In the years in which we have advised owners and managers of privately held businesses, we’ve worked with a multitude of professional service advisors of different types and persuasions. Cutting across the fields of law, accounting, banking, investment management, insurance, and investment banking, certain individuals stand out. They set the bar for everyone who gives advice for a living, including those of us at Zachary Scott, to try to emulate. The essential characteristics of these stars are worth acknowledging as they may act as a reminder to all of us in professional service endeavors, that the service we offer is personal and is taken personally.

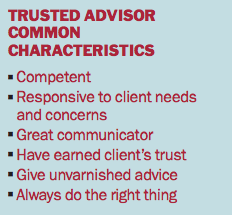

Shared Characteristics

The most trusted advisors that we’ve known all seem to share a few common characteristics. Of course, they are competent in their specific fields, responsive to client needs and concerns, and great communicators. More importantly, they:

- Have earned their clients’ trust;

- Give unvarnished advice without targeting a specific outcome or worrying about whether the message is politically expedient; and

- Do the right thing, without regard to conflicts with their own short-term best interests.

Many advisors sell on the basis of technical competence; however, most buyers buy on the basis of emotion. Technical competence is the easy part. Resumes, credentials, and tombstones demonstrate activity and experience; but, honesty and compassion, the essential prerequisites to trust, can only be earned over time.

Trust is Essential

Trust cannot be developed simply from demonstrating knowledge in an area of expertise. Rather, trustworthiness involves complex emotional elements of reliability, intimacy with the client, and demonstration that the focus is consistently on the client – that is, it is not self-oriented. Enduring advisory relationships develop over time as a result of a demonstrated “client-first” orientation and an intimacy that begets trust. Only after the relationship develops to that point can the client and advisor speak openly about difficult agendas.

Doing the right thing should be self-evident, even common sense. However, it is amazing how often advisors can forget this most basic of tenets. Maybe the ability to do the right thing comes from having confidence in themselves, as well as the strength of the relationship; thereby not feeling anything is at risk.

The hallmark of relationships built on trust is the ability of advisors to tell clients what they don’t want to hear. People wouldn’t be in the personal services business if they didn’t want to please their clients, but “going with the flow” can lead to over-promising and delaying hard decisions and realities. The advisor who has developed the level of trusting relationship that allows open, honest, and clearly stated advice without fear of recrimination is a valuable asset and a pleasure to witness.

Clear, Articulated Advice

The most common breakdown in communication is a misunderstanding about what has been said. It happens in personal relationships, in businesses, and with daunting frequency between advisors and clients. It is a fact of life that people don’t always say what they mean. They tend to hint a lot. Accordingly, truly successful advisors excel at clearly articulating their advice and its relevance to the client, but only after “hearing” the client’s needs and objectives. As Jack Welch once said, “he is really a great advisor, he listens better than anyone else.”

Selling advice is almost never an exclusively logical process. Rather, it takes a complex combination of technical skills, thorough understanding of the issues at hand, an ability to relate to the personalities involved, and a solid base of trust to give credibility to the advice. The talented few who excel in this area are very valuable assets to their clients and worthy of emulation.