April 2, 2020

Life is drastically different today than just a few weeks ago. Even in comparison to 2008 and 2009, the velocity and ferocity of this downturn has no recent analogue – and perhaps no analogue at all.

We have spent much of the last few weeks reaching out to our friends in the deal community as well as current, former, and prospective clients. What follows is a synthesis of these conversations.

In general, we have found a sense of compassion and willingness to be patient that is unlike any recent downturn. Lenders, private equity investors, and others with capital exposure to operating companies recognize that the issues facing nearly all companies are by and large the result of exogenous forces outside of their control. No business could have reasonably been prepared for the extent of the demand destruction caused by the world’s efforts to combat the pandemic. As I have said on many of my calls, no capital budgeting exercise or financial model contemplates multiple months with year-over-year revenue declines in excess of 50%, which is not uncommon in many consumer-facing businesses today.

Lenders are leading the charge, proactively reaching out to their clients and offering creative solutions to help weather the storm. Lenders we spoke with have been busier than ever trying to interpret evolving federal guidance on relief plans and trying to understand each client’s current and near-term view on their financial position to help determine what relief might be in order. In particular, common themes we’ve heard include:

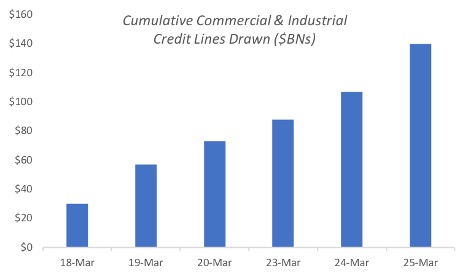

- A surge of customers are drawing upon lines of credit. As illustrated in the chart (source: American Banker), commercial and industrial lines of credit increased nearly fivefold over just a week in late March, from $30 billion to more than $140 billion. These drawdowns are largely to provide excess liquidity in a time of significant uncertainty, as it is prudent in this environment to be more conservative than less in terms of access to cash.

- Banks have taken cues from the Federal Reserve, which has relaxed guidelines regarding loan modifications. Whereas in normal times banks are reluctant to modify loans because of the negative impact on the bank’s risk profile and capital reserve requirements, the Fed has made it clear these modifications (largely deferring current principal and interest payments) will be more acceptable.

- Asset-based lenders are open for business and may be a more palatable funding source as the future looks more murky assuming receivables can be judged as collectible in this environment. The challenge for these lenders will be determining real and reliable orderly liquidation values for assets, as the market for offloading these assets has never seen this much turbulence in such a short time frame.

We think it’s a good idea for owners to make themselves aware of alternative debt sources in situations where they can no longer access traditional bank financing. This would include mezzanine / subordinated debt, factoring lenders, and other non-bank options. Companies with significant current and fixed assets should compare their borrowing capacity under cash flow and asset-based loan (ABL) structures and consider ABL if they believe cash flow weakness may result in covenant breaches. Further, the Small Business Administration (SBA) is creating options to provide flexibility to weather the current environment, but we have heard from many that the system is currently overwhelmed. Owners considering SBA options should move quickly, as historical programs have run on a first-come, first-served basis, and be prepared for slower responses than their business might require.

Private equity groups (PEGs), like lenders, have been incredibly busy assessing the impact on their portfolio companies. As both buyers and sellers of companies, PEGs are excited by the opportunities they expect to see in the turmoil, but also quite anxious as to how this same turmoil impacts their investments and exits. In particular:

- Most we spoke with indicated their portfolios generally have a mix of companies dealing with serious problems and companies relatively insulated.

- PEGs moved rapidly to ensure their portfolio companies were drawing down lines of credit to weather the storm.

- New deal volume has largely come to a screeching halt. We’ve seen a wide range of expectations as to when the M&A market is expected to open up, but at a minimum the belief is that until social distancing measures are lifted, very few deals will get done. The few deals moving forward are typically in the very late stages of the transaction process and are in industries that are heavily or completely insulated from current market dynamics, including healthcare services businesses and companies in certain parts of the food supply chain.

- When the market does come back, there are differing views on how multiples will be impacted. A new lens will be applied to prospective investments, with companies exhibiting resilience to the current environment warranting premium valuations. How credit markets respond in terms of leverage and pricing will certainly impact valuations as well.

- There is a general consensus that we will see universal “coronavirus” adjustments to EBITDA, but how these are quantified certainly remains to be seen.

- The good news for prospective sellers is that PEGs continue to sit on massive amounts of un-deployed capital and will be eager to put that to work.

- Many PEGs are actively promoting their interest in minority equity and other creative solutions that enable owners to achieve a number of potential goals – providing near-term liquidity, taking some chips off the table while not selling out entirely, or helping finance consolidation plays.

Our judgement is that deal pricing will be buoyed by the fact that the supply of attractive candidates relative to the demand and will help overcome lower leverage from lenders and the fear of the unknown.

Transaction professionals, such as M&A attorneys, accountants, and others represent a wide sampling of exposure and levels of impact. We’ve found a number of interesting trends and things for owners to contemplate as they prepare to navigate the new economic environment.

- M&A attorneys, like us in the investment banking world, have largely seen an abrupt slowdown in traditional projects. We have heard numerous stories of withdrawn offers or buyers asking to pause until more clarity emerges in the economy. Perhaps the one bright spot is with bankruptcy and restructuring attorneys, who in one attorney’s words said “it will be an unprecedented 12-24 months” for their practice.

- Accountants are in an interesting situation. They remain busy with both tax and audit work, but the rapid changes in their clients’ financial situations create awkward circumstances where a “going concern” notice, which often is troubling for creditors and owners alike, may be required simply due to covenant breaches forcing long-term debt to be classified as short-term, which given the reality of discussions with lenders described above, may not be as dire as the accountant’s language implies.

- IT consultants are seeing increased interest among clients and prospects to review old IT contracts that typically go overlooked. Opportunities exist to cut expenses, changing from inefficient legacy systems by upgrading or, in many cases, outsourcing more of their systems, particularly as remote working becomes increasingly important.

- Insurance brokers are dealing with clients who are quickly realizing they lack the type of coverage that protects them from significant business interruption. Even businesses with business interruption coverage are encountering pushback from carriers due to myriad carve-outs, and there is an expectation many of these policies will be in litigation for years. These problems have, however, created opportunities for new RFPs as companies reassess their coverage going forward.

Business owners, not surprisingly, report a wide range of fallout – ranging from complete shutdown to essentially (remote) business as usual – depending largely upon their end markets and ability to operate in a remote environment. A sampling of anecdotes include:

- While restaurants have been devastated, most other businesses further up the food and beverage supply chain have held up reasonably well. One interesting pivot to watch has been how distributors, particularly those who have historically served both retail and foodservice channels, navigate the rapid demand shift between the two.

- Consumer retailers and product manufacturers, already reeling from an unprecedented wholesale reduction in demand, are now also struggling with questions related to product forecasting. Uncertainty over the lifting of social distancing measures creates enormous headaches in trying to place orders for future goods – particularly involving seasonal products.

- Manufacturers deemed essential businesses are adapting to a hybrid operating model, where office workers (salespeople, engineers, administrative staff) work remotely while production employees work as effectively as possible within the confines of social distancing measures. Several clients who have successfully implemented this model instituted “crisis management” teams within their organizations and took bold, early steps. Those with global operations and a firm understanding of the Asian supply chain were able to leverage best practices in their domestic operations.

- Few companies appear immune to layoffs. Many we have spoken with, even those in industries seemingly insulated from retail, foodservice, hospitality, and travel, have been proactive in reducing their workforces as they grapple with the ongoing uncertainty. Others, especially those that rely on a transient workforce, are facing potential shortages as closed borders and social distancing restrict available supply of workers.

The swiftness of the economic downturn has left many businesses flat-footed, but everyone is learning how to navigate the new environment. It has been interesting having weekly calls with fellow deal professionals to hear how we are all adapting. Thankfully, technology has advanced to the stage where remote working is in many cases relatively seamless. At Zachary Scott, we are leveraging our tools to continue to push ahead on projects, stay in touch with the deal community, and engage with current, former, and prospective clients as we optimistically look forward to emerging on the other side!