M&A transactions are complex, involving many participants. Selling a business is usually a once-in-a-lifetime experience for the business owner, while for the professionals engaged to assist, the process is their job. Experienced transaction advisors (bankers, attorneys, accountants, and others) may have previously worked on numerous deals together. With joint experience, they might have learned how to blend their individual expert services to gain effectiveness. However, it is far more common that the group serving any particular client will not have worked together in the past. This article focuses on this familiar situation, emphasizing the client, the investment banker, and the owner’s legal counsel, who are at the core of most private transactions.

Four Basic Stages

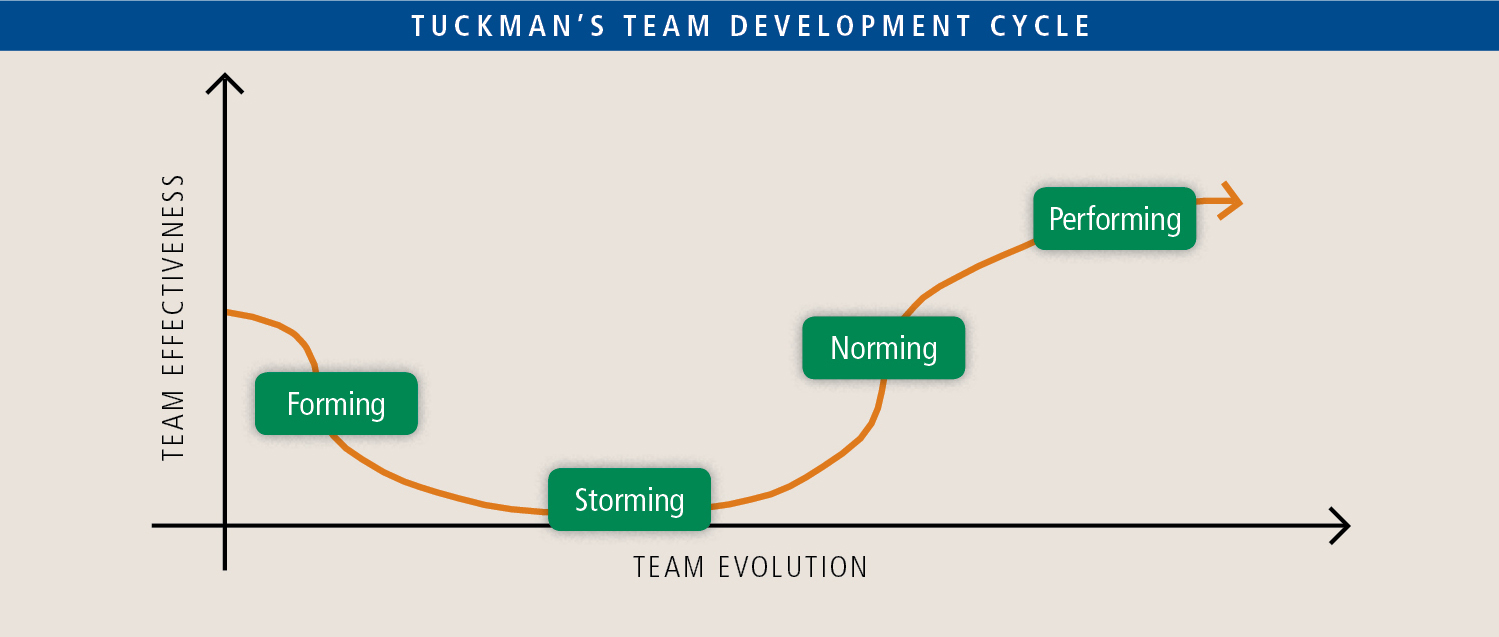

A high-performing M&A team requires each member exceling in their role with an eye towards achieving the client’s objective. According to the team development theory proposed by Dr. Bruce Tuckman, a psychology professor, the journey to become a high performing team can be broken into four basic stages: forming, storming, norming and performing.

According to Tuckman, during the Forming stage of team development, team members are usually excited to be part of the team and are eager about the work ahead. At the start of most M&A engagements, team members have high positive expectations of the outcome and their individual contributions. At the same time, they may also feel some anxiety, wondering how they will fit with the team and if their performance will measure up.

As the team begins to move towards its goals, it enters the Storming stage. Members often discover that the team can’t live up to all of their early excitement and expectations. There are certain perceived conflicts between the attorney and the investment banker. While the latter is charged with achieving the best economic outcome for the client, the attorney’s role is to minimize risk. Their focus may shift from the tasks at hand to feelings of frustration with the deal’s progress or the team cohesiveness. Without a history of past experiences, the Storming stage can be a period to prove oneself worthy of trust. This is usually the stage with the lowest team effectiveness.

Establishing a free network of communications at the onset among all parties is a common challenge. Often, it is more comfortable for each professional to communicate directly with their client and rely on them to decide what and when to pass on to others. We refer to this as the “hub-and-spoke” communications method. It relies on the least experienced person, the client, to be the traffic director of instructions and information flow.

Problems can surface late in the process when deal issues need to be decided and interactions with the opposing team heighten in intensity. Attorneys have an extra level of communications challenge when they bring in subject matter experts (e.g., tax, environmental, employment). Usually, these experts do not have a good sense of the deal dynamics and are asked their opinion on narrow issues. If the lead deal attorney doesn’t properly put their responses in context, the answers can slow or stop the deal’s progress as non-experts (i.e., client and bankers) try to interpret the implications.

Unfortunately, some M&A teams do not move beyond the Storming stage. To achieve higher levels of performance, teams need to up their game. During the Norming stage of team development, team members begin to resolve the discrepancy they felt between their individual expectations and the reality of the team’s experience. Constructive criticism is both possible and welcomed. Members start to truly feel part of the team and can take pleasure from the increased group cohesion. Trust can begin to be earned.

In the final Performing stage, members feel attached to the team as something “greater than the sum of its parts” and feel satisfaction in the team’s effectiveness. Members genuinely feel confident in their individual abilities and those of their teammates. This leads to the highest levels of team effectiveness.

Some Practical Suggestions for Creating a High-Performing Deal Team

1. Define roles early

Our recommendation in every assignment is that, before starting the process, the members of the deal team meet together with the client and agree on a delineation of roles and responsibilities, a process to keep everyone abreast of the process, and a work style that encourages the different experts to collaborate among themselves. The most effective processes are where the client acts more as a CEO than a COO. They are kept abreast and brought in to decide critical decisions and to approve tactics.

2. Communicate effectively

People do business with people. As we discussed in a previous IN$IGHT article (“The Case for Face-to-Face”, IN$IGHT, Fall 2007), the great advances in technology have allowed the speed of data transfer to increase dramatically but with some fallout in terms of actual communication. Our observation:

When working from behind the curtain, it is too easy to avoid hearing or understanding the other’s position. Saying “no” in person is harder than by email. It is also difficult to grasp the entire context of someone’s comments when there is no opportunity for interactive, real-time, probing questions and answers.

The point of interacting with the other side in a transaction is to get resolution to differences or to determine that resolution is not possible. Sending back and forth one side’s position with the hope and expectation that the other side will see the obvious wisdom and rationality of the argument rarely is effective. Meet in person, or at least organize a phone call as soon and as often as practical. Include all the relevant members of the team.

3. Maintain deal momentum

Speed is not just for expediency. At the point in a transaction when the parties have agreed to try and get a deal done, there is nothing good that occurs for the seller by time passing. Having a clear path to closing, turning documents, resolving issues quickly, and having consents and approvals lined up are the tasks for the team. There is no standard for what constitutes “quick” but a team that has been working closely together can often turn a purchase and sale agreement back to the other side overnight.

4. Pick your battles wisely

“My document is better than your document,” or so some negotiations seem to go. Attorneys have thought hard about the issues involved in M&A transactions and revise their base set of agreements to reflect their most current thinking. Getting it right and minimizing risk is the goal. Yet, the team on the other side has the same set of objectives and often sees the same issue through a different lens. The challenge is to determine where the risks lie and what they really mean in terms of potential outcomes for the client. Some issues are not worth the cost of the fight.

It’s Not Easy

Balancing risk, return and professional egos is not easy. However, when professionals gain joint experiences, they can begin to appreciate each other’s skills and have trust that their fellow team members will not fail them or the team. When this happens, advisors can genuinely help their client achieve the best possible deal.