies) for income tax purposes. Businesses organized as C-corporations, however, are obligated to pay corporate income taxes. This creates the potential for accounting treatment of deferred tax liabilities (“DTLs”) on the balance sheet, especially when the business has a large fixed asset base. The DTL becomes a matter of value for buyer and seller in a stock sale transaction. This infrequent situation can introduce an unusual wrinkle that either or both sides may not fully understand and may not be adequately prepared to negotiate their impact on the deal.

Beyond the Green Eyeshade

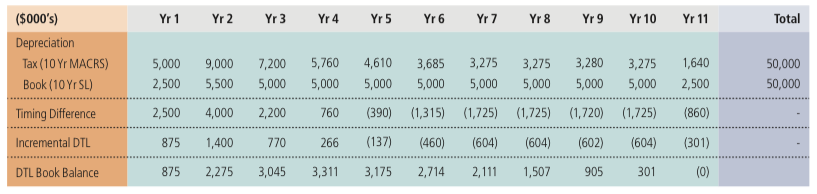

From an accounting perspective, DTLs represent timing differences of income taxes payable between the company’s financial accounting and tax accounting methods. DTLs occur when a company with a large fixed asset base takes advantage of accelerated depreciation methods for tax purposes. While the company’s financial statements may show operating income and taxes payable based on generally accepted accounting principles (“GAAP”) depreciation rates, the company actually pays less taxes than the amount recorded on its financial statements in the early portion and more taxes in the latter portion of the assets’ lives. The difference between taxes payable as measured by GAAP and cash taxes payable is accrued on the balance sheet as a DTL. Early in the asset’s life, the DTL account builds and is “drawn down” later in the asset life until the DTL eventually is eliminated. The following exhibit schedules out the accounting treatment for an example $50 million asset over its life.

The deferral of income taxes related to a specific capital expenditure will ultimately reverse. However, for businesses that continue to invest in fixed assets and retain the same tax policy on depreciation, the total amount of DTL on the balance sheet may not change as earlier liabilities are paid off, but are replaced by newer liabilities related to new fixed assets.

The fact that the account balance can remain stable over time gives rise to the accountant’s view that, in this scenario, DTLs are more like equity than debt. That view is counter to the actual economics of the business.

The Economic View of a Deferred Tax Liability

DTLs affect value through their impact on future free cash flows. Operations are not affected by DTLs and neither is EBITDA. But, the after-tax cash flows of the business can be affected and represent a different future cash flow stream and value. It is the present value of the remaining cash effects of the DTLs that impact value.

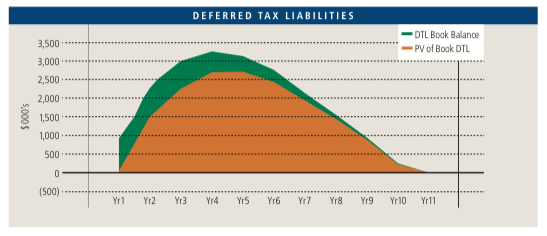

As can be seen from the adjacent graph, the present value of deferred tax payments is always less than the DTL balance, although age in the life of the asset is a major determinant of the magnitude. When a group of assets with varying in-service dates and useful lives comprise the DTL balance, the analysis can become complex.

The argument that a going-concern business will replenish its fixed assets, thereby leaving the DTL balance stable is irrelevant because the free cash flow analysis determines the difference between having or not having a balance at a specific measurement point. So long as there is operating income to tax, the present value of cash flows will always be less than the GAAP DTL balance. In essence, the company has “borrowed” the tax shield from the future in order to increase cash flows early in the asset life. Because of the time value of money, this is a logical economic policy as the increased taxes at a later date are “cheaper.”

What Happens in a Sale Transaction?

At the time of a sale, a sophisticated buyers’ evaluation takes into account the expected future after-tax cash flows and assigns a value to the DTL separate from the value of the operations. That value, which represents the present value of the tax timing differences, is less than the account balance shown on the balance sheet as a result of the specific asset depreciation schedules, the tax rate, and the present value discount rate. In essence, the DTL value calculation is “debt” for transaction purposes.

Part of the reason why this can be confusing to the parties is that DTLs are not even considered in transactions involving pass-through entities. DTLs still exist, but they sit on the owners’, not the company’s, balance sheet. At the time of a transaction, purchase price must be allocated for tax purposes (to the extent that there is value to allocate) to the lesser of market value or original cost of the asset. Assuming that economic depreciation approximates accounting depreciation, the difference between the asset amount on the tax books and the GAAP books is taxed at ordinary income rates. At the time of sale, all future tax differences are brought current in the form of depreciation recapture, thereby making the negative economic effect even greater to the seller than when measured against the same situation in a C-corporation.

The analysis is not an exact comparison because of the differences in personal and corporate tax rates, but the fact still remains—DTLs are not free. They represent value and are taken into account in transactions.

Conclusions

DTLs are “debt” in the economic sense, but with the following provisos:

The amount of debt associated with DTLs is not the accounting balance; rather it is the present value of the remaining tax payment differential over the life of the assets. The amount depends on the specific schedule of remaining differential and the point in time of the asset life.

Owners should understand that the company received the benefit of the lower effective tax payments during the period of DTL creation and, but for that, would have had offsetting cash or line of credit balances.

For DTLs to have value as debt, the company needs to be expected to be profitable. A failing company has nothing to worry about.

Prior to beginning negotiations on the sale of stock in a C-corporation that shows DTLs on its balance sheet, it is wise to conduct an economic analysis of the DTL’s impact on shareholder value. The buyer should be made aware of the tax situation prior to submission of a purchase proposal to ensure a fair valuation of the DTL is incorporated into the deal, and doesn’t become an unexpected surprise at a later date. zs