May 21, 2020

Just three months ago, the market for middle market lending was as hot as ever. Senior and junior lenders alike were fighting to deploy too much capital into too few opportunities. As a result, there was constant pressure on credit structures, leverage, and pricing. When the impacts of COVID-19 began to spread throughout the economy, the supply-demand equation suddenly flipped. Borrowers became liquidity-constrained and quickly moved to draw down lines of credit, lenders became inundated with loan modifications and Paycheck Protection Program (PPP) loans, and the market for new loan originations essentially dried up.

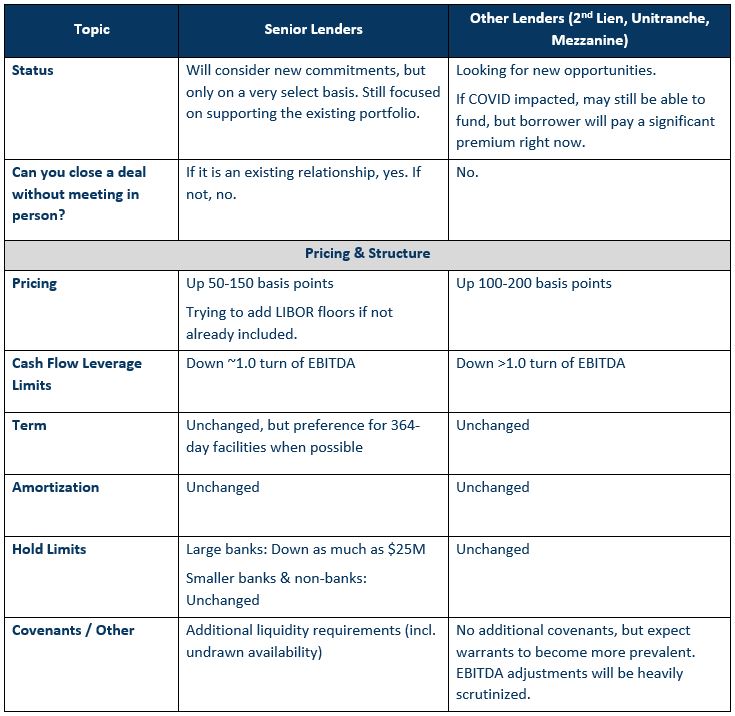

Lenders are pretty much the only source of funding for middle market privately-held businesses. Liquidity is the first thing a CFO thinks about when they wake up and assuring that reliable, flexible supply of capital for operations and acquisitions is one of their top priorities. That job has become more difficult in the post-COVID era. To understand how these markets have changed, we interviewed lenders across different segments of the market to better understand just that: How are you operating in today’s marketplace, and what can borrowers expect from you? While each lender is unique, there are some common themes that owners and management teams should be aware of. The following table summarizes those conclusions, with additional commentary below:

Senior Lenders:

Senior lenders have been on a bit of a rollercoaster for the past eight weeks. In March, they were focused on responding to the immediate needs of existing borrowers, including processing line of credit draws and setting customers up for remote treasury work. For bank lenders, the first half of April was then filled with processing PPP loans. It wasn’t until the latter part of April that these lenders were able to take a step back and begin looking at new credit opportunities again. While most lenders indicate they are now “open for business,” the reality is that underwriting teams remain busy with loan modifications and restructurings within the existing portfolio, so any new credit decisions will take longer than usual. In addition, any new commitments will involve heightened scrutiny around downside scenarios and more strict underwriting criteria.

The lack of opportunities for face-to-face meetings further impedes lenders’ ability to support new relationships. Most lenders will not fund a new relationship without first meeting the management team and conducting full due diligence. Video conferences can only do so much to get a lender comfortable. Most still need to “see the whites of the eyes” of their prospective borrowers to get truly comfortable with the first “C” of credit – Character.

Anecdotally, we have seen several large bank lenders reduce their hold limits for exposure to a single company or industry, some as much as 50%. Companies that sat well within previous hold limits are now being told they can’t borrow any more, and the lender may actually need to reduce its exposure by bringing in another lender.

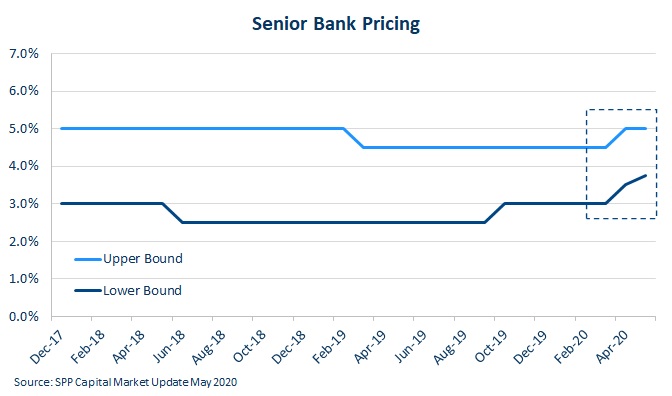

The massive line of credit draws that occured in March, combined with deteriorating asset quality in their portfolios, drove increased capital reserve requirements for banks. These capital requirements and the uncertainty associated with business performance in the near-to-mid-term have resulted in increased credit spreads of 50 – 150 basis points across the board. Other loan terms, including amortization and covenants, are largely unchanged. On tenor, many lenders are opting for 364-day facilities in order to reduce capital reserve requirements and offer better pricing.

Borrowers are learning the real value of relationships. For the first time in a decade, lenders feel fairly comfortable turning away business. If not a current customer or a marquee prospect, it is difficult to get attention. The phrase, “we need to get paid for the risk” came up quite often and indicates that pricing will be adjusted if there is a need to adjust current commitments. The conclusion is that if you don’t need to ask your bank for something, don’t, and if you need a new bank, be prepared for an uphill battle.

Other Lenders (2nd Lien, Unitranche, & Mezzanine):

Much like senior lenders, junior lenders spent most of the past two months working with their existing portfolios to understand the degree of COVID-19 impact and develop short term liquidity projections. In recent weeks, they have shifted their attention back to new opportunities, but are being very selective in which opportunities they put real effort into. For existing borrowers, junior lenders have been very supportive, with some even funding additional capital into the business as debt or equity. When reviewing new opportunities, there is an obvious preference for companies that are well insulated from COVID-19 impacts. If a company is somewhat or severely impacted, most junior lenders are taking a “wait and see” approach and not making formal commitments.

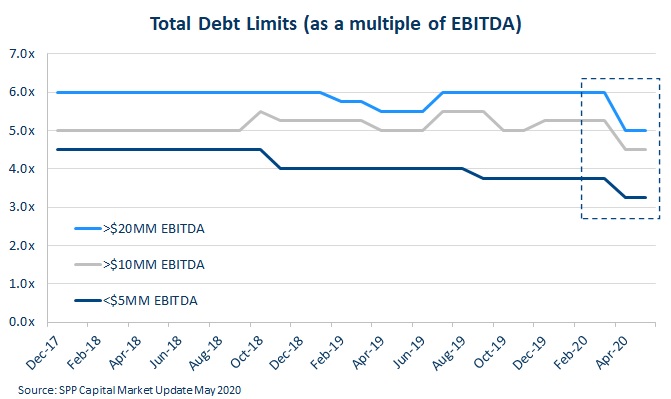

Overall cash flow leverage limits have come down 1-2x EBITDA, and most lenders expect deals to be funded with more equity and less debt as compared to three months ago. The reduction in leverage limits is driving a similar decline in overall transaction multiples. Apart from leverage, pricing is the only other major change in terms and structure. Pricing in the junior debt market has increased approximately 200 – 250 basis points.

Overall, junior lenders expect to see more opportunities in their pipeline as senior debt has become more expensive and more heavily structured. Credit facilities that may have been structured as 3x Senior Debt to EBITDA three months ago will likely include a subordinated debt portion to reduce current cash payment requirements and increase flexibility for the borrower.

What to Expect Moving Forward:

When we started formally interviewing lenders two weeks ago, the question we set out to answer was simple: Is credit available to support the businesses that need it, both now and coming out of the pandemic?

The short answer is “maybe.” The longer answer is this: The supply-demand equation has shifted in favor of lenders. Pricing has increased and leverage limits have decreased. The fear of catching a falling knife is leading lenders to heavily scrutinize any forecast that is put in front of them. But, for businesses with a defensible value proposition and a reasonable path to profitability, there are lenders that are willing to come to the table.